- South Korea

- /

- Machinery

- /

- KOSE:A042660

Asian Stocks That May Be Trading Below Estimated Value In May 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by easing trade tensions and mixed economic signals, the Asian stock markets have been particularly intriguing. Despite challenges such as trade negotiations and fluctuating economic indicators, opportunities may exist for investors seeking stocks that appear to be trading below their estimated value. Identifying undervalued stocks often involves looking at companies with strong fundamentals that are temporarily overlooked or impacted by broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Lingbao Gold Group (SEHK:3330) | HK$9.09 | HK$18.05 | 49.6% |

| Renesas Electronics (TSE:6723) | ¥1733.00 | ¥3423.30 | 49.4% |

| Lucky Harvest (SZSE:002965) | CN¥55.10 | CN¥108.00 | 49% |

| Rakus (TSE:3923) | ¥2184.00 | ¥4339.96 | 49.7% |

| Suzhou Dongshan Precision Manufacturing (SZSE:002384) | CN¥27.30 | CN¥53.34 | 48.8% |

| Seegene (KOSDAQ:A096530) | ₩26550.00 | ₩53043.34 | 49.9% |

| World Fitness Services (TWSE:2762) | NT$81.30 | NT$162.29 | 49.9% |

| giftee (TSE:4449) | ¥1536.00 | ¥3045.88 | 49.6% |

| Innovent Biologics (SEHK:1801) | HK$54.30 | HK$108.54 | 50% |

| Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266) | CN¥101.60 | CN¥199.10 | 49% |

Below we spotlight a couple of our favorites from our exclusive screener.

Hanwha Ocean (KOSE:A042660)

Overview: Hanwha Ocean Co., Ltd. is a South Korean company that operates as a shipbuilding and offshore contractor both domestically and internationally, with a market cap of ₩24.17 trillion.

Operations: The company's revenue primarily comes from its Merchant Ship segment, generating ₩8.68 trillion, followed by the Marine and Special Ship segment at ₩2.14 trillion, and the E&I segment contributing ₩336.82 million.

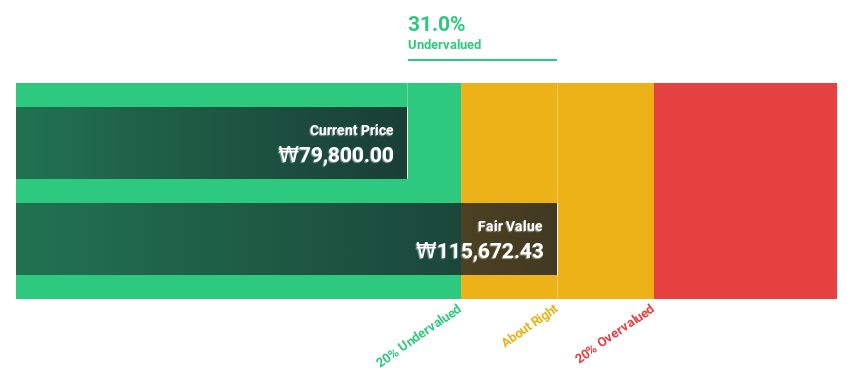

Estimated Discount To Fair Value: 32%

Hanwha Ocean's earnings grew by 271% last year, with net income rising to ₩528.12 billion from ₩159.89 billion the previous year. Trading at 32% below its estimated fair value, it is significantly undervalued based on discounted cash flow analysis. While earnings are expected to grow significantly over the next three years, interest payments are not well covered by earnings and revenue growth is projected to be modest at 7.7% annually.

- The analysis detailed in our Hanwha Ocean growth report hints at robust future financial performance.

- Click here to discover the nuances of Hanwha Ocean with our detailed financial health report.

Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636)

Overview: Guangdong Fenghua Advanced Technology (Holding) Co., Ltd. operates in the electronic components industry, focusing on the production and sale of passive electronic components, with a market cap of approximately CN¥15.73 billion.

Operations: The company generates revenue primarily from its Electronic Components & Parts segment, amounting to approximately CN¥5.16 billion.

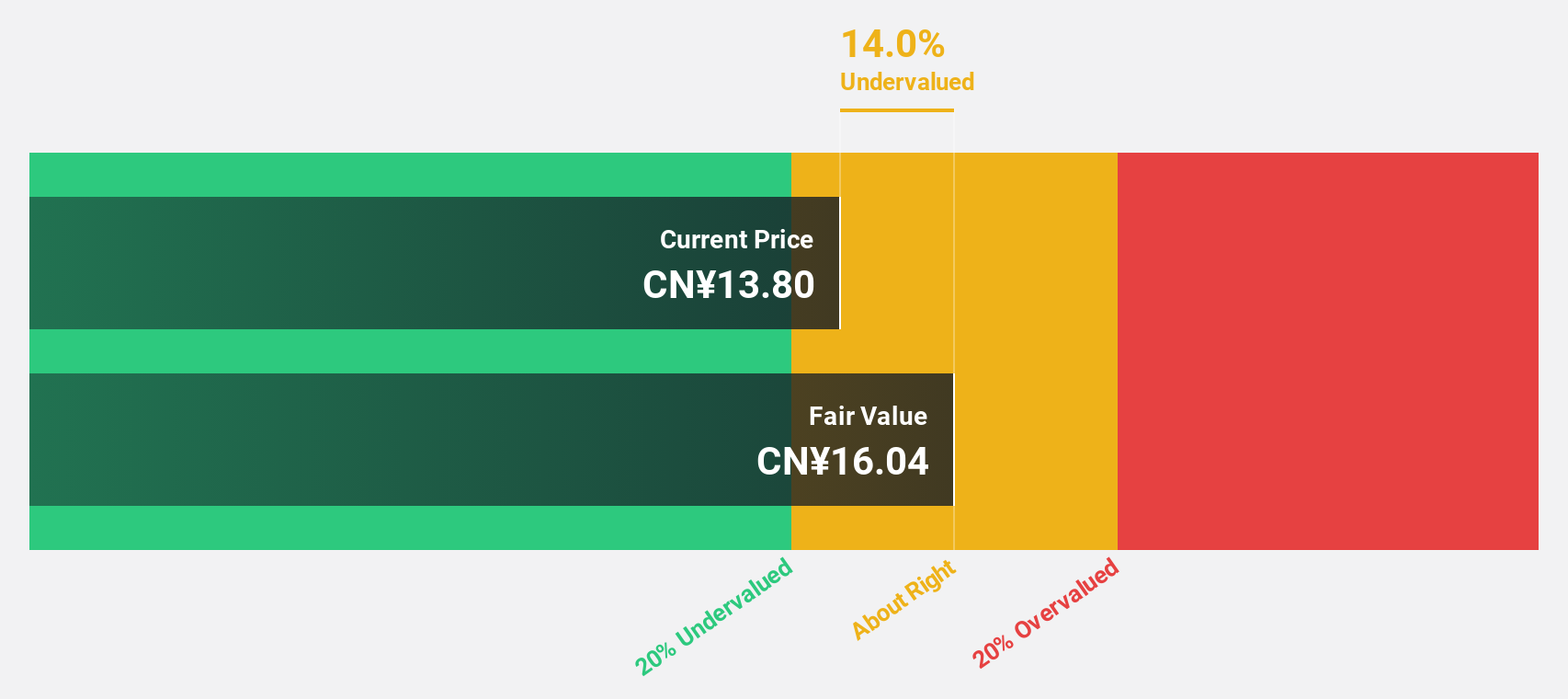

Estimated Discount To Fair Value: 11.7%

Guangdong Fenghua Advanced Technology (Holding) is trading at CN¥13.71, approximately 11.7% below its estimated fair value of CN¥15.52, indicating it may be undervalued based on discounted cash flow analysis. Despite a modest dividend yield of 1.09% not being well-covered by free cash flows, the company shows strong growth potential with earnings forecasted to grow significantly at 32.8% annually and revenue expected to outpace the Chinese market's average growth rate.

- Our earnings growth report unveils the potential for significant increases in Guangdong Fenghua Advanced Technology (Holding)'s future results.

- Get an in-depth perspective on Guangdong Fenghua Advanced Technology (Holding)'s balance sheet by reading our health report here.

Shenzhen KSTAR Science and Technology (SZSE:002518)

Overview: Shenzhen KSTAR Science and Technology Co., Ltd. operates in the technology sector, focusing on providing power supply solutions, with a market cap of approximately CN¥13.66 billion.

Operations: Unfortunately, I cannot provide a summary of the company's revenue segments as the necessary data is missing from your provided text. Please include the relevant information to assist further.

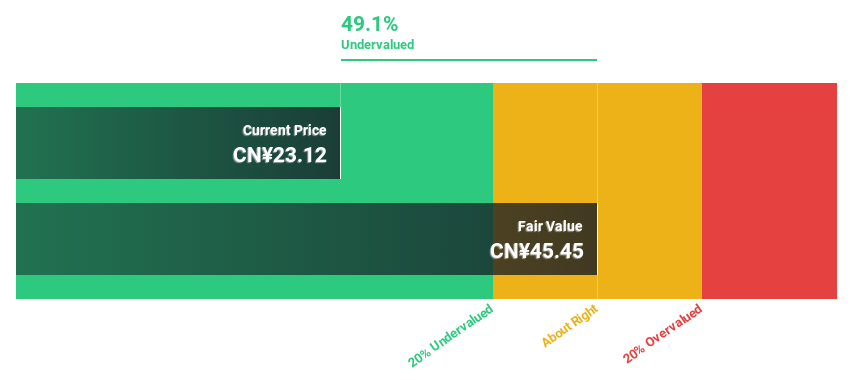

Estimated Discount To Fair Value: 47.9%

Shenzhen KSTAR Science and Technology is trading at CN¥23.47, significantly below its estimated fair value of CN¥45.06, highlighting potential undervaluation based on cash flows. Despite a recent drop in profit margins to 8.9% from 15.1%, the company anticipates robust growth with revenue expected to rise by 21.2% annually, surpassing market averages. However, dividend sustainability remains a concern due to an unstable track record and recent decreases in payouts.

- The growth report we've compiled suggests that Shenzhen KSTAR Science and Technology's future prospects could be on the up.

- Dive into the specifics of Shenzhen KSTAR Science and Technology here with our thorough financial health report.

Taking Advantage

- Take a closer look at our Undervalued Asian Stocks Based On Cash Flows list of 271 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanwha Ocean might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A042660

Hanwha Ocean

Operates as a shipbuilding and offshore contractor in South Korea and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives