- South Korea

- /

- Machinery

- /

- KOSE:A042670

HD Hyundai Infracore Co., Ltd. (KRX:042670) Screens Well But There Might Be A Catch

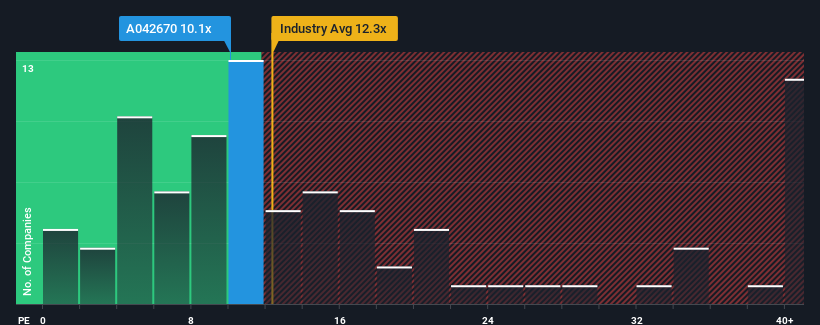

With a median price-to-earnings (or "P/E") ratio of close to 11x in Korea, you could be forgiven for feeling indifferent about HD Hyundai Infracore Co., Ltd.'s (KRX:042670) P/E ratio of 10.1x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

While the market has experienced earnings growth lately, HD Hyundai Infracore's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for HD Hyundai Infracore

How Is HD Hyundai Infracore's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like HD Hyundai Infracore's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 58% decrease to the company's bottom line. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to climb by 27% per year during the coming three years according to the six analysts following the company. With the market only predicted to deliver 16% per annum, the company is positioned for a stronger earnings result.

With this information, we find it interesting that HD Hyundai Infracore is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From HD Hyundai Infracore's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that HD Hyundai Infracore currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Having said that, be aware HD Hyundai Infracore is showing 3 warning signs in our investment analysis, you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if HD Hyundai Infracore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A042670

HD Hyundai Infracore

Engages in the production and sale of construction equipment, engines, attachments, and utility equipment in South Korea and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives