- South Korea

- /

- Machinery

- /

- KOSE:A071970

Undiscovered Gems And 2 Promising Small Caps To Enhance Your Portfolio

Reviewed by Simply Wall St

In a global market landscape marked by volatility, with U.S. stocks experiencing fluctuations due to AI competition fears and mixed economic indicators, investors are increasingly looking towards small-cap opportunities for potential growth. As the S&P 600 Index reflects the dynamic nature of smaller companies amidst these broader market shifts, identifying promising small-cap stocks can be crucial for enhancing portfolio diversity and tapping into under-the-radar opportunities that align with current economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Padma Oil | 0.73% | 7.10% | 12.89% | ★★★★★★ |

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Voltamp Energy SAOG | 35.98% | -1.56% | 50.16% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| All E Technologies | NA | 18.60% | 31.35% | ★★★★★★ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.04% | 16.85% | ★★★★☆☆ |

| Bank MNC Internasional | 18.72% | 4.80% | 43.63% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

HD-Hyundai Marine Engine (KOSE:A071970)

Simply Wall St Value Rating: ★★★★★★

Overview: HD-Hyundai Marine Engine Co., Ltd. manufactures and sells marine engines, industrial facilities, and plants in South Korea and internationally, with a market cap of ₩1.01 trillion.

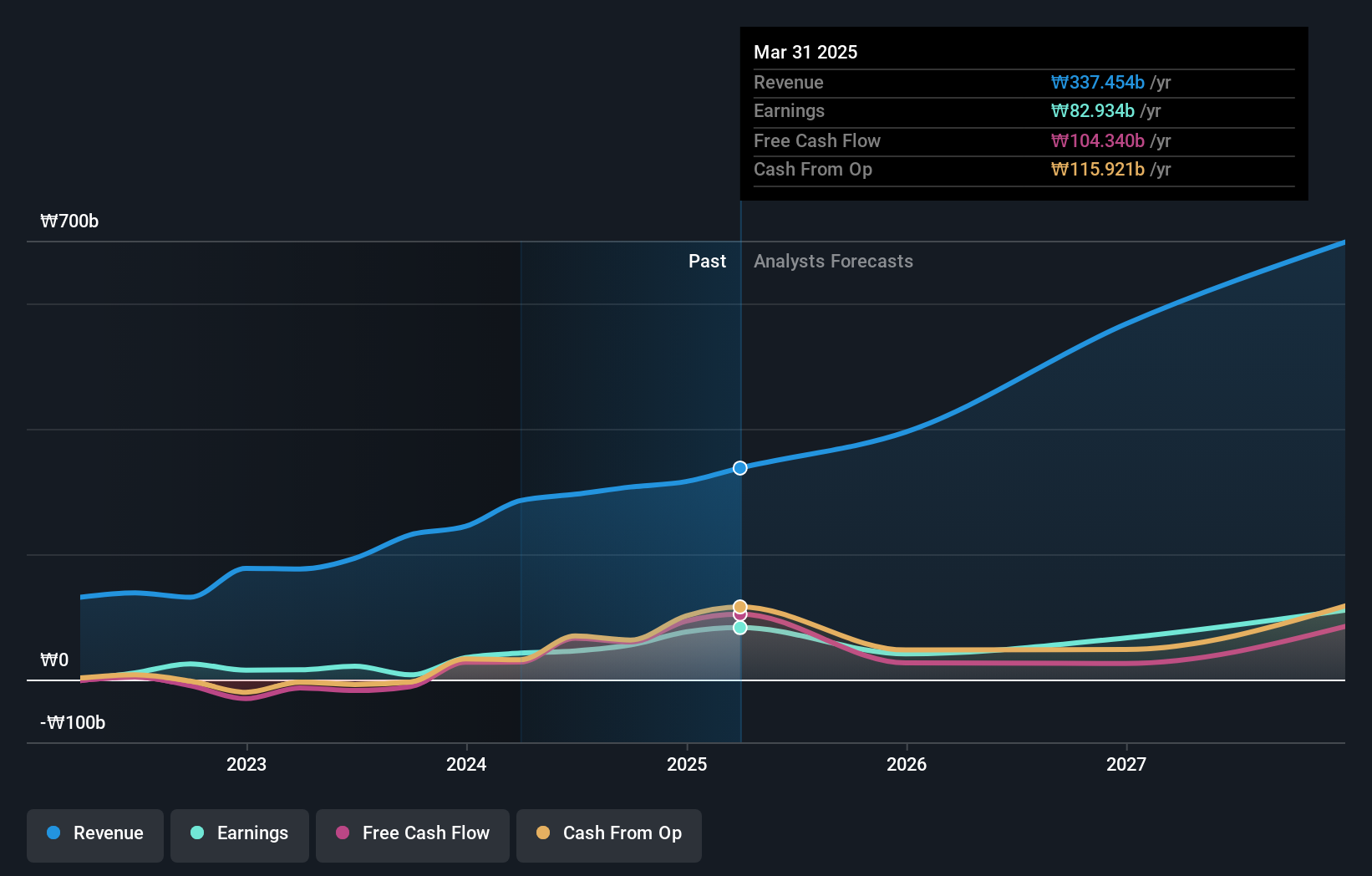

Operations: HD-Hyundai Marine Engine generates revenue primarily from its Engine and Equipment segment, amounting to ₩307.81 billion.

HD-Hyundai Marine Engine has shown remarkable growth, with earnings surging 581.8% over the past year, outpacing the broader Machinery industry. The company's debt to equity ratio impressively decreased from 85.5% to 0.6% over five years, indicating strong financial management. Interest payments are well covered by EBIT at 17.7 times coverage, showcasing robust profitability and operational efficiency. Recent earnings reports reveal a net income of KRW 9,512 million for Q3 compared to a net loss of KRW 244 million last year, with basic EPS jumping from a loss of KRW 9 to KRW 296 per share this quarter.

Partner Communications (TASE:PTNR)

Simply Wall St Value Rating: ★★★★★★

Overview: Partner Communications Company Ltd. offers a range of communication services in Israel and has a market capitalization of ₪4.72 billion.

Operations: Partner Communications generates revenue primarily from its Cellular Segment, contributing ₪2.09 billion, and its Stationary Segment, adding ₪1.33 billion.

