- South Korea

- /

- Luxury

- /

- KOSE:A005390

Shinsung Tongsang (KRX:005390) shareholder returns have been favorable, earning 49% in 5 years

Stock pickers are generally looking for stocks that will outperform the broader market. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. For example, the Shinsung Tongsang Co., Ltd. (KRX:005390) share price is up 45% in the last 5 years, clearly besting the market return of around 14% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 14%.

Since the stock has added ₩38b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for Shinsung Tongsang

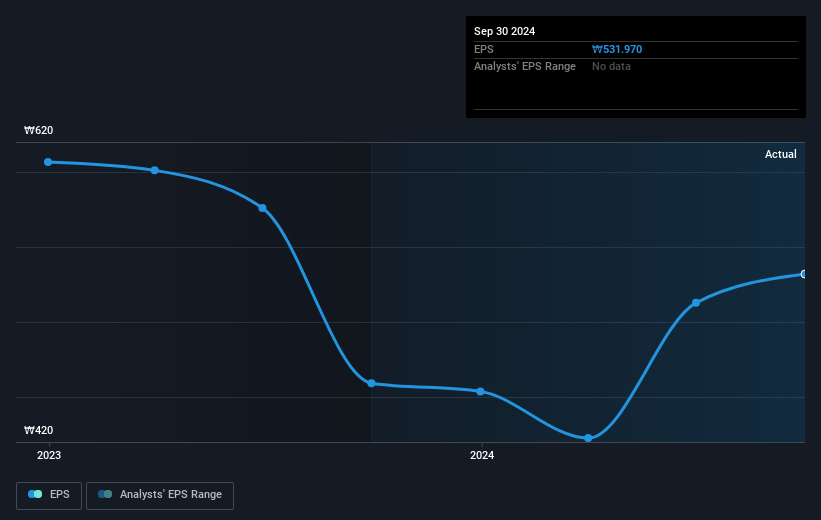

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last half decade, Shinsung Tongsang became profitable. That would generally be considered a positive, so we'd hope to see the share price to rise. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. We can see that the Shinsung Tongsang share price is down 35% in the last three years. Meanwhile, EPS is up 28% per year. It would appear there's a real mismatch between the increasing EPS and the share price, which has declined -13% a year for three years.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Shinsung Tongsang the TSR over the last 5 years was 49%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that Shinsung Tongsang shareholders have received a total shareholder return of 14% over the last year. And that does include the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 8% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. You could get a better understanding of Shinsung Tongsang's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A005390

Shinsung Tongsang

Manufactures, distributes, and sells clothing products in South Korea and internationally.

Flawless balance sheet and good value.