- South Korea

- /

- Building

- /

- KOSE:A009450

Unveiling Three Undiscovered Gems In South Korea With Strong Potential

Reviewed by Simply Wall St

The South Korea stock market has experienced a challenging period, finishing lower in seven consecutive sessions and shedding over 170 points or 6.4 percent. Despite this downturn, optimism about interest rates has led to an upbeat global forecast, suggesting potential stability ahead. In such volatile times, identifying stocks with strong fundamentals and growth potential becomes crucial. Here are three undiscovered gems in South Korea that stand out amidst current market conditions for their promising outlooks.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.74% | ★★★★★★ |

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| Woori Technology Investment | NA | 25.66% | -1.45% | ★★★★★★ |

| Namuga | 14.47% | 0.88% | 38.25% | ★★★★★★ |

| Synergy Innovation | 12.39% | 12.87% | 28.82% | ★★★★★★ |

| ASIA Holdings | 34.98% | 8.43% | 16.17% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

| Daewon Cable | 30.50% | 8.72% | 60.28% | ★★★★★☆ |

| FnGuide | 36.10% | 8.92% | 10.27% | ★★★★☆☆ |

We'll examine a selection from our screener results.

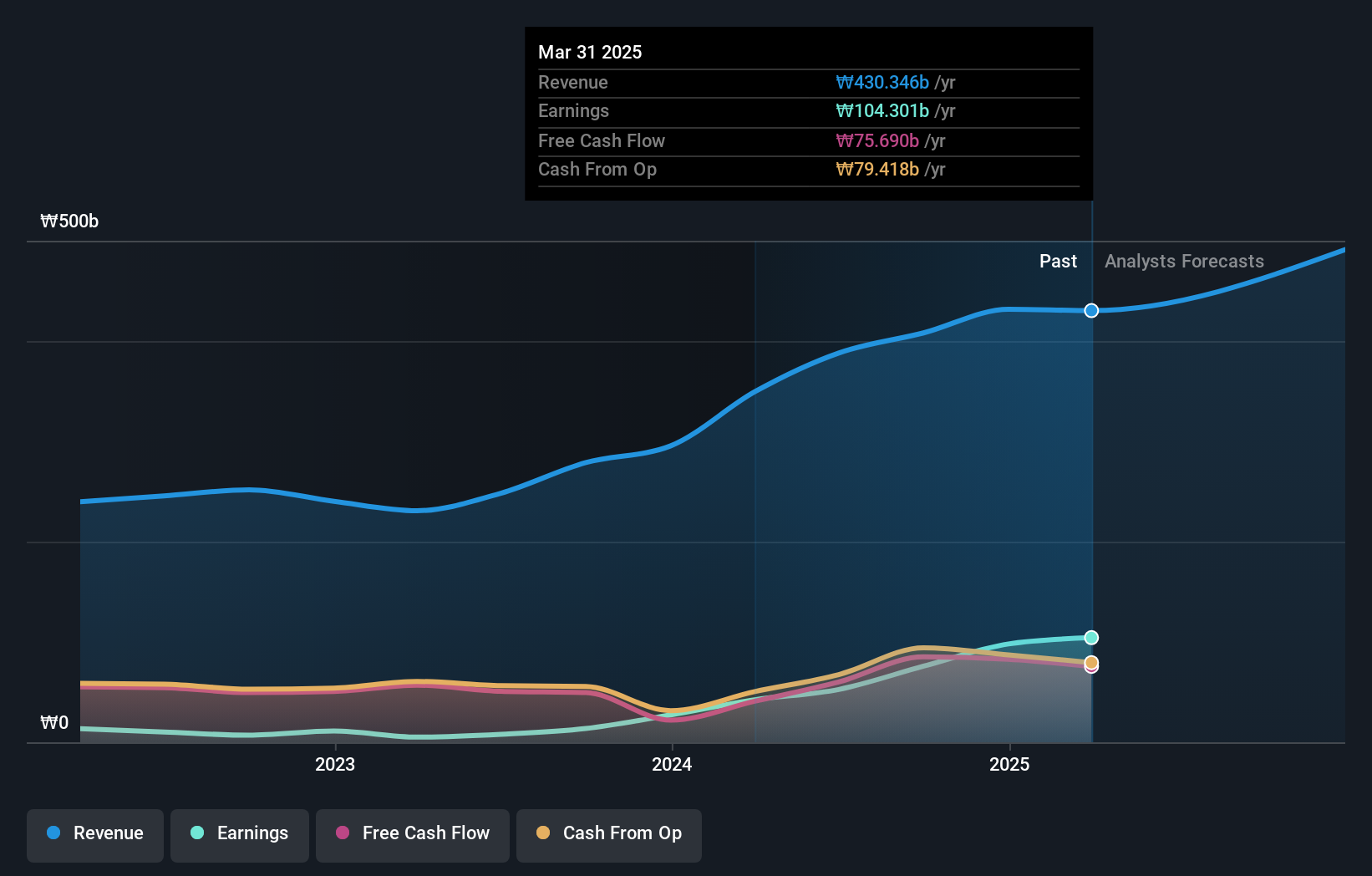

VT (KOSDAQ:A018290)

Simply Wall St Value Rating: ★★★★★★

Overview: VT Co., Ltd. produces and exports laminating machines and films worldwide, with a market cap of ₩1.20 trillion.

Operations: VT Co., Ltd. generates revenue primarily from its Cosmetic segment (₩256.27 billion) and Entertainment segment (₩93.74 billion), with additional income from Laminating products (₩33.86 billion).

VT Co., Ltd. reported KRW 113.35 billion in sales for Q2 2024, up from KRW 74.69 billion a year ago, with net income soaring to KRW 15.40 million from KRW 5.08 million last year. The company trades at 14% below its estimated fair value and has reduced its debt-to-equity ratio from 71% to 22% over five years. Earnings grew by an impressive 563%, far outpacing the industry’s growth of around 30%.

- Click to explore a detailed breakdown of our findings in VT's health report.

Evaluate VT's historical performance by accessing our past performance report.

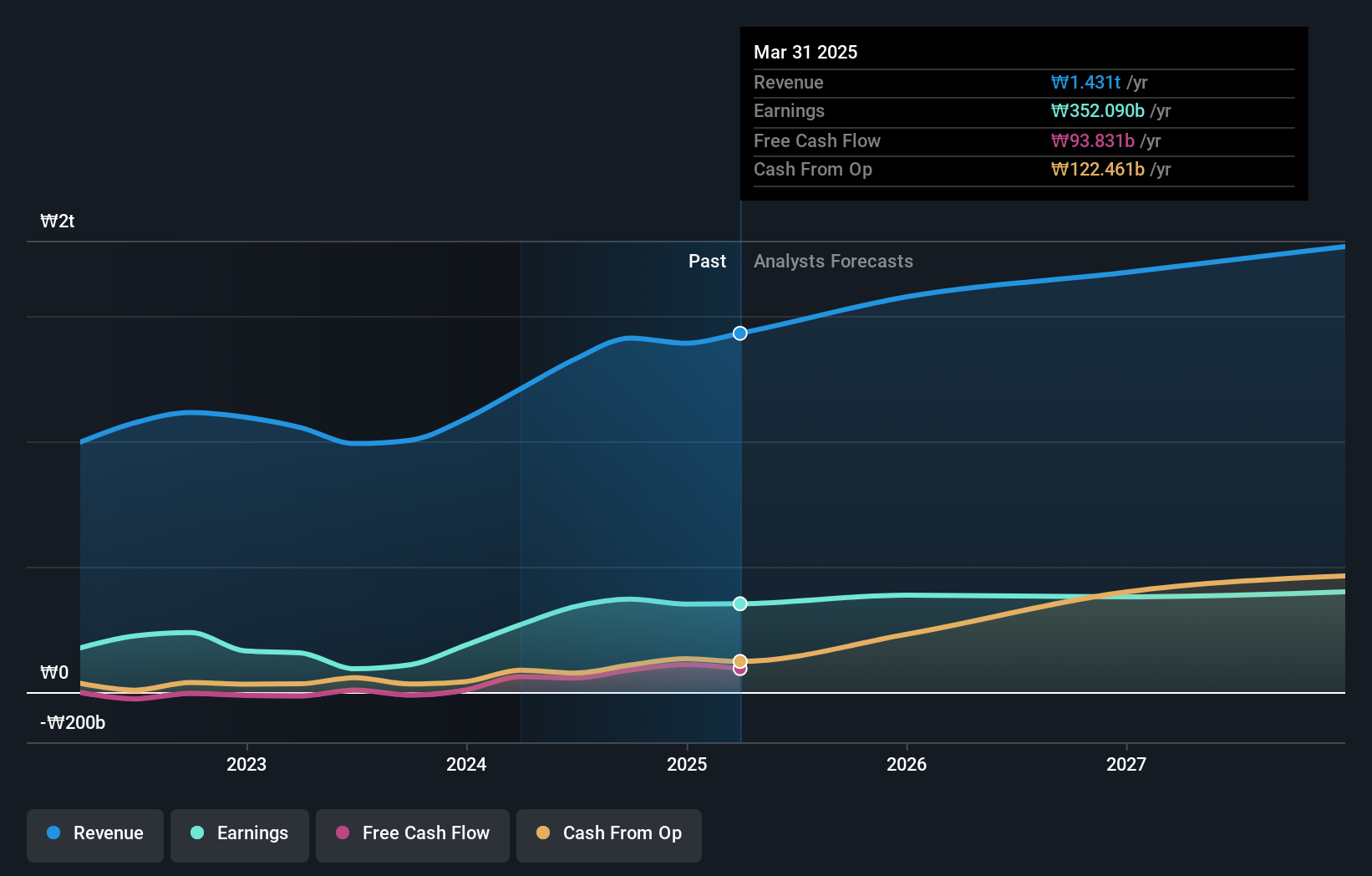

Hankook (KOSE:A000240)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hankook & Company Co., Ltd. manufactures and sells storage batteries, with a market cap of ₩1.70 trillion.

Operations: Hankook & Company Co., Ltd. generates revenue primarily from the sale of storage batteries.

Hankook has demonstrated impressive performance, with earnings growth of 267% in the past year, significantly outpacing the Auto Components industry’s 20.8%. The company’s net debt to equity ratio stands at a satisfactory 1.4%, and its interest payments are well covered by EBIT (40x coverage). Trading at a P/E ratio of 4.9x, Hankook is valued attractively compared to the KR market's average of 11x. Recent earnings reports show net income soaring to KRW108 billion for Q2-2024 from KRW36 billion a year ago, reflecting robust financial health and potential for future growth.

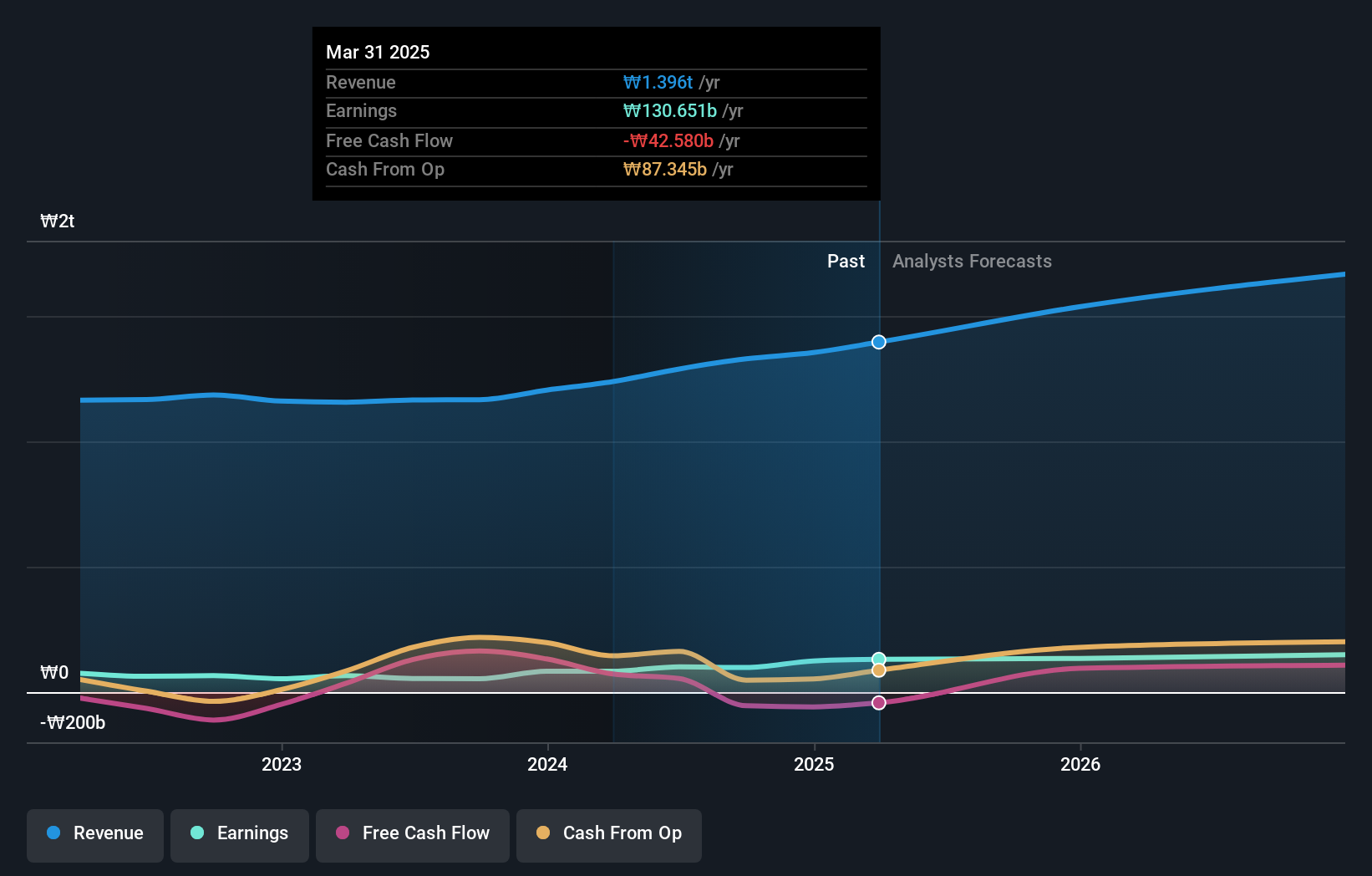

Kyung Dong Navien (KOSE:A009450)

Simply Wall St Value Rating: ★★★★★★

Overview: Kyung Dong Navien Co., Ltd. manufactures and sells machinery and heat combustion equipment in South Korea, with a market cap of approximately ₩979.91 billion.

Operations: Kyung Dong Navien generates revenue primarily from the manufacturing and sale of air conditioning equipment, amounting to ₩1.29 billion.

Kyung Dong Navien, a notable player in South Korea's building industry, has demonstrated impressive earnings growth of 85.5% over the past year, outpacing the sector's 28.5%. With a price-to-earnings ratio of 9.7x below the KR market average of 11x, it offers good value. The company's net debt to equity ratio stands at a satisfactory 6.5%, and its interest payments are well covered by EBIT with a coverage ratio of 27.4x.

Seize The Opportunity

- Dive into all 183 of the KRX Undiscovered Gems With Strong Fundamentals we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kyung Dong Navien might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A009450

Kyung Dong Navien

Manufactures and sells machinery and heat combustion equipment in South Korea.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion