- South Korea

- /

- Industrials

- /

- KOSE:A383800

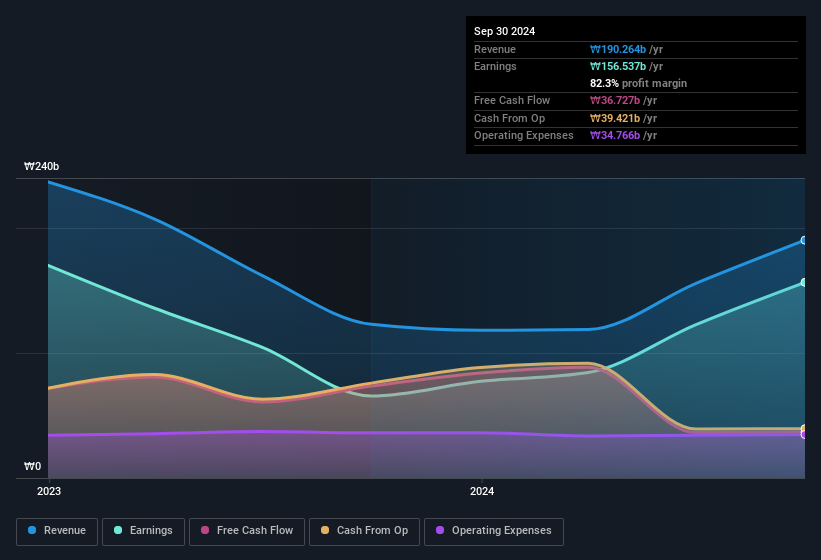

Statutory Profit Doesn't Reflect How Good LX Holdings' (KRX:383800) Earnings Are

Last week's profit announcement from LX Holdings Corp. (KRX:383800) was underwhelming for investors, despite headline numbers being robust. We think that the market might be paying attention to some underlying factors that they find to be concerning.

View our latest analysis for LX Holdings

Our Take On LX Holdings' Profit Performance

Therefore, it seems possible to us that LX Holdings' true underlying earnings power is actually less than its statutory profit. So while earnings quality is important, it's equally important to consider the risks facing LX Holdings at this point in time. At Simply Wall St, we found 1 warning sign for LX Holdings and we think they deserve your attention.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A383800

LX Holdings

Through its subsidiaries, engages in the energy, palm, living resources, logistics, living space, silicon works, and materials and solutions businesses.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives