As global markets navigate a landscape marked by cautious Federal Reserve commentary and political uncertainties, investors are increasingly seeking stability amidst volatility. With U.S. stocks experiencing fluctuations and interest rate expectations shifting, dividend stocks offer a potential source of steady income, making them an attractive option for those looking to balance their portfolios in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.30% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.98% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.23% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.28% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.78% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.56% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.53% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.34% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.05% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.74% | ★★★★★★ |

Click here to see the full list of 1956 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

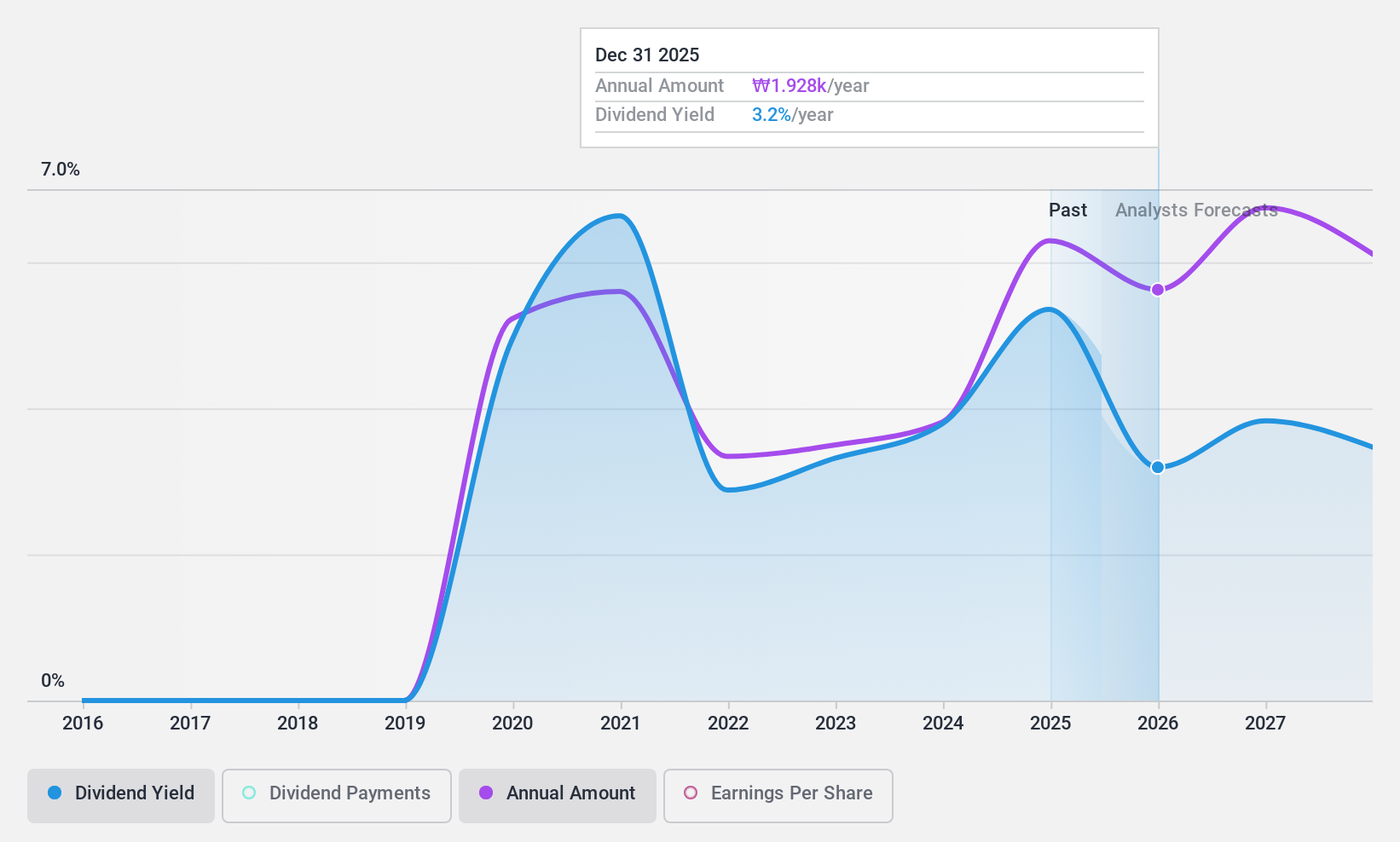

KEPCO Plant Service & EngineeringLtd (KOSE:A051600)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KEPCO Plant Service & Engineering Co., Ltd. operates in the maintenance and repair of power generation facilities and has a market cap of ₩2.11 trillion.

Operations: KEPCO Plant Service & Engineering Co., Ltd. generates revenue of ₩1.57 trillion from its business services segment, focusing on the maintenance and repair of power generation facilities.

Dividend Yield: 4.6%

KEPCO Plant Service & Engineering Ltd. offers a dividend yield of 4.6%, ranking in the top 25% of Korean market payers, with dividends covered by earnings (53% payout ratio) and cash flows (35.1%). Despite recent earnings growth, its dividend history is unstable and volatile over the past five years. The stock trades at a favorable P/E ratio of 11.5x compared to industry averages, indicating potential value despite its unreliable dividend track record.

- Navigate through the intricacies of KEPCO Plant Service & EngineeringLtd with our comprehensive dividend report here.

- Our valuation report unveils the possibility KEPCO Plant Service & EngineeringLtd's shares may be trading at a discount.

