- South Korea

- /

- Oil and Gas

- /

- KOSE:A267250

Hyundai Heavy Industries Holdings' (KRX:267250) Shareholders Are Down 33% On Their Shares

Hyundai Heavy Industries Holdings Co., Ltd. (KRX:267250) shareholders should be happy to see the share price up 15% in the last month. But that doesn't change the fact that the returns over the last three years have been less than pleasing. In fact, the share price is down 33% in the last three years, falling well short of the market return.

See our latest analysis for Hyundai Heavy Industries Holdings

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

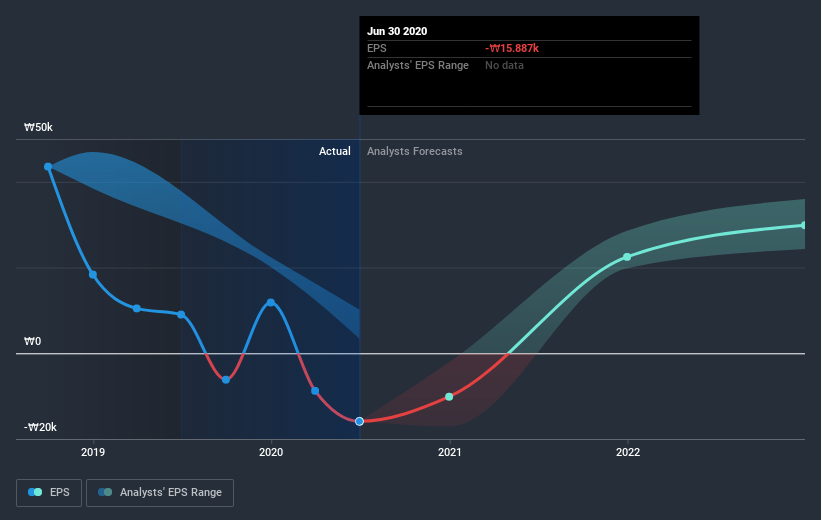

Over the three years that the share price declined, Hyundai Heavy Industries Holdings' earnings per share (EPS) dropped significantly, falling to a loss. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. But it's safe to say we'd generally expect the share price to be lower as a result!

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Hyundai Heavy Industries Holdings' key metrics by checking this interactive graph of Hyundai Heavy Industries Holdings's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Hyundai Heavy Industries Holdings, it has a TSR of -26% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Over the last year, Hyundai Heavy Industries Holdings shareholders took a loss of 19%, including dividends. In contrast the market gained about 25%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 8% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Hyundai Heavy Industries Holdings (1 is significant!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade Hyundai Heavy Industries Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if HD Hyundai might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A267250

HD Hyundai

Through its subsidiaries, engages in oil refining business in Korea and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives