- South Korea

- /

- Construction

- /

- KOSE:A053690

Some Investors May Be Willing To Look Past HanmiGlobal's (KRX:053690) Soft Earnings

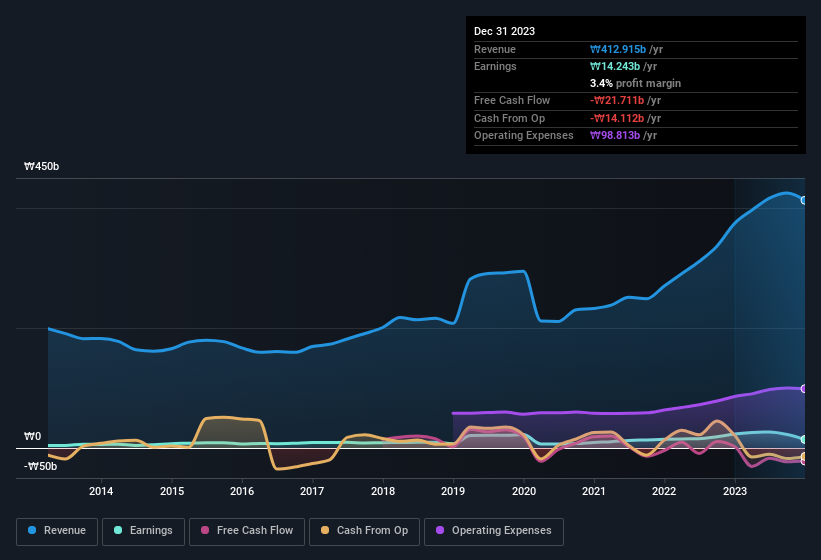

The market was pleased with the recent earnings report from HanmiGlobal Co., Ltd. (KRX:053690), despite the profit numbers being soft. However, we think the company is showing some signs that things are more promising than they seem.

See our latest analysis for HanmiGlobal

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. HanmiGlobal expanded the number of shares on issue by 7.4% over the last year. That means its earnings are split among a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out HanmiGlobal's historical EPS growth by clicking on this link.

A Look At The Impact Of HanmiGlobal's Dilution On Its Earnings Per Share (EPS)

As you can see above, HanmiGlobal has been growing its net income over the last few years, with an annualized gain of 53% over three years. Net profit actually dropped by 39% in the last year. But the EPS result was even worse, with the company recording a decline of 43%. And so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, if HanmiGlobal's earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of HanmiGlobal.

How Do Unusual Items Influence Profit?

On top of the dilution, we should also consider the ₩4.5b impact of unusual items in the last year, which had the effect of suppressing profit. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. If HanmiGlobal doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

Our Take On HanmiGlobal's Profit Performance

To sum it all up, HanmiGlobal took a hit from unusual items which pushed its profit down; without that, it would have made more money. But unfortunately the dilution means that shareholders now own a smaller proportion of the company (assuming they maintained the same number of shares). That will weigh on earnings per share, even if it is not reflected in net income. Based on these factors, it's hard to tell if HanmiGlobal's profits are a reasonable reflection of its underlying profitability. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. While conducting our analysis, we found that HanmiGlobal has 3 warning signs and it would be unwise to ignore these.

Our examination of HanmiGlobal has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if HanmiGlobal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A053690

HanmiGlobal

Provides construction project management services in South Korea and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives