- South Korea

- /

- Electrical

- /

- KOSE:A298040

Hyosung Heavy Industries' (KRX:298040) earnings growth rate lags the 61% CAGR delivered to shareholders

We think all investors should try to buy and hold high quality multi-year winners. And we've seen some truly amazing gains over the years. Don't believe it? Then look at the Hyosung Heavy Industries Corporation (KRX:298040) share price. It's 961% higher than it was five years ago. And this is just one example of the epic gains achieved by some long term investors. Also pleasing for shareholders was the 55% gain in the last three months. Anyone who held for that rewarding ride would probably be keen to talk about it.

While the stock has fallen 5.4% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

View our latest analysis for Hyosung Heavy Industries

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

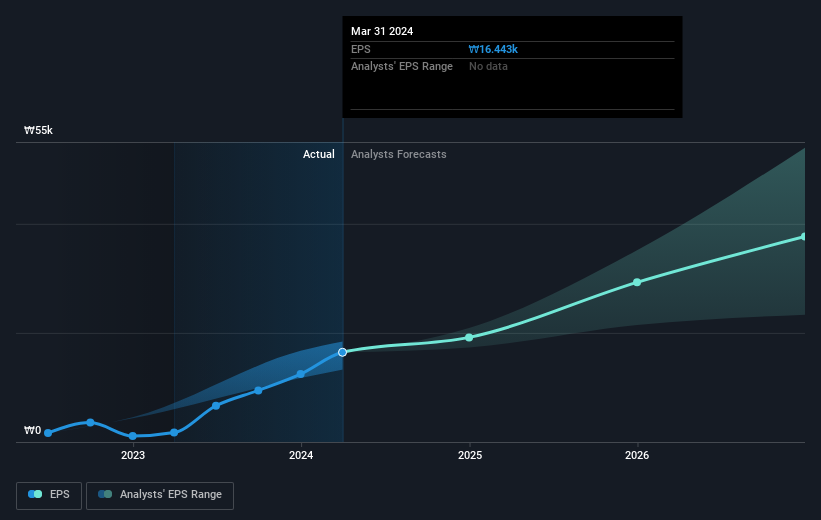

During five years of share price growth, Hyosung Heavy Industries achieved compound earnings per share (EPS) growth of 116% per year. The EPS growth is more impressive than the yearly share price gain of 60% over the same period. So it seems the market isn't so enthusiastic about the stock these days.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how Hyosung Heavy Industries has grown profits over the years, but the future is more important for shareholders. This free interactive report on Hyosung Heavy Industries' balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Hyosung Heavy Industries' total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Hyosung Heavy Industries hasn't been paying dividends, but its TSR of 977% exceeds its share price return of 961%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's good to see that Hyosung Heavy Industries has rewarded shareholders with a total shareholder return of 286% in the last twelve months. That gain is better than the annual TSR over five years, which is 61%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Hyosung Heavy Industries better, we need to consider many other factors. Take risks, for example - Hyosung Heavy Industries has 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

Of course Hyosung Heavy Industries may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hyosung Heavy Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A298040

Hyosung Heavy Industries

Manufactures and sells heavy electrical equipment in South Korea and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives