- South Korea

- /

- Machinery

- /

- KOSE:A007460

If You Had Bought Aprogen KIC's (KRX:007460) Shares Three Years Ago You Would Be Down 86%

While not a mind-blowing move, it is good to see that the Aprogen KIC Inc. (KRX:007460) share price has gained 11% in the last three months. But the last three years have seen a terrible decline. Indeed, the share price is down a whopping 86% in the last three years. So we're relieved for long term holders to see a bit of uplift. Only time will tell if the company can sustain the turnaround.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

See our latest analysis for Aprogen KIC

Aprogen KIC isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, Aprogen KIC saw its revenue grow by 44% per year, compound. That is faster than most pre-profit companies. So why has the share priced crashed 23% per year, in the same time? The share price makes us wonder if there is an issue with profitability. Sometimes fast revenue growth doesn't lead to profits. If the company is low on cash, it may have to raise capital soon.

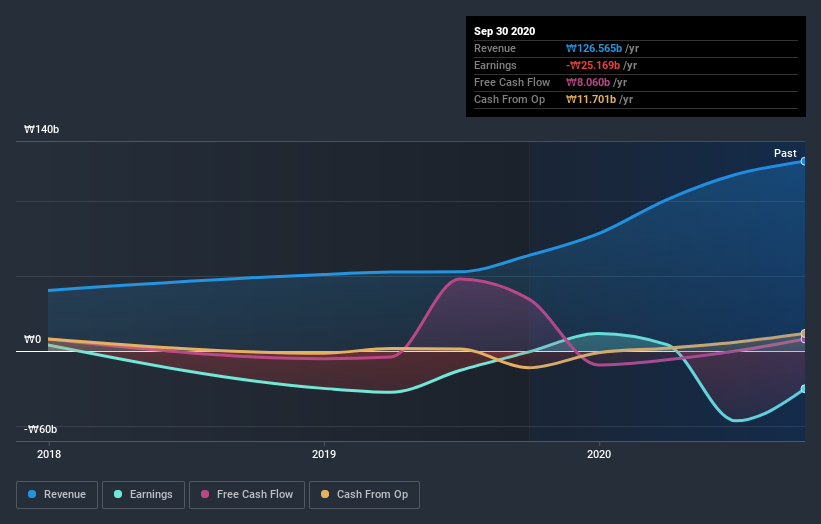

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Aprogen KIC's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Aprogen KIC had a tough year, with a total loss of 21%, against a market gain of about 44%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 5% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Aprogen KIC better, we need to consider many other factors. For instance, we've identified 1 warning sign for Aprogen KIC that you should be aware of.

But note: Aprogen KIC may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade Aprogen KIC, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Aprogen Medicines, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A007460

Aprogen Medicines

Designs, manufactures, and maintains plant facilities for steelwork, petrochemistry, shipbuilding, power plant, and LNG base industries in South Korea.

Mediocre balance sheet low.

Market Insights

Community Narratives