- South Korea

- /

- Luxury

- /

- KOSDAQ:A323230

It's Down 27% But MFM KOREA Co., Ltd. (KOSDAQ:323230) Could Be Riskier Than It Looks

To the annoyance of some shareholders, MFM KOREA Co., Ltd. (KOSDAQ:323230) shares are down a considerable 27% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 43% share price drop.

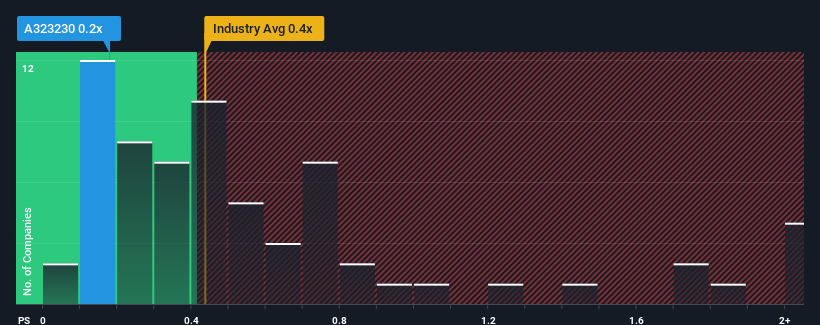

Although its price has dipped substantially, it's still not a stretch to say that MFM KOREA's price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Luxury industry in Korea, where the median P/S ratio is around 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for MFM KOREA

What Does MFM KOREA's P/S Mean For Shareholders?

With revenue that's retreating more than the industry's average of late, MFM KOREA has been very sluggish. One possibility is that the P/S is moderate because investors think the company's revenue trend will eventually fall in line with most others in the industry. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on MFM KOREA will help you uncover what's on the horizon.How Is MFM KOREA's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like MFM KOREA's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 23%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 18% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next year should generate growth of 20% as estimated by the only analyst watching the company. With the industry only predicted to deliver 6.8%, the company is positioned for a stronger revenue result.

In light of this, it's curious that MFM KOREA's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From MFM KOREA's P/S?

MFM KOREA's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite enticing revenue growth figures that outpace the industry, MFM KOREA's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Having said that, be aware MFM KOREA is showing 3 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

If these risks are making you reconsider your opinion on MFM KOREA, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A323230

Good value slight.

Market Insights

Community Narratives