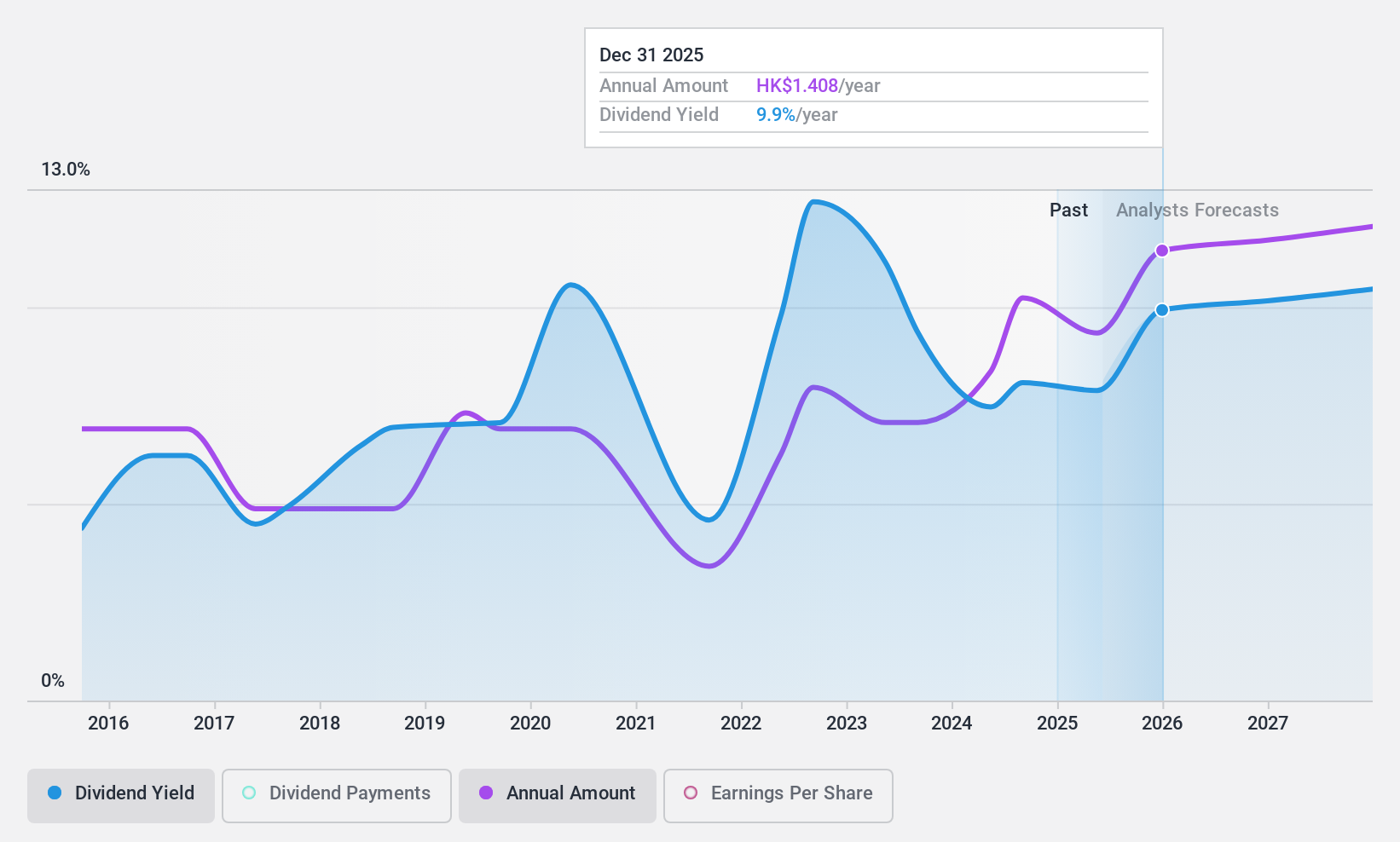

Stella International Holdings (SEHK:1836)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Stella International Holdings Limited is an investment holding company involved in the development, manufacture, and sale of footwear products and leather goods across North America, China, Europe, Asia, and other international markets with a market cap of approximately HK$13.08 billion.

Operations: Stella International Holdings Limited generates its revenue primarily from the manufacturing segment, which accounts for $1.55 billion, and to a lesser extent from retailing and wholesaling activities amounting to $2.84 million.

Dividend Yield: 7.9%

Stella International Holdings' dividend yield of 7.86% is below the top 25% in Hong Kong, with a payout ratio of 72.6% and cash payout ratio of 54.4%, suggesting dividends are covered by earnings and cash flows. However, its dividend history has been volatile and unreliable over the past decade despite recent growth in earnings by 56.6%. The company reported modest revenue increases, with US$389.7 million for Q3 and US$1.16 billion for nine months ending September 2024.

- Delve into the full analysis dividend report here for a deeper understanding of Stella International Holdings.

- According our valuation report, there's an indication that Stella International Holdings' share price might be on the expensive side.

