- South Korea

- /

- Aerospace & Defense

- /

- KOSE:A047810

Asian Stocks That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

As global markets navigate a landscape of easing trade tensions and mixed economic signals, investors are increasingly turning their attention to Asia, where opportunities may arise amidst the region's unique economic challenges and potential. In this context, identifying undervalued stocks becomes crucial, as these equities may offer growth potential by being priced below their estimated value in a market characterized by volatility and evolving trade dynamics.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Aidma Holdings (TSE:7373) | ¥1843.00 | ¥3675.49 | 49.9% |

| Shibaura Mechatronics (TSE:6590) | ¥6760.00 | ¥13268.26 | 49.1% |

| Sany Renewable EnergyLtd (SHSE:688349) | CN¥22.70 | CN¥44.89 | 49.4% |

| RACCOON HOLDINGS (TSE:3031) | ¥798.00 | ¥1576.52 | 49.4% |

| Jiangshan Oupai Door Industry (SHSE:603208) | CN¥14.06 | CN¥27.62 | 49.1% |

| Rakus (TSE:3923) | ¥2184.00 | ¥4288.17 | 49.1% |

| Wuxi Lead Intelligent EquipmentLTD (SZSE:300450) | CN¥19.92 | CN¥39.08 | 49% |

| Beijing Zhong Ke San Huan High-Tech (SZSE:000970) | CN¥10.50 | CN¥20.69 | 49.2% |

| HanJung Natural Connectivity System.co.Ltd (KOSDAQ:A107640) | ₩27400.00 | ₩54530.89 | 49.8% |

| ASMPT (SEHK:522) | HK$53.40 | HK$105.00 | 49.1% |

Let's take a closer look at a couple of our picks from the screened companies.

LS ELECTRIC (KOSE:A010120)

Overview: LS ELECTRIC Co., Ltd. offers smart energy solutions in South Korea and internationally, with a market cap of ₩6.25 trillion.

Operations: The company's revenue primarily comes from the Power Sector with ₩4.07 trillion, followed by the Metal Sector at ₩617.77 million, Automation Division at ₩590.16 million, and IT Sector at ₩117.11 million.

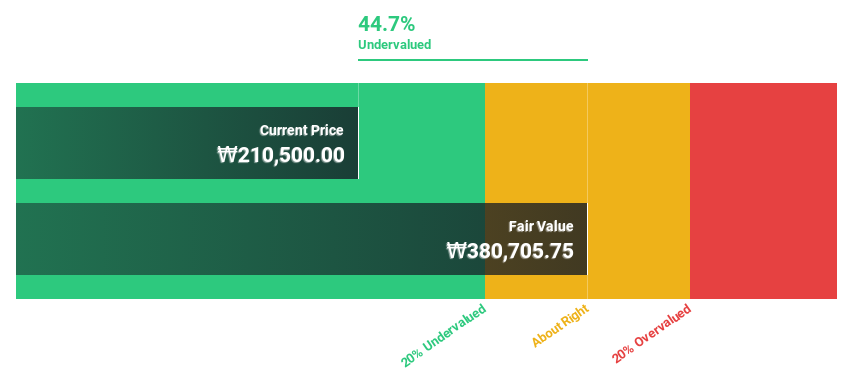

Estimated Discount To Fair Value: 44.7%

LS ELECTRIC appears undervalued with shares trading 44.7% below estimated fair value of ₩380,705.75. Despite a volatile share price and a dividend yield of 1.38% not fully covered by free cash flows, earnings have grown at 24% annually over the past five years and are expected to grow significantly at 21.53% per year, outpacing the Korean market's growth rate. Revenue is projected to grow faster than the market average, enhancing its investment appeal based on cash flows.

- Our growth report here indicates LS ELECTRIC may be poised for an improving outlook.

- Click here to discover the nuances of LS ELECTRIC with our detailed financial health report.

Korea Aerospace Industries (KOSE:A047810)

Overview: Korea Aerospace Industries, Ltd. engages in the manufacturing and sale of fixed and rotary wing aircrafts as well as airframe products in South Korea, with a market cap of ₩8.31 trillion.

Operations: The company's revenue segments include the Fixed Wing Division with ₩1.69 trillion, the Rotating Wing Division with ₩707.13 billion, and Airframe products generating ₩949.73 billion.

