- China

- /

- Entertainment

- /

- SZSE:002602

Global Stocks That May Be Trading Below Estimated Value In July 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by new U.S. tariffs and mixed economic signals, investors are observing muted reactions across major indices, with the Nasdaq Composite showing resilience amidst these developments. In this environment, identifying stocks that may be trading below their estimated value can offer potential opportunities for investors looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| RVRC Holding (OM:RVRC) | SEK45.50 | SEK90.97 | 50% |

| QPR Software Oyj (HLSE:QPR1V) | €0.81 | €1.61 | 49.7% |

| Medy-Tox (KOSDAQ:A086900) | ₩161300.00 | ₩322233.66 | 49.9% |

| Livero (TSE:9245) | ¥1720.00 | ¥3433.06 | 49.9% |

| Lectra (ENXTPA:LSS) | €24.70 | €49.10 | 49.7% |

| Hybrid Software Group (ENXTBR:HYSG) | €3.46 | €6.92 | 50% |

| HL Holdings (KOSE:A060980) | ₩42050.00 | ₩83698.93 | 49.8% |

| Grand Korea Leisure (KOSE:A114090) | ₩16900.00 | ₩33732.58 | 49.9% |

| E-Globe (BIT:EGB) | €0.685 | €1.37 | 49.9% |

| cottaLTD (TSE:3359) | ¥429.00 | ¥854.19 | 49.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

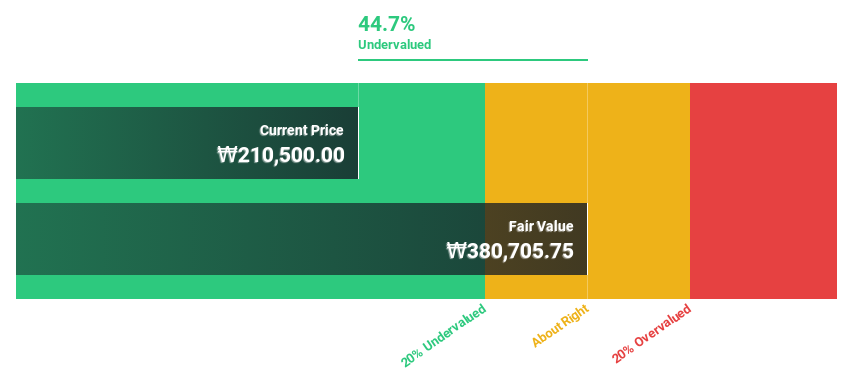

LS ELECTRIC (KOSE:A010120)

Overview: LS ELECTRIC Co., Ltd. offers smart energy solutions both in South Korea and internationally, with a market cap of ₩7.86 trillion.

Operations: The company's revenue segments include the Power Sector at ₩4.14 trillion, the Metal Sector at ₩654.23 million, the Automation Division at ₩607.47 million, and the IT Sector at ₩122.17 million.

Estimated Discount To Fair Value: 26.9%

LS ELECTRIC is trading at ₩278,000, significantly below its estimated fair value of ₩380,389.58. Despite a highly volatile share price recently, the company's earnings are expected to grow 22.1% annually over the next three years, outpacing the Korean market's growth rate of 20.7%. However, revenue growth is slower at 9.9% per year but still exceeds market expectations. Return on equity remains modestly forecasted at 18.6%.

- Our earnings growth report unveils the potential for significant increases in LS ELECTRIC's future results.

- Click here to discover the nuances of LS ELECTRIC with our detailed financial health report.

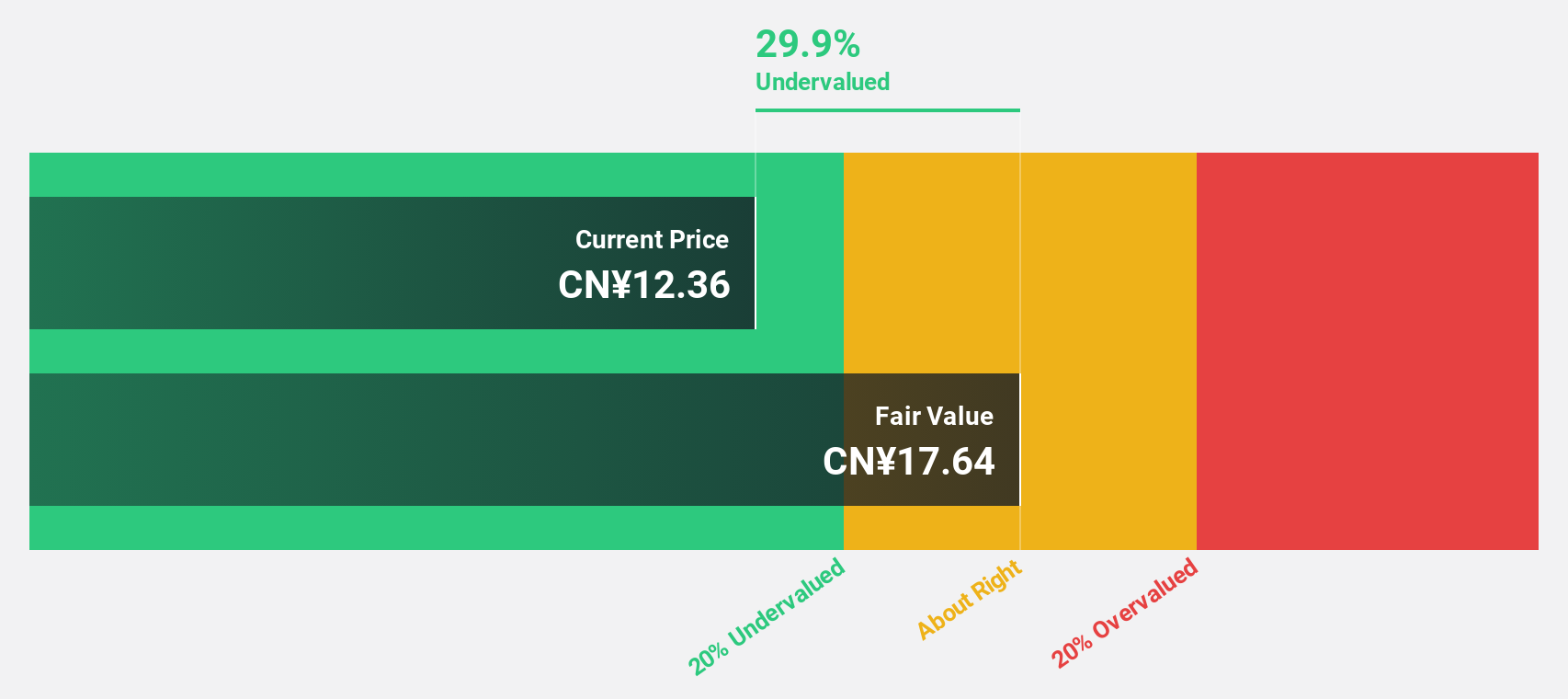

Zhejiang Century Huatong GroupLtd (SZSE:002602)

Overview: Zhejiang Century Huatong Group Co., Ltd operates in the auto parts, Internet games, and cloud data sectors both in China and internationally, with a market cap of CN¥93.91 billion.

Operations: The company generates revenue through its operations in auto parts, Internet games, and cloud data services across both domestic and international markets.

Estimated Discount To Fair Value: 26.3%

Zhejiang Century Huatong Group is trading at CN¥13.01, below its estimated fair value of CN¥17.65, reflecting a potential undervaluation based on cash flows. Despite slower revenue growth forecasts of 15.3% per year compared to the market, earnings are projected to grow significantly at 37.4% annually over the next three years, outpacing the Chinese market's growth rate. The company recently announced a share buyback program aimed at enhancing shareholder value and safeguarding investor interests.

- The analysis detailed in our Zhejiang Century Huatong GroupLtd growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Zhejiang Century Huatong GroupLtd.

Range Intelligent Computing Technology Group (SZSE:300442)

Overview: Range Intelligent Computing Technology Group Company Limited offers server hosting services to internet companies and large cloud vendors in China, with a market cap of CN¥79.07 billion.

Operations: The company's revenue is primarily derived from IDC Services, totaling CN¥4.58 billion.

Estimated Discount To Fair Value: 48.5%

Range Intelligent Computing Technology Group, trading at CN¥52.97, is significantly undervalued with a fair value estimate of CN¥102.88 based on discounted cash flows. Despite high debt levels and volatile share prices, the company's earnings are forecast to grow 28.63% annually over the next three years, surpassing market expectations. Recent discussions about a potential Hong Kong listing could enhance liquidity and investor interest in the company’s shares.

- Insights from our recent growth report point to a promising forecast for Range Intelligent Computing Technology Group's business outlook.

- Dive into the specifics of Range Intelligent Computing Technology Group here with our thorough financial health report.

Next Steps

- Gain an insight into the universe of 482 Undervalued Global Stocks Based On Cash Flows by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Century Huatong GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002602

Zhejiang Century Huatong GroupLtd

Engages in the auto parts, Internet games, and cloud data businesses in China and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives