In the midst of market volatility spurred by renewed tariff threats and fluctuating Treasury yields, global markets have seen a mixed performance, with major indices like the S&P 500 and Dow Jones Industrial Average slipping into negative territory for the year. Amidst these uncertainties, dividend stocks can offer stability and income potential, making them an attractive option for investors looking to enhance their portfolios in challenging economic climates.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| en-japan (TSE:4849) | 4.29% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.01% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.23% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.52% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.68% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.35% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.02% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.35% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.55% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.41% | ★★★★★★ |

Click here to see the full list of 1583 stocks from our Top Global Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Motonic (KOSE:A009680)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Motonic Corporation manufactures and sells automotive components worldwide, with a market cap of ₩218.01 billion.

Operations: Motonic Corporation generates revenue through its global sales of automotive components.

Dividend Yield: 5.8%

Motonic's dividend yield ranks in the top 25% of the KR market, supported by a low payout ratio of 40.1%, ensuring coverage by earnings and cash flows. Despite only six years of dividend history, payments have been stable and reliable. Trading significantly below its estimated fair value, Motonic shows potential for capital appreciation alongside income generation. Recent earnings growth further strengthens its ability to sustain dividends moving forward.

- Take a closer look at Motonic's potential here in our dividend report.

- Our valuation report here indicates Motonic may be undervalued.