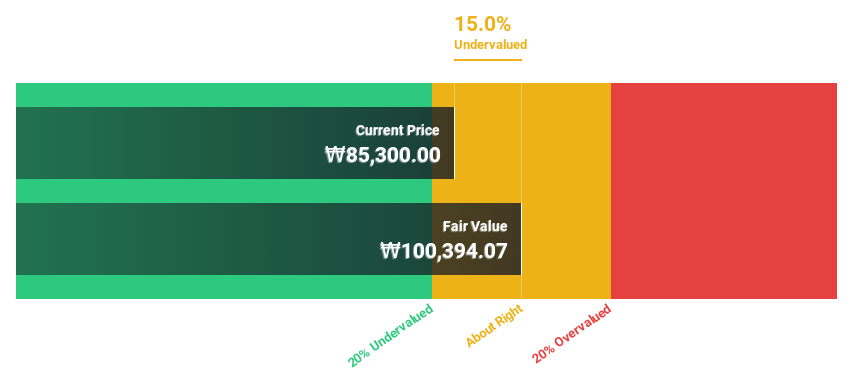

Estimated Discount To Fair Value: 15%

Korea Aerospace Industries is trading at ₩85,300, approximately 15% below its estimated fair value of ₩100,394.07. Despite a highly volatile share price recently and high non-cash earnings affecting quality perception, the company anticipates significant earnings growth of 28.24% annually over the next three years—outpacing the Korean market's average. However, debt coverage by operating cash flow remains a concern despite expected revenue growth surpassing market averages at 15.9% annually.

- Insights from our recent growth report point to a promising forecast for Korea Aerospace Industries' business outlook.

- Navigate through the intricacies of Korea Aerospace Industries with our comprehensive financial health report here.

Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990)

Overview: Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd. is a biopharmaceutical company focused on the research, development, manufacturing, and commercialization of novel drugs in oncology and immunology both in China and internationally, with a market cap of HK$78.13 billion.

Operations: The company's revenue is primarily derived from its pharmaceuticals segment, totaling CN¥1.93 billion.

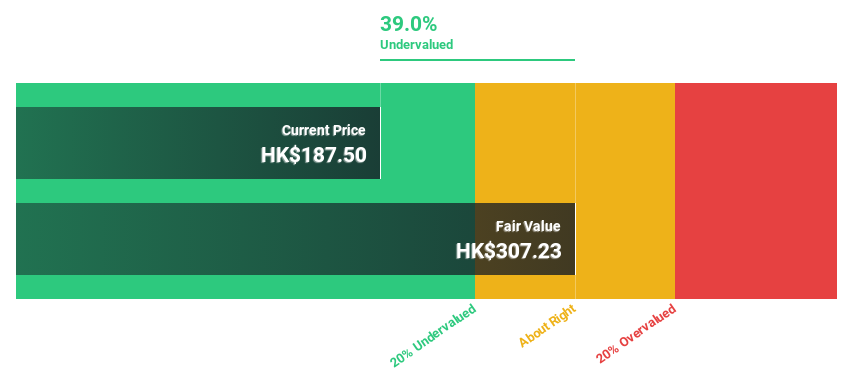

Estimated Discount To Fair Value: 17.9%

Sichuan Kelun-Biotech Biopharmaceutical is trading at HK$343.8, approximately 17.9% below its estimated fair value of HK$418.94, indicating potential undervaluation based on cash flows. The company’s revenue is expected to grow significantly at 28.4% annually, surpassing the Hong Kong market average and supporting future profitability projections within three years. Recent advancements in clinical trials and product approvals highlight its innovative pipeline, although current return on equity forecasts remain modest at 16.3%.

- In light of our recent growth report, it seems possible that Sichuan Kelun-Biotech Biopharmaceutical's financial performance will exceed current levels.

- Take a closer look at Sichuan Kelun-Biotech Biopharmaceutical's balance sheet health here in our report.

Seize The Opportunity

- Click here to access our complete index of 264 Undervalued Asian Stocks Based On Cash Flows.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Korea Aerospace Industries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Korea Aerospace Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A047810

Korea Aerospace Industries

Manufactures and sells fixed and rotary wing aircrafts, and airframe products in South Korea.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives