The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Castelbajac Co., Ltd. (KOSDAQ:308100) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Castelbajac

What Is Castelbajac's Net Debt?

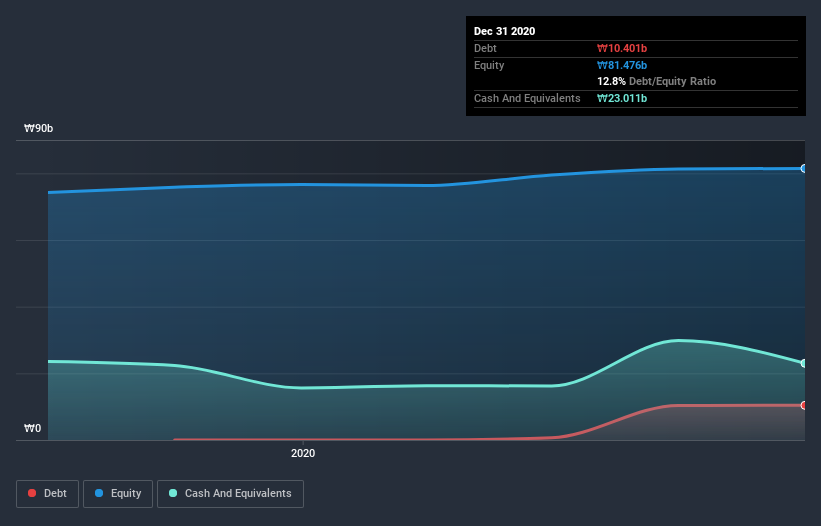

The image below, which you can click on for greater detail, shows that at December 2020 Castelbajac had debt of ₩10.4b, up from none in one year. But it also has ₩23.0b in cash to offset that, meaning it has ₩12.6b net cash.

How Healthy Is Castelbajac's Balance Sheet?

According to the last reported balance sheet, Castelbajac had liabilities of ₩10.1b due within 12 months, and liabilities of ₩12.1b due beyond 12 months. Offsetting this, it had ₩23.0b in cash and ₩11.3b in receivables that were due within 12 months. So it can boast ₩12.1b more liquid assets than total liabilities.

It's good to see that Castelbajac has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Given it has easily adequate short term liquidity, we don't think it will have any issues with its lenders. Succinctly put, Castelbajac boasts net cash, so it's fair to say it does not have a heavy debt load!

It is just as well that Castelbajac's load is not too heavy, because its EBIT was down 28% over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Castelbajac can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While Castelbajac has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last two years, Castelbajac recorded negative free cash flow, in total. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Castelbajac has net cash of ₩12.6b, as well as more liquid assets than liabilities. So we are not troubled with Castelbajac's debt use. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 4 warning signs for Castelbajac (1 shouldn't be ignored!) that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you decide to trade Castelbajac, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hyungji Global might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A308100

Excellent balance sheet with slight risk.

Market Insights

Community Narratives