- South Korea

- /

- Machinery

- /

- KOSE:A119650

KC Cottrell Co., Ltd. (KRX:119650) Surges 46% Yet Its Low P/S Is No Reason For Excitement

Despite an already strong run, KC Cottrell Co., Ltd. (KRX:119650) shares have been powering on, with a gain of 46% in the last thirty days. But the last month did very little to improve the 60% share price decline over the last year.

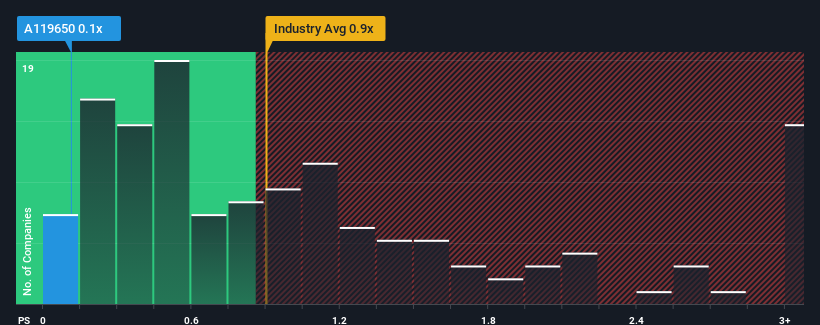

Even after such a large jump in price, given about half the companies operating in Korea's Machinery industry have price-to-sales ratios (or "P/S") above 0.9x, you may still consider KC Cottrell as an attractive investment with its 0.1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for KC Cottrell

How Has KC Cottrell Performed Recently?

For instance, KC Cottrell's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on KC Cottrell will help you shine a light on its historical performance.How Is KC Cottrell's Revenue Growth Trending?

In order to justify its P/S ratio, KC Cottrell would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 22%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 23% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

This is in contrast to the rest of the industry, which is expected to grow by 41% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in consideration, it's easy to understand why KC Cottrell's P/S falls short of the mark set by its industry peers. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Final Word

KC Cottrell's stock price has surged recently, but its but its P/S still remains modest. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

In line with expectations, KC Cottrell maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with KC Cottrell (at least 3 which don't sit too well with us), and understanding them should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if KC Cottrell might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A119650

KC Cottrell

Engages in the research and development, engineering, construction, operation, supply, and post-management of environmental equipment and technology.

Moderate and slightly overvalued.

Similar Companies

Market Insights

Community Narratives