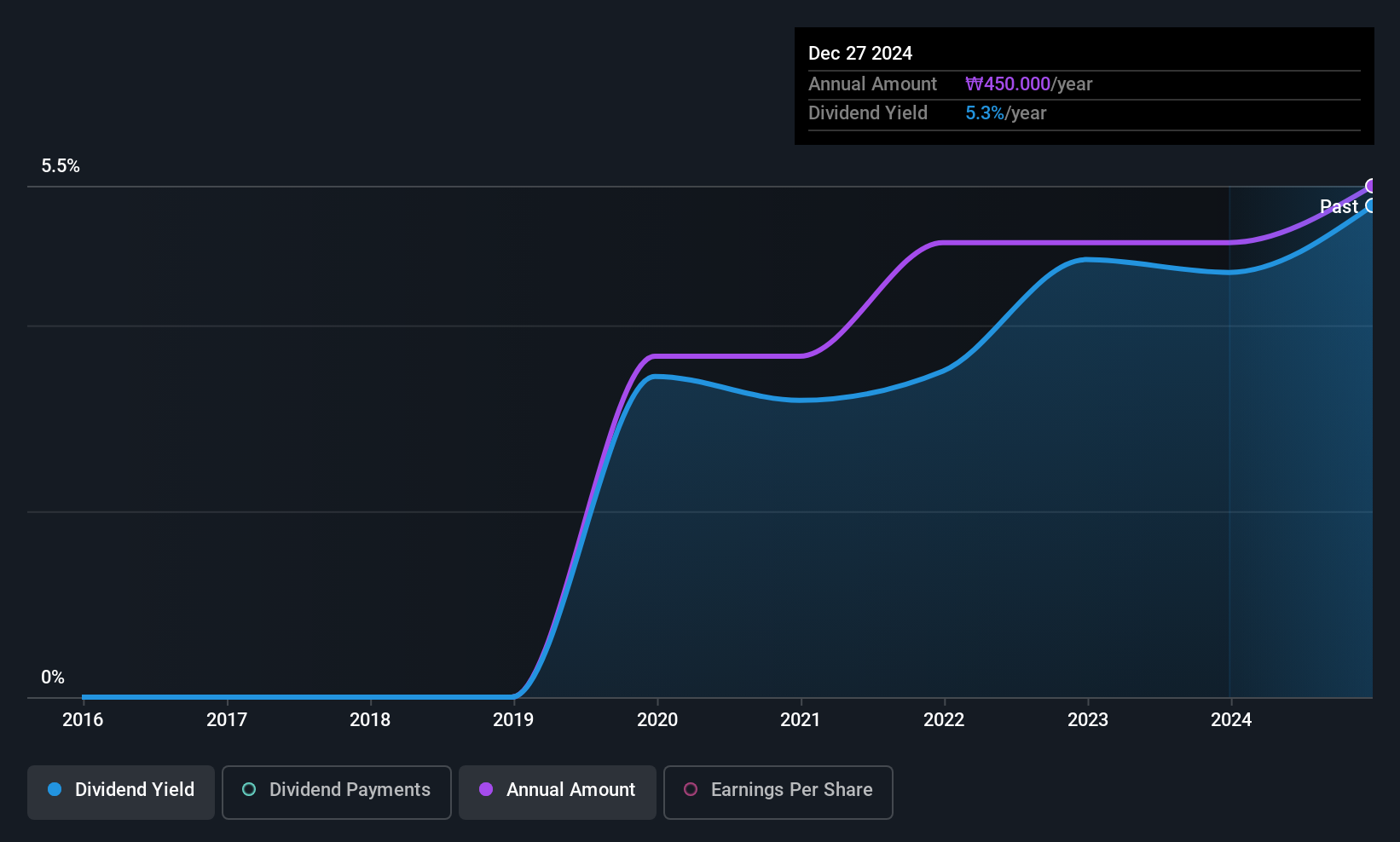

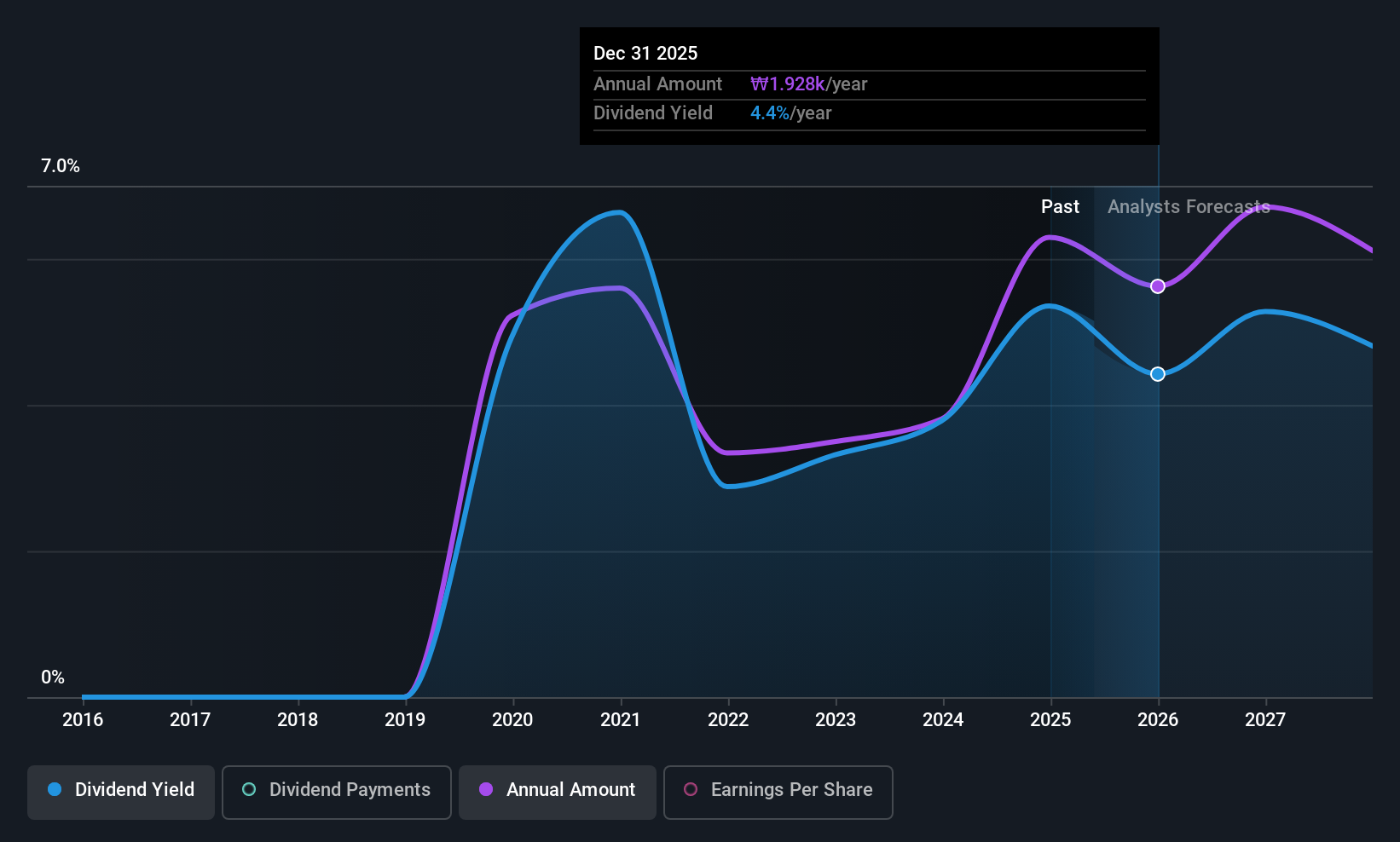

KEPCO Plant Service & EngineeringLtd (KOSE:A051600)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KEPCO Plant Service & Engineering Co., Ltd. provides maintenance services for power plants and other industrial facilities, with a market cap of ₩1.99 trillion.

Operations: KEPCO Plant Service & Engineering Ltd generates revenue of ₩1.56 trillion from its business services segment.

Dividend Yield: 5.5%

KEPCO Plant Service & Engineering Ltd. offers a compelling dividend yield in the top 25% of the KR market, with dividends well-covered by both earnings and cash flows, indicated by payout ratios of 64.4% and 22.7%, respectively. However, its six-year dividend history has been marked by volatility and unreliability, with significant annual drops exceeding 20%. Despite this instability, the stock trades at a favorable price-to-earnings ratio of 11.8x compared to the market average.

- Click to explore a detailed breakdown of our findings in KEPCO Plant Service & EngineeringLtd's dividend report.

