- South Korea

- /

- Machinery

- /

- KOSE:A082740

If You Had Bought HSD Engine (KRX:082740) Stock A Year Ago, You Could Pocket A 68% Gain Today

HSD Engine Co., Ltd. (KRX:082740) shareholders might be concerned after seeing the share price drop 11% in the last month. While that might be a setback, it doesn't negate the nice returns received over the last twelve months. To wit, it had solidly beat the market, up 68%.

View our latest analysis for HSD Engine

Given that HSD Engine didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year HSD Engine saw its revenue grow by 60%. That's well above most other pre-profit companies. While the share price gain of 68% over twelve months is pretty tasty, you might argue it doesn't fully reflect the strong revenue growth. If that's the case, now might be the time to take a close look at HSD Engine. Human beings have trouble conceptualizing (and valuing) exponential growth. Is that what we're seeing here?

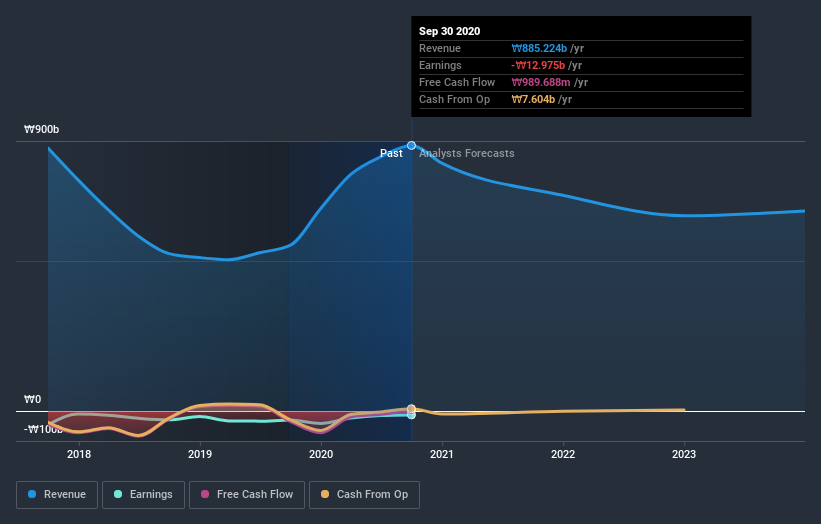

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's good to see that HSD Engine has rewarded shareholders with a total shareholder return of 68% in the last twelve months. That's better than the annualised return of 33% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand HSD Engine better, we need to consider many other factors. For instance, we've identified 1 warning sign for HSD Engine that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade HSD Engine, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hanwha Engine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A082740

Reasonable growth potential with weak fundamentals.

Market Insights

Community Narratives