- South Korea

- /

- Electrical

- /

- KOSE:A025540

Korea Electric Terminal's (KRX:025540) Shareholders Are Down 47% On Their Shares

Korea Electric Terminal Co., Ltd. (KRX:025540) shareholders should be happy to see the share price up 17% in the last quarter. But that doesn't change the fact that the returns over the last five years have been less than pleasing. After all, the share price is down 47% in that time, significantly under-performing the market.

View our latest analysis for Korea Electric Terminal

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

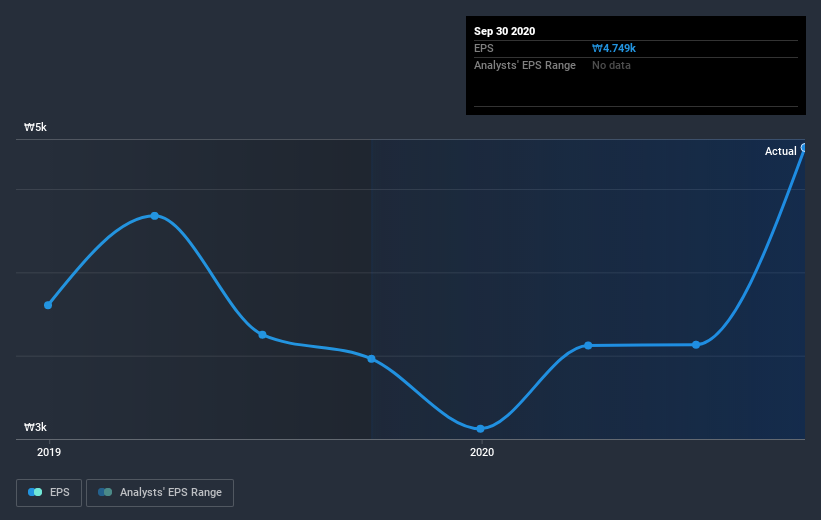

Looking back five years, both Korea Electric Terminal's share price and EPS declined; the latter at a rate of 4.7% per year. This reduction in EPS is less than the 12% annual reduction in the share price. This implies that the market is more cautious about the business these days. The less favorable sentiment is reflected in its current P/E ratio of 11.16.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on Korea Electric Terminal's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Korea Electric Terminal the TSR over the last 5 years was -44%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Korea Electric Terminal shareholders gained a total return of 28% during the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 7% endured over half a decade. It could well be that the business is stabilizing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Korea Electric Terminal you should know about.

We will like Korea Electric Terminal better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading Korea Electric Terminal or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Korea Electric Terminal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A025540

Korea Electric Terminal

Manufactures and sells parts for automotive and electronics in South Korea and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives