- South Korea

- /

- Luxury

- /

- KOSE:A007980

Pan-Pacific's (KRX:007980) Stock Price Has Reduced 56% In The Past Three Years

Pan-Pacific Co., Ltd. (KRX:007980) shareholders should be happy to see the share price up 17% in the last month. But that doesn't change the fact that the returns over the last three years have been disappointing. Tragically, the share price declined 56% in that time. So it is really good to see an improvement. While many would remain nervous, there could be further gains if the business can put its best foot forward.

Check out our latest analysis for Pan-Pacific

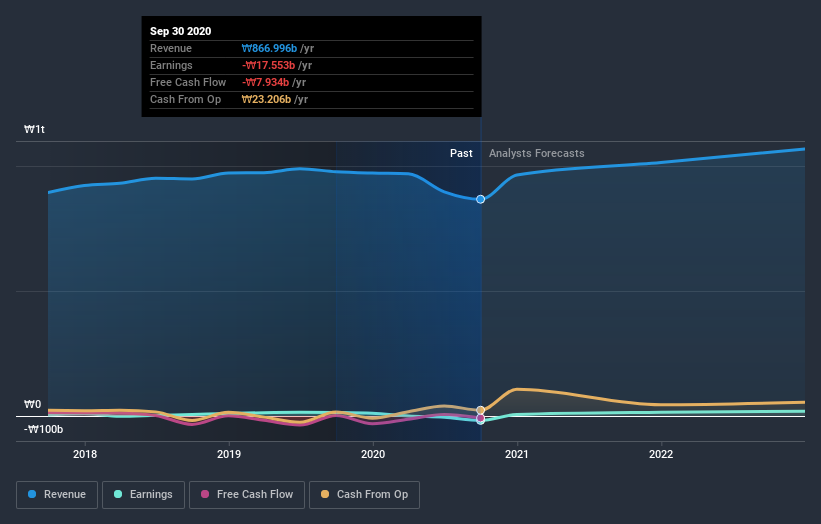

Pan-Pacific isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last three years, Pan-Pacific's revenue dropped 0.01% per year. That is not a good result. With revenue in decline, and profit but a dream, we can understand why the share price has been declining at 16% per year. Of course, it's the future that will determine whether today's price is a good one. We don't generally like to own companies that lose money and can't grow revenues. But any company is worth looking at when it makes a maiden profit.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Pan-Pacific's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Pan-Pacific shareholders are down 27% for the year (even including dividends), but the market itself is up 27%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 9% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Pan-Pacific that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade Pan-Pacific, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A007980

Solid track record and good value.

Market Insights

Community Narratives