- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3356

Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As of February 2025, global markets are navigating a complex landscape characterized by geopolitical tensions and fluctuating consumer spending, with major U.S. indices experiencing volatility amid concerns over tariffs and economic growth. Amidst this backdrop, dividend stocks can offer investors a measure of stability through regular income streams, making them an attractive consideration in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Padma Oil (DSE:PADMAOIL) | 7.61% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.06% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.03% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.75% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.06% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.92% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.37% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.24% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.90% | ★★★★★★ |

Click here to see the full list of 2008 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

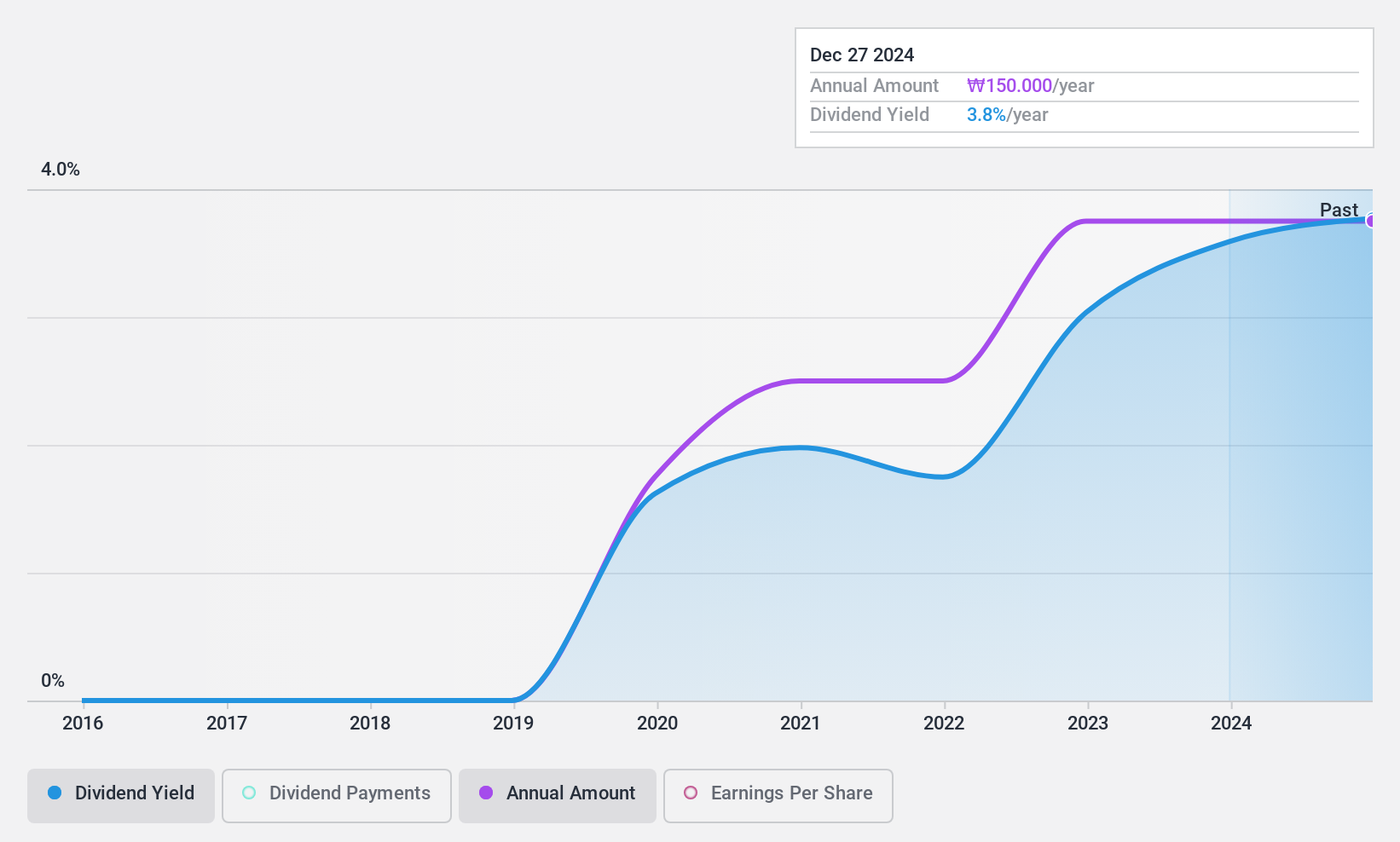

ILJIN HoldingsLtd (KOSE:A015860)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ILJIN Holdings Co., Ltd. operates as a parts and materials specialized company worldwide, with a market cap of ₩173.37 billion.

Operations: ILJIN Holdings Co., Ltd. generates revenue primarily from its Front Line Power segment (₩1.46 billion), followed by Tool Material (₩148.50 million) and Medical Devices (₩57.87 million), with additional income from Real Estate Rental (₩10.34 million).

Dividend Yield: 4%

ILJIN Holdings Ltd. offers a compelling dividend profile with a payout ratio of 25.8%, indicating dividends are well covered by earnings and cash flows. The company has maintained stable and reliable dividend payments over its six-year history, with a yield of 3.98% placing it in the top quartile of KR market payers. Despite its short track record, strong earnings growth (31% last year) and an attractive P/E ratio of 6.5x suggest potential value for investors seeking dividends in the KR market context.

- Navigate through the intricacies of ILJIN HoldingsLtd with our comprehensive dividend report here.

- The analysis detailed in our ILJIN HoldingsLtd valuation report hints at an inflated share price compared to its estimated value.

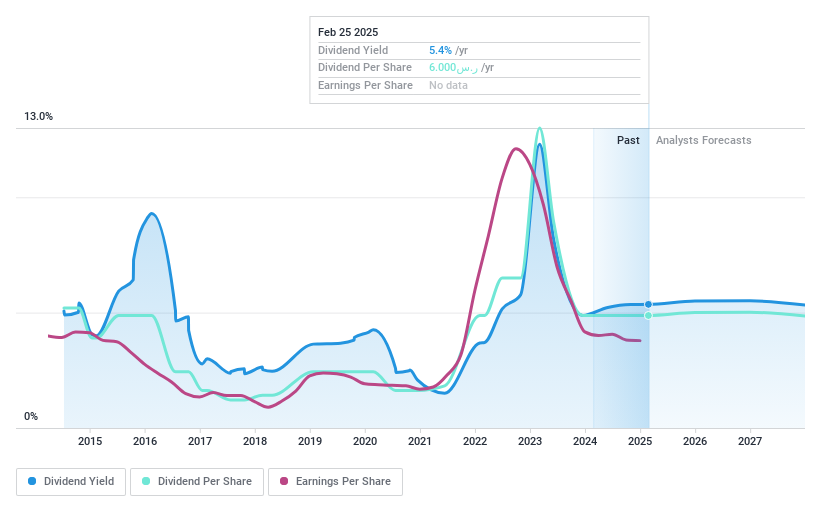

SABIC Agri-Nutrients (SASE:2020)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SABIC Agri-Nutrients Company is involved in the production, conversion, manufacturing, marketing, and trade of agri-nutrients and chemical products across various international markets including Saudi Arabia and has a market cap of SAR54.17 billion.

Operations: The company's revenue is primarily derived from its agri-nutrients and chemical products business across multiple international markets.

Dividend Yield: 5.3%

SABIC Agri-Nutrients offers a mixed dividend profile. The company reported SAR 11.06 billion in sales for 2024, with net income declining to SAR 3.33 billion. Despite a high payout ratio of 85.2%, dividends are covered by earnings and cash flows, but have been volatile over the past decade with no growth trend. Its P/E ratio of 16.3x suggests good relative value compared to the SA market, yet its unstable dividend history may concern investors seeking reliability.

- Delve into the full analysis dividend report here for a deeper understanding of SABIC Agri-Nutrients.

- The analysis detailed in our SABIC Agri-Nutrients valuation report hints at an deflated share price compared to its estimated value.

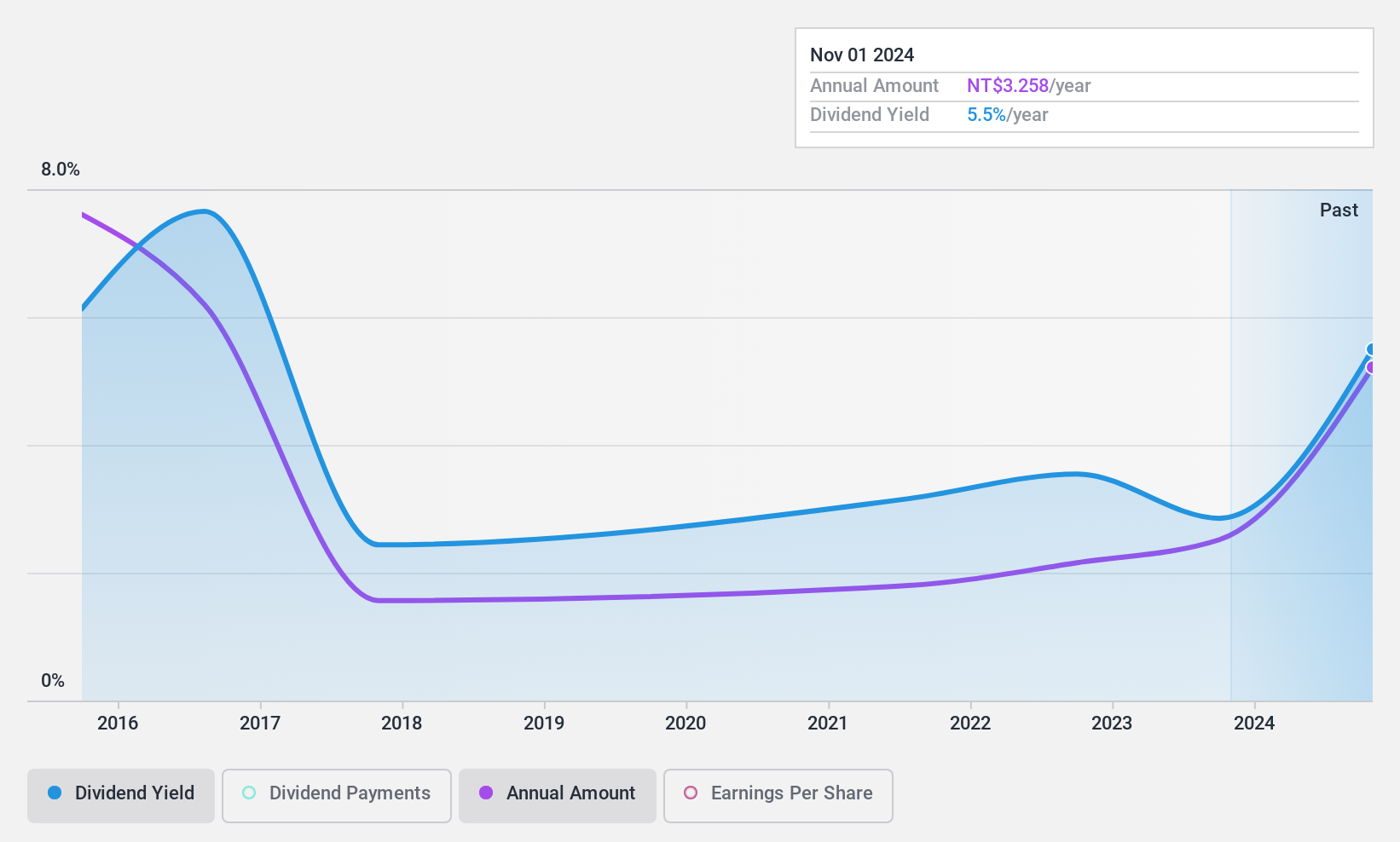

GeoVision (TWSE:3356)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GeoVision Inc., along with its subsidiaries, operates as a digital and networked video surveillance company globally, with a market cap of NT$4.13 billion.

Operations: GeoVision Inc.'s revenue is primarily derived from its operations in Taiwan (NT$591.95 million), the United States (NT$888.11 million), and the Czech Republic (NT$186.72 million).

Dividend Yield: 5.6%

GeoVision's dividend profile reveals challenges with reliability and growth. Despite a strong dividend yield of 5.61%, placing it in the top quartile of TW market payers, its dividends have been volatile and declining over the past decade. The payout ratio is sustainable at 54%, indicating coverage by earnings, while cash flows cover dividends at a 76.4% ratio. The P/E ratio of 7.9x suggests attractive valuation, though non-cash earnings raise quality concerns.

- Click here and access our complete dividend analysis report to understand the dynamics of GeoVision.

- Our comprehensive valuation report raises the possibility that GeoVision is priced higher than what may be justified by its financials.

Key Takeaways

- Delve into our full catalog of 2008 Top Dividend Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3356

GeoVision

Operates as a digital and networked video surveillance company worldwide.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success