As global markets continue to navigate the complexities of rising inflation and shifting trade policies, U.S. stock indexes are climbing toward record highs, with growth stocks leading the charge. In this dynamic environment, dividend stocks can offer a measure of stability and income potential, making them an attractive option for investors seeking reliable returns amidst economic uncertainty.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.92% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.33% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.51% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.99% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.97% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.85% | ★★★★★★ |

Click here to see the full list of 1970 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

LX Hausys (KOSE:A108670)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LX Hausys, Ltd., along with its subsidiaries, manufactures and sells building materials both in South Korea and internationally, with a market cap of ₩298.43 billion.

Operations: LX Hausys generates revenue primarily from its Building Materials segment, which accounts for ₩2.56 trillion, and its Automotive Materials / Industrial Films segment, contributing ₩1.01 trillion.

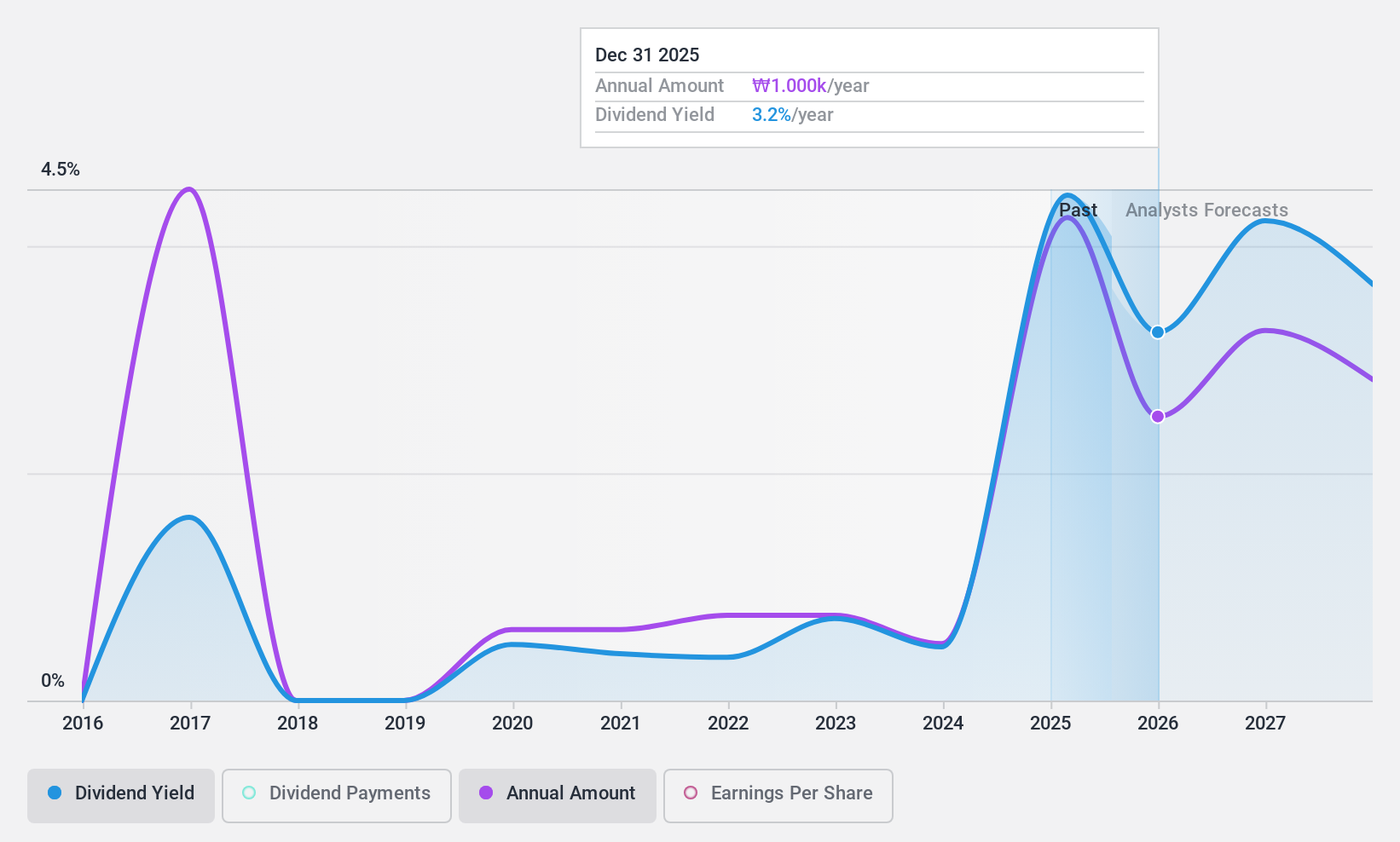

Dividend Yield: 5.4%

LX Hausys trades at a significant discount to its estimated fair value and offers a dividend yield of 5.45%, placing it in the top quartile of Korean dividend payers. The company's dividends are well covered by earnings and cash flows, with payout ratios of 33.3% and 36.8%, respectively. However, the dividend history is volatile, with payments decreasing over its nine-year track record, raising concerns about reliability despite its attractive yield.

- Unlock comprehensive insights into our analysis of LX Hausys stock in this dividend report.

- Our valuation report here indicates LX Hausys may be undervalued.

Miyoshi Oil & Fat (TSE:4404)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Miyoshi Oil & Fat Co., Ltd. manufactures and sells food and oil products in Japan, with a market cap of ¥15.59 billion.

Operations: Miyoshi Oil & Fat Co., Ltd.'s revenue is primarily derived from its Food Business, contributing ¥39.82 billion, and its Oil Business, generating ¥16.84 billion.

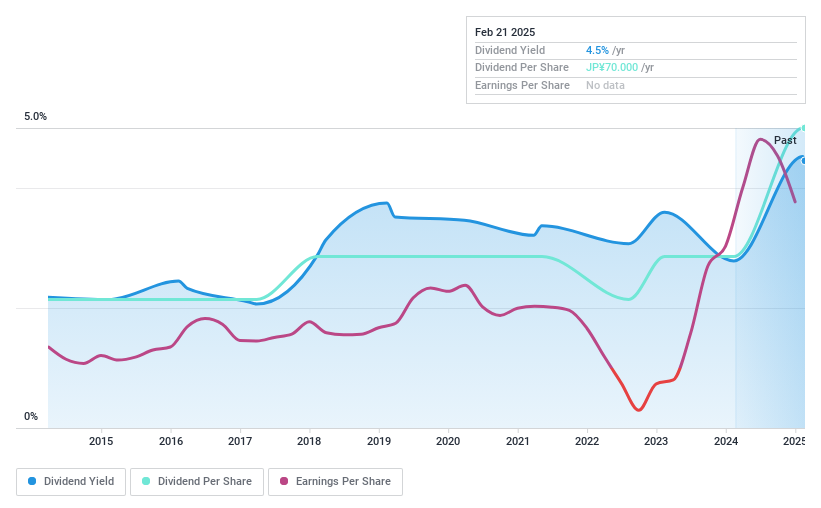

Dividend Yield: 4.6%

Miyoshi Oil & Fat offers a dividend yield of 4.57%, ranking it in the top quartile among Japanese dividend payers. While dividends have been stable and growing over the past decade, they are not well covered by free cash flows, despite a low payout ratio of 14.2%. Earnings have grown significantly by 35.7% recently, but large one-off items affect earnings quality. The stock's price-to-earnings ratio is favorable at 5.5x compared to the market average of 13.2x.

- Delve into the full analysis dividend report here for a deeper understanding of Miyoshi Oil & Fat.

- According our valuation report, there's an indication that Miyoshi Oil & Fat's share price might be on the expensive side.

Hosokawa Micron (TSE:6277)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hosokawa Micron Corporation specializes in providing powder and plastic processing equipment across Japan, the Americas, Europe, Asia, and internationally, with a market cap of ¥57.98 billion.

Operations: Hosokawa Micron Corporation generates revenue from its Powder-Related Business, which accounts for ¥63.06 billion, and its Plastic Thin Film Related Business, contributing ¥20.29 billion.

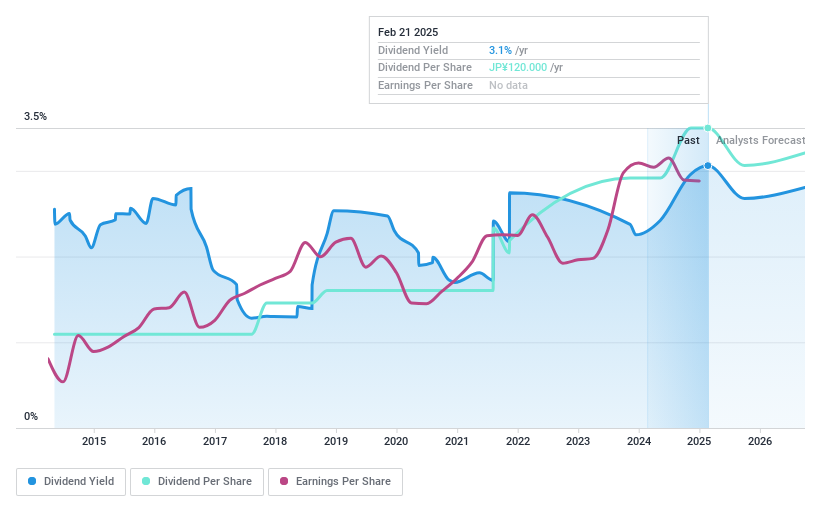

Dividend Yield: 3.1%

Hosokawa Micron's dividend payments are well covered by earnings and cash flows, with payout ratios of 32.4% and 33.4%, respectively, indicating sustainability despite a volatile track record over the past decade. Recent guidance suggests a year-end dividend decrease to JPY 60 per share from JPY 70 last year, but an increase in second quarter dividends from JPY 50 to JPY 60 per share reflects some growth potential amidst its trading value below estimated fair value.

- Navigate through the intricacies of Hosokawa Micron with our comprehensive dividend report here.

- The analysis detailed in our Hosokawa Micron valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Embark on your investment journey to our 1970 Top Dividend Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hosokawa Micron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6277

Hosokawa Micron

Provides powder and plastic processing equipment in Japan, the Americas, Europe, Asia, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026