- South Korea

- /

- Machinery

- /

- KOSE:A010140

Samsung Heavy Industries Co., Ltd.'s (KRX:010140) 40% Price Boost Is Out Of Tune With Revenues

Despite an already strong run, Samsung Heavy Industries Co., Ltd. (KRX:010140) shares have been powering on, with a gain of 40% in the last thirty days. The annual gain comes to 199% following the latest surge, making investors sit up and take notice.

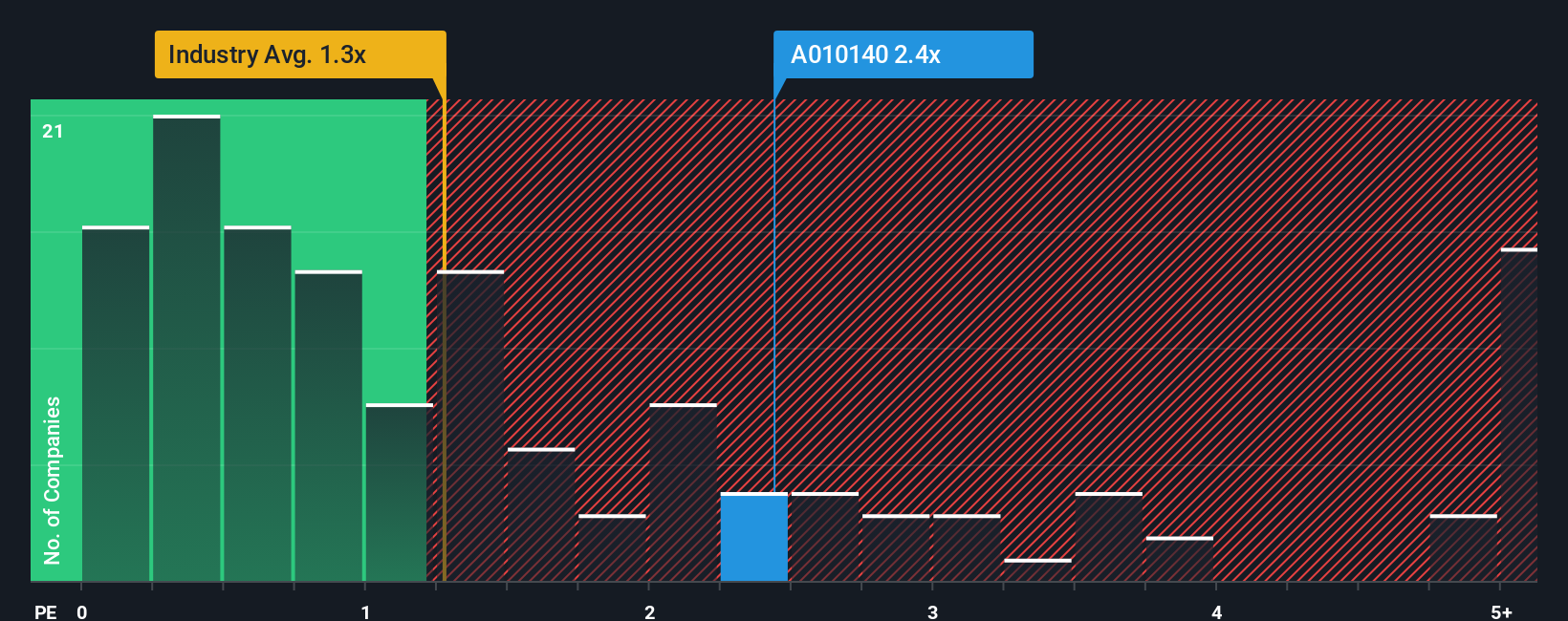

After such a large jump in price, you could be forgiven for thinking Samsung Heavy Industries is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.4x, considering almost half the companies in Korea's Machinery industry have P/S ratios below 1.3x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Samsung Heavy Industries

How Samsung Heavy Industries Has Been Performing

Samsung Heavy Industries could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Samsung Heavy Industries.Is There Enough Revenue Growth Forecasted For Samsung Heavy Industries?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Samsung Heavy Industries' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 9.2%. Pleasingly, revenue has also lifted 63% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 11% each year during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 10% per annum, which is not materially different.

With this information, we find it interesting that Samsung Heavy Industries is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Samsung Heavy Industries' P/S is on the rise since its shares have risen strongly. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Analysts are forecasting Samsung Heavy Industries' revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 1 warning sign for Samsung Heavy Industries you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A010140

Samsung Heavy Industries

Engages in the shipbuilding, offshore, and energy and infra businesses worldwide.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives