- South Korea

- /

- Banks

- /

- KOSE:A175330

Top KRX Dividend Stocks For August 2024

Reviewed by Simply Wall St

The South Korean market has climbed 1.9% in the last 7 days and 3.8% over the past year, with earnings forecasted to grow by 28% annually. In this context of steady growth, identifying strong dividend stocks can be a strategic way to enhance portfolio returns while benefiting from regular income streams.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 5.43% | ★★★★★★ |

| NH Investment & Securities (KOSE:A005940) | 5.78% | ★★★★★☆ |

| LOTTE Fine Chemical (KOSE:A004000) | 4.37% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 6.94% | ★★★★★☆ |

| KT (KOSE:A030200) | 5.17% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 6.78% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.24% | ★★★★★☆ |

| Snt DynamicsLtd (KOSE:A003570) | 4.47% | ★★★★☆☆ |

| Hansae Yes24 Holdings (KOSE:A016450) | 5.50% | ★★★★☆☆ |

| Korea Cast Iron Pipe Ind (KOSE:A000970) | 6.02% | ★★★★☆☆ |

Click here to see the full list of 74 stocks from our Top KRX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Samyang Holdings (KOSE:A000070)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samyang Holdings Corporation, with a market cap of ₩561.65 billion, operates in the chemical, food, packaging, pharmaceutical sectors and more across South Korea and internationally.

Operations: Samyang Holdings Corporation generates revenue from its segments as follows: Chemicals ₩1.54 billion and Food (Including Trade) ₩1.61 billion.

Dividend Yield: 4.8%

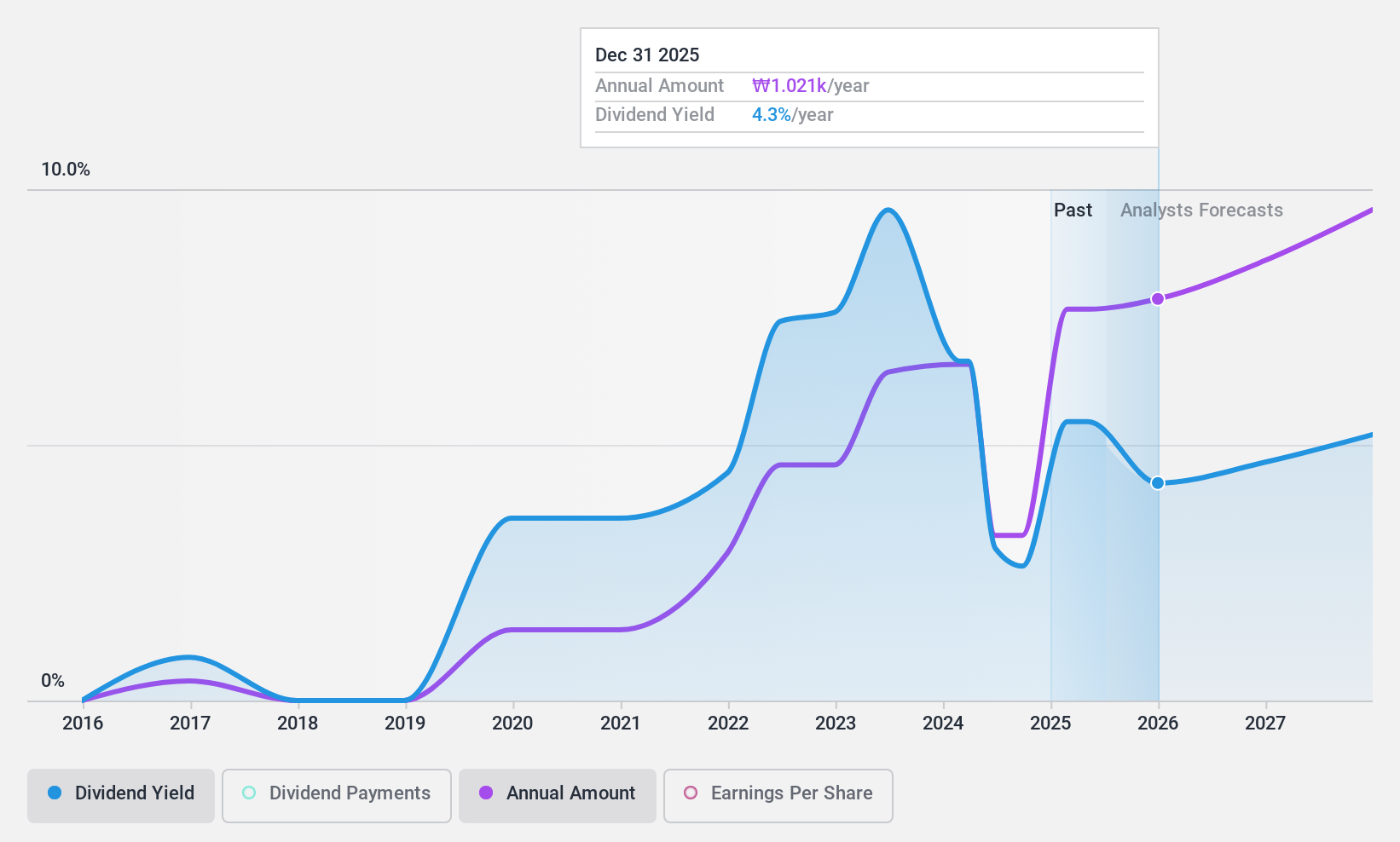

Samyang Holdings offers a compelling dividend yield of 4.77%, placing it in the top 25% of South Korean dividend payers. The company has a stable but short track record, having paid dividends for only five years. Dividends are well-covered by both earnings (15.5% payout ratio) and cash flows (24.4% cash payout ratio), suggesting sustainability despite its limited history in dividend payments. Additionally, the stock trades at 20.9% below its estimated fair value, enhancing its appeal for value investors.

- Unlock comprehensive insights into our analysis of Samyang Holdings stock in this dividend report.

- Our valuation report unveils the possibility Samyang Holdings' shares may be trading at a discount.

Hyundai G.F. Holdings (KOSE:A005440)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hyundai G.F. Holdings Co., Ltd. engages in rental and investment businesses with a market cap of ₩678.96 billion.

Operations: Hyundai G.F. Holdings Co., Ltd. generates revenue primarily from the furniture segment (₩1.12 billion), heavy equipment segment (₩329.12 million), and corporate operations (₩596.20 million).

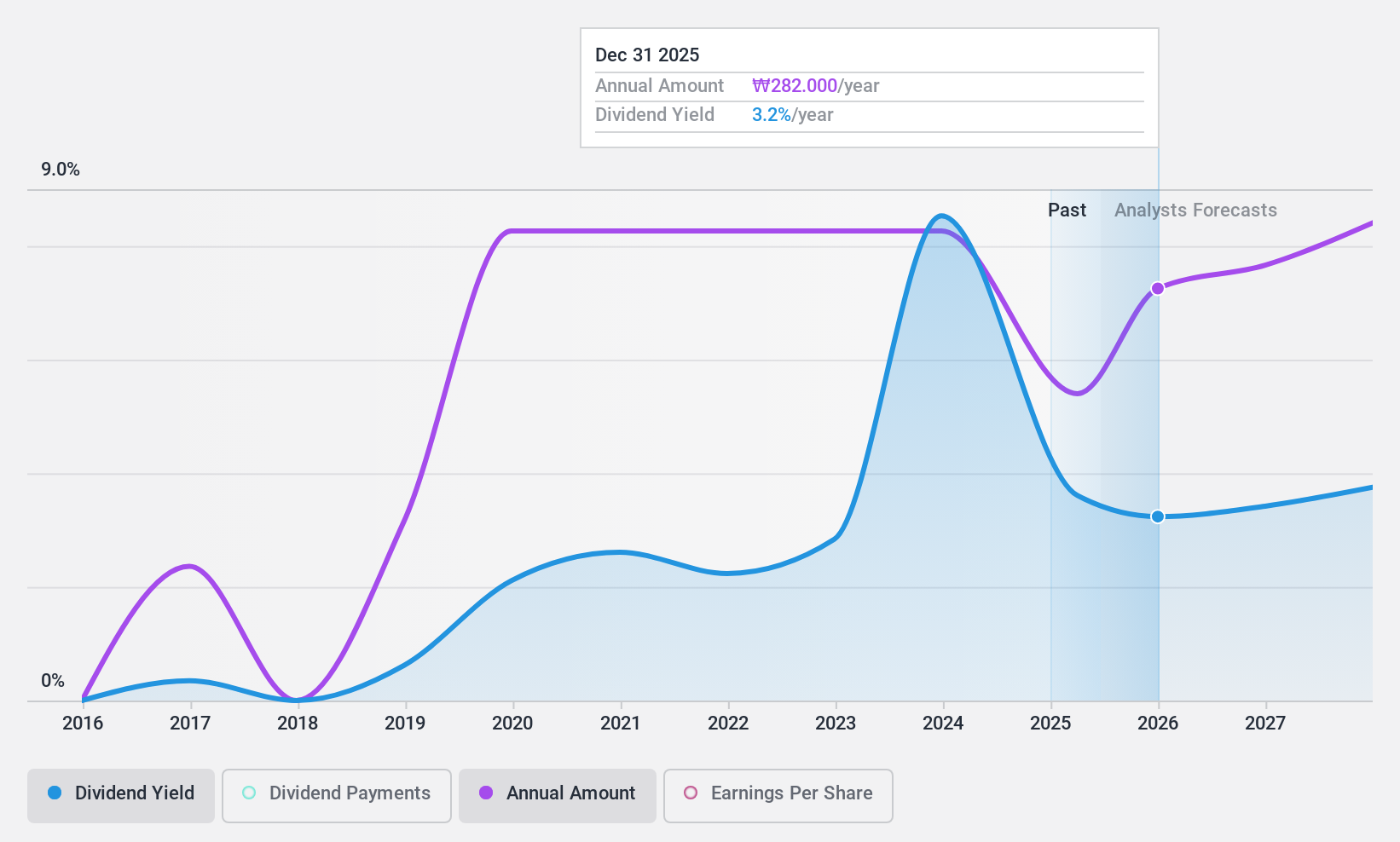

Dividend Yield: 4.4%

Hyundai G.F. Holdings provides a notable dividend yield of 4.42%, ranking it among the top 25% of South Korean dividend payers. Despite its attractive yield, the company has only paid dividends for eight years, with payments being volatile and unreliable. However, dividends are well-covered by earnings (2.1% payout ratio) and cash flows (57.3% cash payout ratio). The stock’s low Price-To-Earnings ratio (0.7x) compared to the KR market suggests potential value for investors seeking income and growth opportunities.

- Click to explore a detailed breakdown of our findings in Hyundai G.F. Holdings' dividend report.

- The analysis detailed in our Hyundai G.F. Holdings valuation report hints at an inflated share price compared to its estimated value.

JB Financial Group (KOSE:A175330)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JB Financial Group Co., Ltd., with a market cap of ₩2.90 trillion, offers banking products and services both in South Korea and internationally through its subsidiaries.

Operations: JB Financial Group Co., Ltd. generates revenue from its Banking Sector (₩1.20 trillion), Capital Segment (₩362.87 billion), and Asset Management Division (₩20.53 billion).

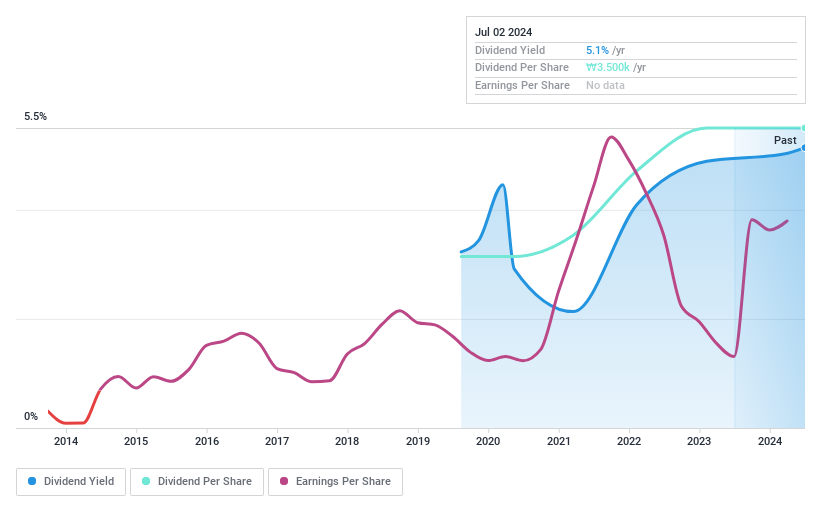

Dividend Yield: 5.6%

JB Financial Group offers a strong dividend yield of 5.64%, placing it in the top 25% of South Korean dividend payers. Despite only eight years of consistent payments, dividends are well-covered by earnings with a low payout ratio (28.8%). The company also announced a KRW 30 billion share repurchase program to enhance shareholder value, indicating management's commitment to returning capital to investors. Earnings are forecasted to grow at 6% annually, supporting future dividend stability and growth potential.

- Click here and access our complete dividend analysis report to understand the dynamics of JB Financial Group.

- Our comprehensive valuation report raises the possibility that JB Financial Group is priced lower than what may be justified by its financials.

Summing It All Up

- Navigate through the entire inventory of 74 Top KRX Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A175330

JB Financial Group

Through its subsidiaries, provides banking products and services in South Korea and internationally.

Undervalued with adequate balance sheet and pays a dividend.