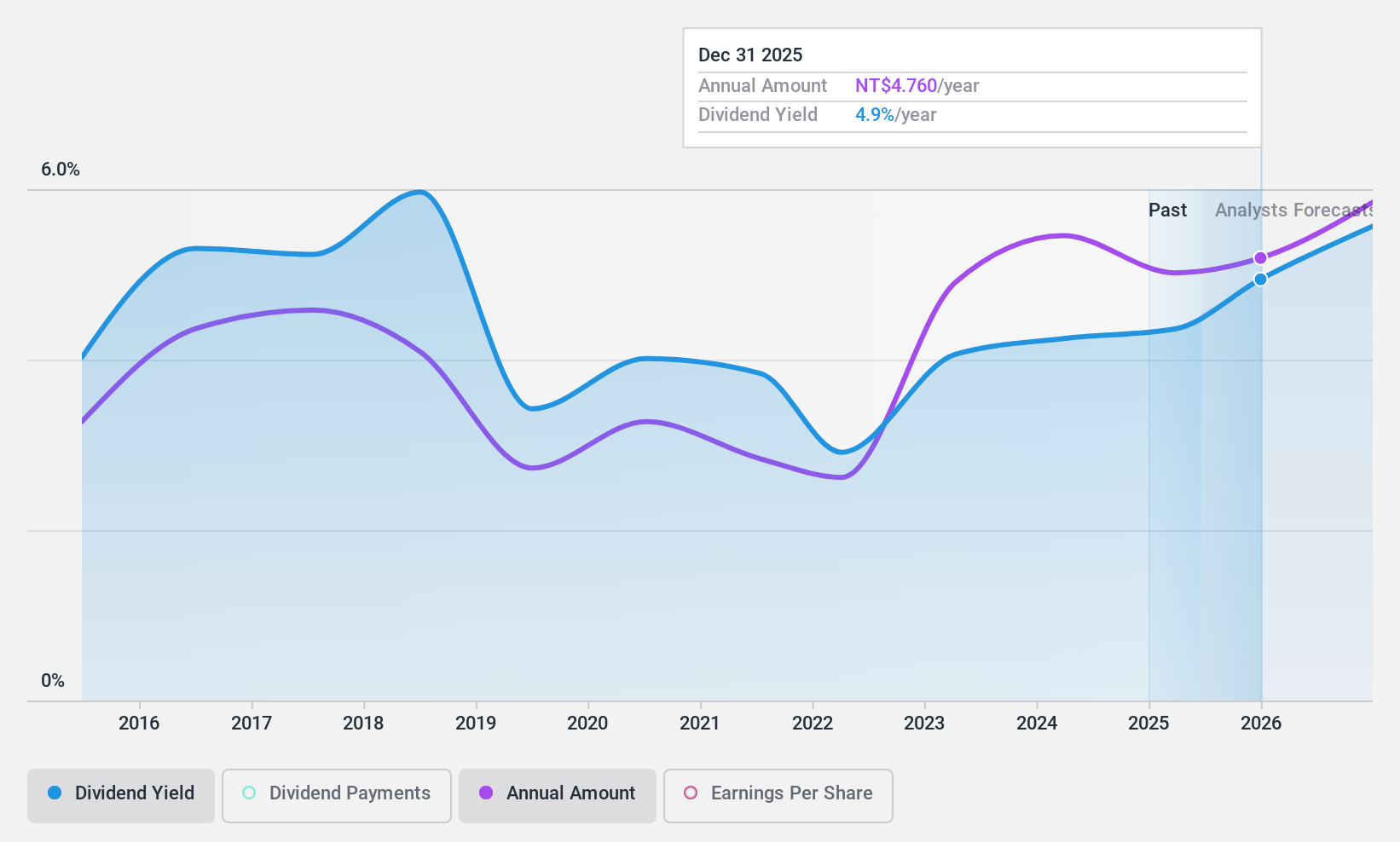

Sercomm (TWSE:5388)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sercomm Corporation researches, develops, manufactures, and sells networking communication software and equipment across North America, Europe, and the Asia Pacific with a market cap of NT$36.48 billion.

Operations: Sercomm Corporation generates revenue of NT$58.99 billion from its Computer Networks segment.

Dividend Yield: 4.1%

Sercomm's dividend yield of 4.08% is lower than the top 25% in Taiwan, with a payout ratio of 58.2% and cash payout ratio of 56.8%, indicating coverage by earnings and cash flows despite a volatile dividend history over the past decade. Recent earnings showed a decline in Q3 sales to TWD 13.46 billion from TWD 15.63 billion last year, though nine-month net income rose to TWD 1.77 billion from TWD 1.69 billion previously.

- Dive into the specifics of Sercomm here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Sercomm is priced lower than what may be justified by its financials.

Seize The Opportunity

- Click here to access our complete index of 1956 Top Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1836

Stella International Holdings

An investment holding company, engages in development, manufacture, and sale of footwear products and leather goods in North America, the People’s Republic of China, Europe, Asia, and internationally.

Flawless balance sheet with solid track record and pays a dividend.