Dividend paying stocks like Daelim B&Co Co.,Ltd. (KRX:005750) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

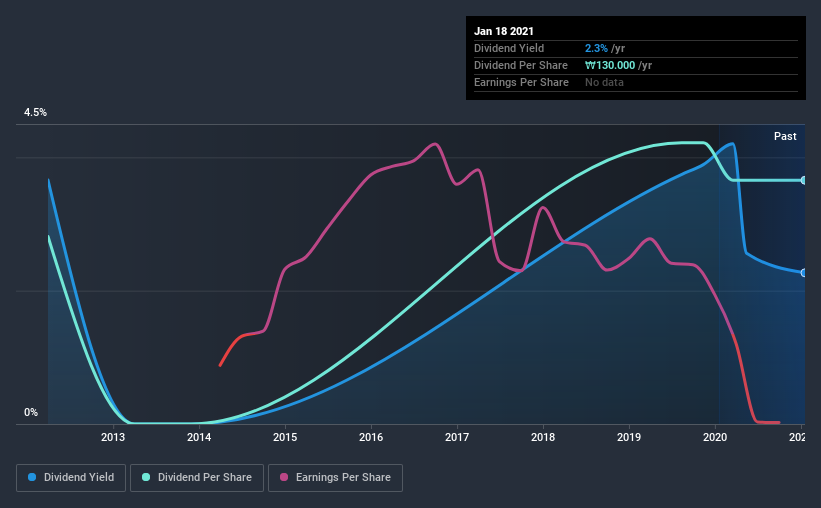

With a 2.3% yield and a nine-year payment history, investors probably think Daelim B&CoLtd looks like a reliable dividend stock. While the yield may not look too great, the relatively long payment history is interesting. The company also bought back stock equivalent to around 0.8% of market capitalisation this year. Some simple research can reduce the risk of buying Daelim B&CoLtd for its dividend - read on to learn more.

Explore this interactive chart for our latest analysis on Daelim B&CoLtd!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Although it reported a loss over the past 12 months, Daelim B&CoLtd currently pays a dividend. When a company is loss-making, we next need to check to see if its cash flows can support the dividend.

Daelim B&CoLtd's cash payout ratio last year was 14%. Cash flows are typically lumpy, but this looks like an appropriately conservative payout.

Remember, you can always get a snapshot of Daelim B&CoLtd's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Looking at the last decade of data, we can see that Daelim B&CoLtd paid its first dividend at least nine years ago. Although it has been paying a dividend for several years now, the dividend has been cut at least once, and we're cautious about the consistency of its dividend across a full economic cycle. During the past nine-year period, the first annual payment was ₩100 in 2012, compared to ₩130 last year. This works out to be a compound annual growth rate (CAGR) of approximately 3.0% a year over that time. Daelim B&CoLtd's dividend payments have fluctuated, so it hasn't grown 3.0% every year, but the CAGR is a useful rule of thumb for approximating the historical growth.

It's good to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth, anyway. We're not that enthused by this.

Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Daelim B&CoLtd's earnings per share have shrunk at 41% a year over the past five years. A sharp decline in earnings per share is not great from from a dividend perspective, as even conservative payout ratios can come under pressure if earnings fall far enough.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. We're not keen on the fact that Daelim B&CoLtd paid dividends despite reporting a loss over the past year, although fortunately its dividend was covered by cash flow. Earnings per share are down, and Daelim B&CoLtd's dividend has been cut at least once in the past, which is disappointing. Overall, Daelim B&CoLtd falls short in several key areas here. Unless the investor has strong grounds for an alternative conclusion, we find it hard to get interested in a dividend stock with these characteristics.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Just as an example, we've come accross 4 warning signs for Daelim B&CoLtd you should be aware of, and 2 of them shouldn't be ignored.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

When trading Daelim B&CoLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A005750

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026