- The analysis detailed in our KEPCO Plant Service & EngineeringLtd valuation report hints at an deflated share price compared to its estimated value.

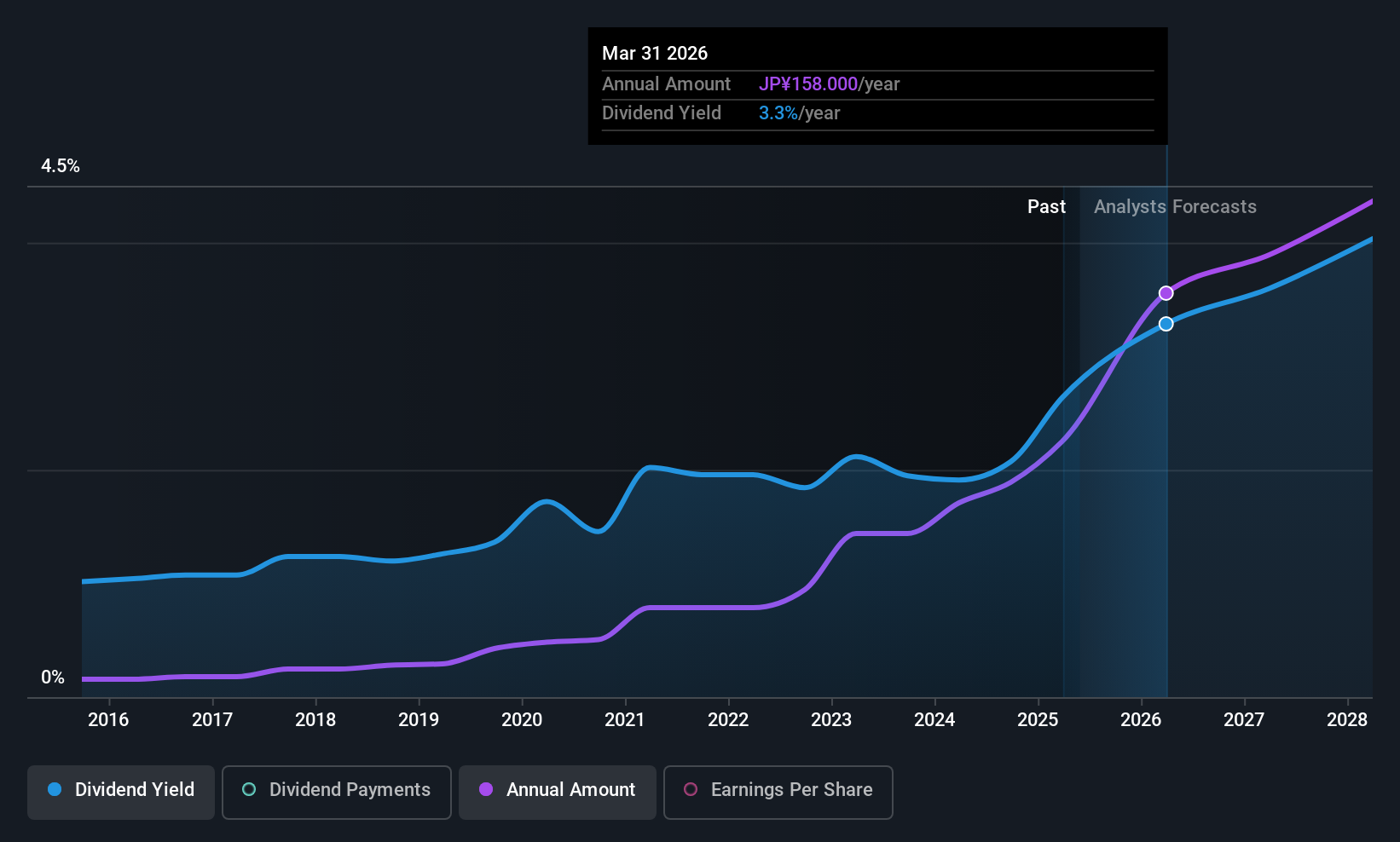

Business Engineering (TSE:4828)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Business Engineering Corporation plans, develops, sells, and leases information and communications systems globally with a market cap of ¥53.53 billion.

Operations: Business Engineering Corporation generates revenue from the planning, development, sales, and leasing of information and communications systems on a global scale.

Dividend Yield: 3.4%

Business Engineering Corporation offers a stable dividend profile, with dividends reliably growing over the past decade and covered by earnings (payout ratio 35.3%) and cash flows (77.7%). Recent announcements include an increased dividend of JPY 58 per share for fiscal year 2025, up from JPY 46, and a revised policy aiming for a payout ratio over 50% from fiscal year ending March 2026. Despite its attractive valuation, the dividend yield of 3.35% remains below top-tier levels in Japan.

- Dive into the specifics of Business Engineering here with our thorough dividend report.

- Our valuation report unveils the possibility Business Engineering's shares may be trading at a discount.

Seize The Opportunity

- Explore the 1583 names from our Top Global Dividend Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Business Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4828

Business Engineering

Plans, develops, sells, and leases information and communications systems worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives