- South Korea

- /

- Electrical

- /

- KOSE:A361610

SK IE Technology Co., Ltd.'s (KRX:361610) 25% Jump Shows Its Popularity With Investors

SK IE Technology Co., Ltd. (KRX:361610) shareholders are no doubt pleased to see that the share price has bounced 25% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 47% over that time.

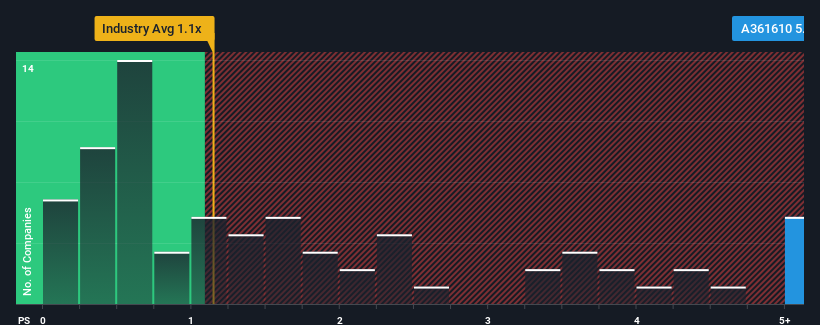

After such a large jump in price, you could be forgiven for thinking SK IE Technology is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.8x, considering almost half the companies in Korea's Electrical industry have P/S ratios below 1.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for SK IE Technology

What Does SK IE Technology's Recent Performance Look Like?

SK IE Technology has been struggling lately as its revenue has declined faster than most other companies. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think SK IE Technology's future stacks up against the industry? In that case, our free report is a great place to start.How Is SK IE Technology's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like SK IE Technology's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 24%. As a result, revenue from three years ago have also fallen 16% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 55% each year over the next three years. With the industry only predicted to deliver 24% per year, the company is positioned for a stronger revenue result.

In light of this, it's understandable that SK IE Technology's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From SK IE Technology's P/S?

The strong share price surge has lead to SK IE Technology's P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of SK IE Technology's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You always need to take note of risks, for example - SK IE Technology has 1 warning sign we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade SK IE Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A361610

SK IE Technology

Engages in manufacturing and selling of battery materials in South Korea, Asia, and Europe.

High growth potential and slightly overvalued.

Market Insights

Community Narratives