- South Korea

- /

- Luxury

- /

- KOSDAQ:A337930

Why Investors Shouldn't Be Surprised By Brand X Co.,Ltd.'s (KOSDAQ:337930) 28% Share Price Surge

Brand X Co.,Ltd. (KOSDAQ:337930) shares have continued their recent momentum with a 28% gain in the last month alone. The annual gain comes to 127% following the latest surge, making investors sit up and take notice.

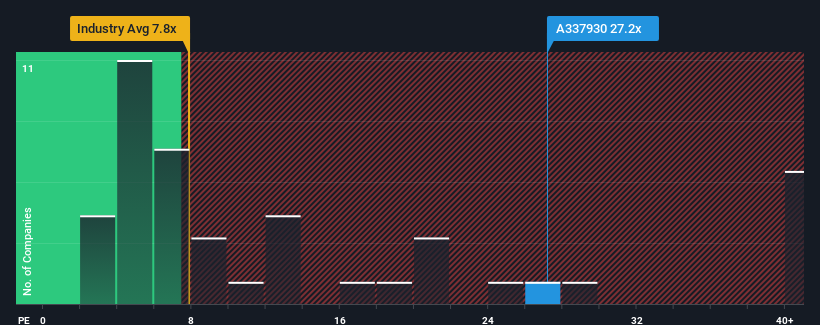

After such a large jump in price, given close to half the companies in Korea have price-to-earnings ratios (or "P/E's") below 11x, you may consider Brand XLtd as a stock to avoid entirely with its 27.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With earnings that are retreating more than the market's of late, Brand XLtd has been very sluggish. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Brand XLtd

Is There Enough Growth For Brand XLtd?

Brand XLtd's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered a frustrating 20% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 67% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 60% per year as estimated by the dual analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 20% each year, which is noticeably less attractive.

In light of this, it's understandable that Brand XLtd's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Brand XLtd's P/E is flying high just like its stock has during the last month. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Brand XLtd maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Brand XLtd that you need to be mindful of.

Of course, you might also be able to find a better stock than Brand XLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A337930

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives