- South Korea

- /

- Machinery

- /

- KOSE:A210540

Is DY Power Corporation's(KRX:210540) Recent Stock Performance Tethered To Its Strong Fundamentals?

DY Power (KRX:210540) has had a great run on the share market with its stock up by a significant 35% over the last month. Since the market usually pay for a company’s long-term fundamentals, we decided to study the company’s key performance indicators to see if they could be influencing the market. In this article, we decided to focus on DY Power's ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Put another way, it reveals the company's success at turning shareholder investments into profits.

View our latest analysis for DY Power

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for DY Power is:

9.6% = ₩18b ÷ ₩184b (Based on the trailing twelve months to September 2020).

The 'return' is the amount earned after tax over the last twelve months. One way to conceptualize this is that for each ₩1 of shareholders' capital it has, the company made ₩0.10 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of DY Power's Earnings Growth And 9.6% ROE

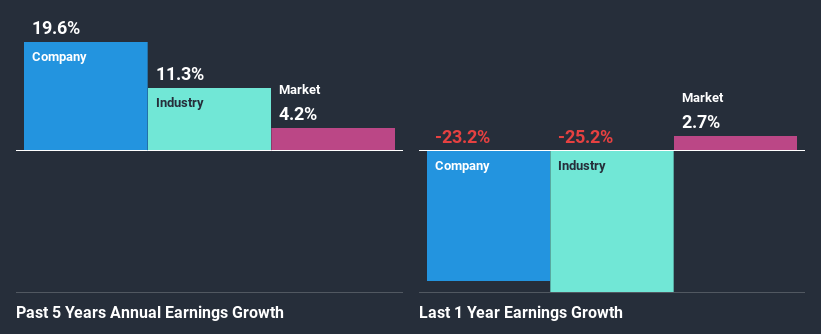

When you first look at it, DY Power's ROE doesn't look that attractive. Although a closer study shows that the company's ROE is higher than the industry average of 4.8% which we definitely can't overlook. This certainly adds some context to DY Power's moderate 20% net income growth seen over the past five years. That being said, the company does have a slightly low ROE to begin with, just that it is higher than the industry average. Hence there might be some other aspects that are causing earnings to grow. For example, it is possible that the broader industry is going through a high growth phase, or that the company has a low payout ratio.

We then compared DY Power's net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 11% in the same period.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if DY Power is trading on a high P/E or a low P/E, relative to its industry.

Is DY Power Using Its Retained Earnings Effectively?

DY Power's three-year median payout ratio to shareholders is 13% (implying that it retains 87% of its income), which is on the lower side, so it seems like the management is reinvesting profits heavily to grow its business.

While DY Power has been growing its earnings, it only recently started to pay dividends which likely means that the company decided to impress new and existing shareholders with a dividend.

Conclusion

In total, we are pretty happy with DY Power's performance. Particularly, we like that the company is reinvesting heavily into its business at a moderate rate of return. Unsurprisingly, this has led to an impressive earnings growth. If the company continues to grow its earnings the way it has, that could have a positive impact on its share price given how earnings per share influence long-term share prices. Not to forget, share price outcomes are also dependent on the potential risks a company may face. So it is important for investors to be aware of the risks involved in the business. You can see the 2 risks we have identified for DY Power by visiting our risks dashboard for free on our platform here.

If you decide to trade DY Power, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A210540

DY Power

Engages in production and sales of hydraulic cylinders for construction equipment in Korea.

Flawless balance sheet and good value.

Market Insights

Community Narratives