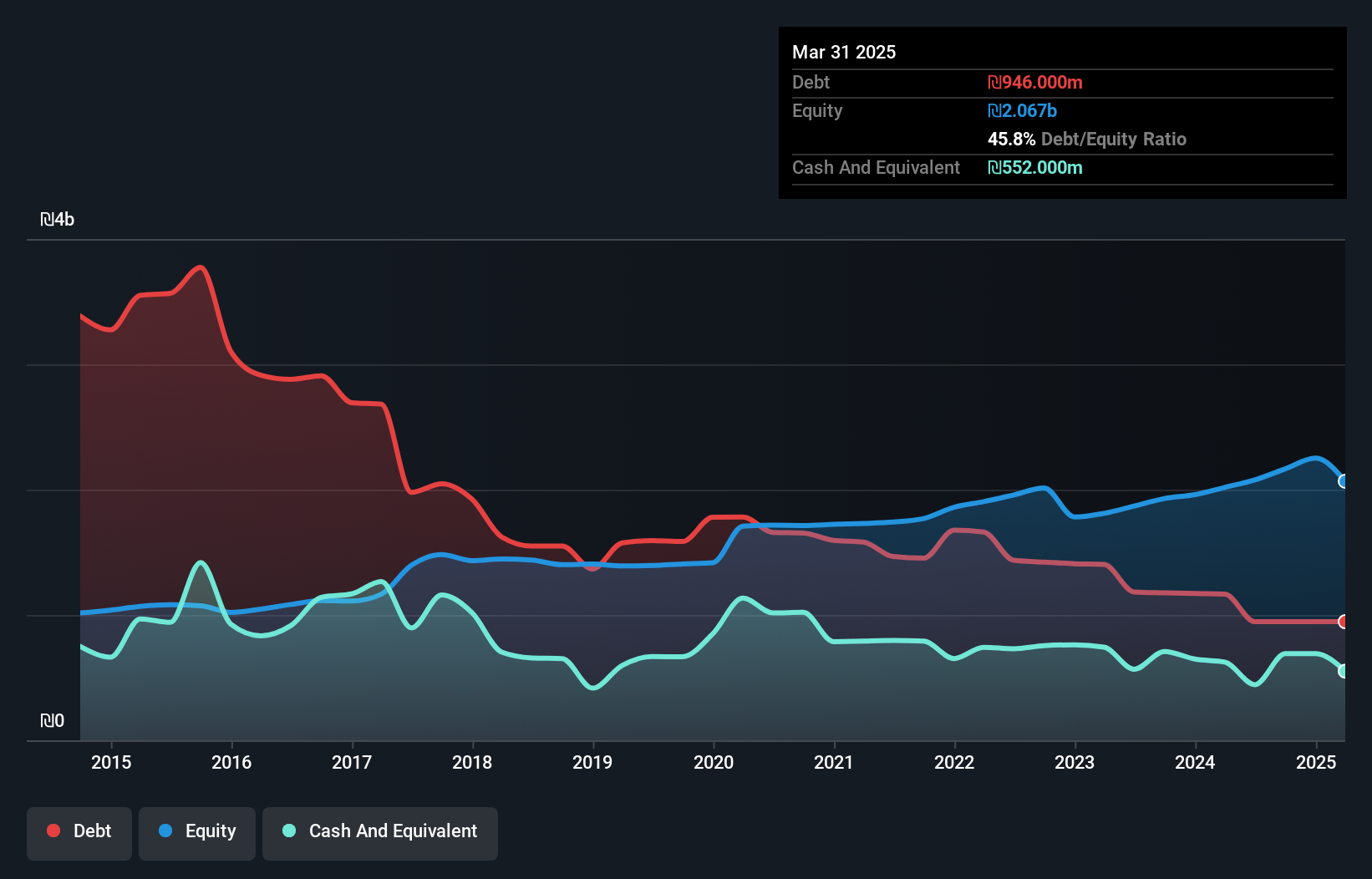

Partner Communications has shown a promising turnaround, becoming profitable this year with earnings growth outpacing the Wireless Telecom industry. Its debt to equity ratio improved significantly from 112.7% to 43.7% over five years, and net debt to equity stands at a satisfactory 11.8%. Trading at a value estimated to be 31.2% below fair value, it appears undervalued in the market. Recent results highlight robust performance with third-quarter sales reaching ILS 851 million and net income rising to ILS 85 million from ILS 56 million last year, reflecting strong financial health despite share price volatility recently observed.

Yamagata Bank (TSE:8344)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Yamagata Bank, Ltd. offers a range of banking products and services in Japan with a market cap of ¥40.90 billion.

Operations: Yamagata Bank generates revenue through its diverse banking products and services in Japan. The company's market capitalization stands at ¥40.90 billion, reflecting its position in the financial sector.

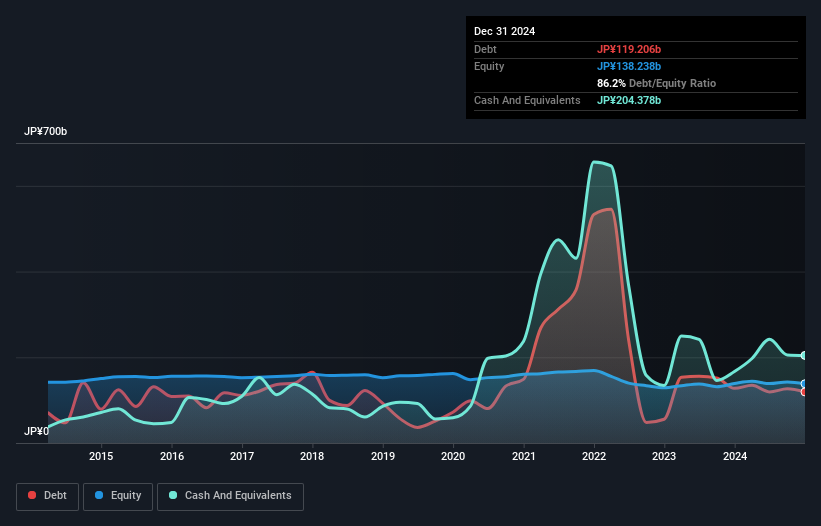

With total assets of ¥3,168.7 billion and equity standing at ¥138.2 billion, Yamagata Bank is navigating the financial landscape with a balance of strengths and challenges. Customer deposits form 95% of its liabilities, ensuring a low-risk funding structure. The bank's earnings surged by 43.8% last year, outpacing the industry growth rate significantly. Despite this impressive growth, its allowance for bad loans remains low at 42%, against a backdrop of non-performing loans at 1.1%. Trading below estimated fair value by 22.4%, it presents an intriguing proposition for those eyeing potential value opportunities in banking stocks.

- Navigate through the intricacies of Yamagata Bank with our comprehensive health report here.

Review our historical performance report to gain insights into Yamagata Bank's's past performance.

Summing It All Up

- Click through to start exploring the rest of the 4661 Undiscovered Gems With Strong Fundamentals now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HD-Hyundai Marine Engine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A071970

HD-Hyundai Marine Engine

Manufactures and sells marine engines, industrial facilities, and plants in South Korea and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives