- South Korea

- /

- Industrials

- /

- KOSE:A028260

Earnings Not Telling The Story For Samsung C&T Corporation (KRX:028260)

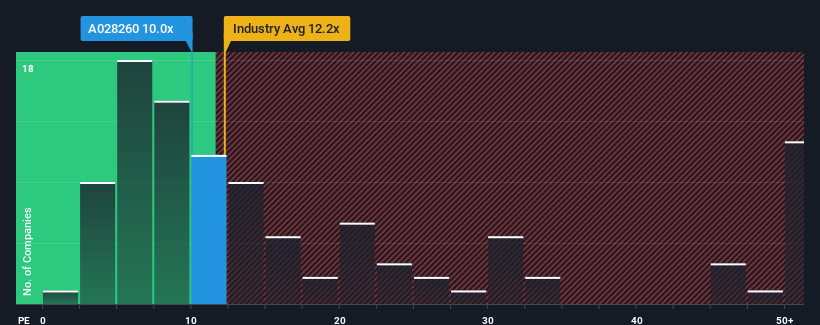

It's not a stretch to say that Samsung C&T Corporation's (KRX:028260) price-to-earnings (or "P/E") ratio of 10x right now seems quite "middle-of-the-road" compared to the market in Korea, where the median P/E ratio is around 11x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Samsung C&T could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for Samsung C&T

Is There Some Growth For Samsung C&T?

The only time you'd be comfortable seeing a P/E like Samsung C&T's is when the company's growth is tracking the market closely.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 36% overall rise in EPS, in spite of its uninspiring short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 5.9% per annum during the coming three years according to the analysts following the company. With the market predicted to deliver 16% growth each year, the company is positioned for a weaker earnings result.

In light of this, it's curious that Samsung C&T's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Samsung C&T currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 1 warning sign for Samsung C&T that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A028260

Samsung C&T

Engages in the engineering and construction, trading and investment, fashion, and resort businesses in South Korea, Europe, the Middle East, Africa, the Asia Pacific, and the Americas.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives