- South Korea

- /

- Leisure

- /

- KOSDAQ:A900270

Subdued Growth No Barrier To Heng Sheng Holding Group Limited (KOSDAQ:900270) With Shares Advancing 31%

Heng Sheng Holding Group Limited (KOSDAQ:900270) shares have had a really impressive month, gaining 31% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 19% in the last twelve months.

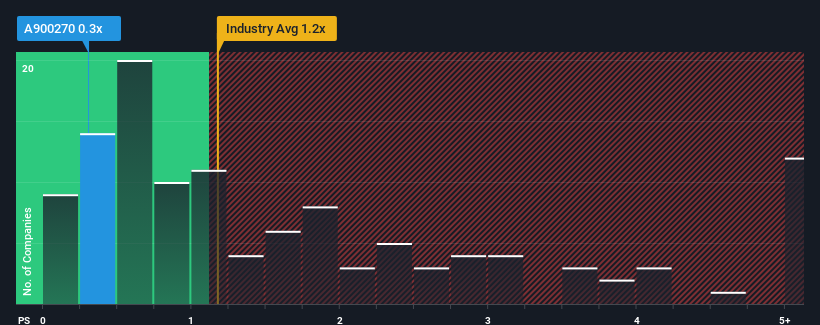

Although its price has surged higher, you could still be forgiven for feeling indifferent about Heng Sheng Holding Group's P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Leisure industry in Korea is also close to 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Heng Sheng Holding Group

What Does Heng Sheng Holding Group's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Heng Sheng Holding Group over the last year, which is not ideal at all. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Heng Sheng Holding Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Heng Sheng Holding Group's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Heng Sheng Holding Group's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 23% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 8.3% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we find it concerning that Heng Sheng Holding Group is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

What Does Heng Sheng Holding Group's P/S Mean For Investors?

Heng Sheng Holding Group appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

The fact that Heng Sheng Holding Group currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Heng Sheng Holding Group (1 makes us a bit uncomfortable!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Heng Sheng Holding Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A900270

Heng Sheng Holding Group

Engages in research and development, manufacturing, and distribution of toys, children's clothing in Hong Kong and internationally.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives