- South Korea

- /

- Trade Distributors

- /

- KOSE:A003010

Be Sure To Check Out Haein Corporation (KRX:003010) Before It Goes Ex-Dividend

Haein Corporation (KRX:003010) stock is about to trade ex-dividend in four days. You will need to purchase shares before the 29th of December to receive the dividend, which will be paid on the 21st of April.

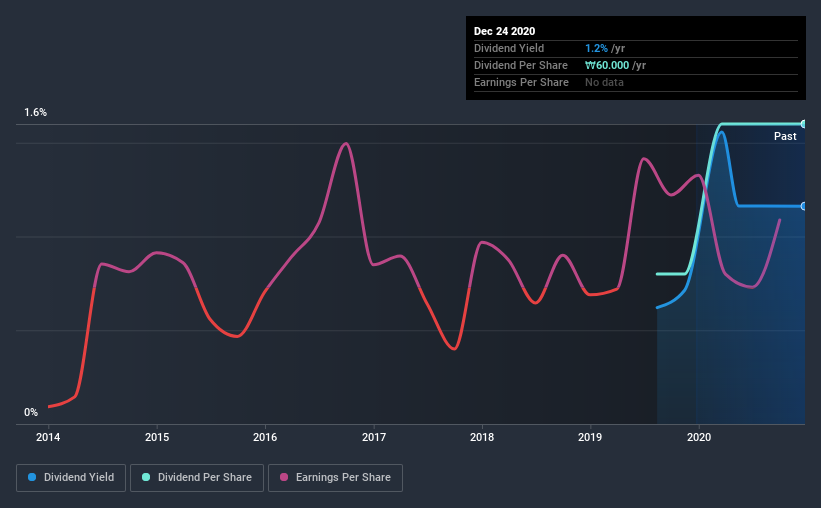

Haein's next dividend payment will be ₩60.00 per share, and in the last 12 months, the company paid a total of ₩60.00 per share. Last year's total dividend payments show that Haein has a trailing yield of 1.2% on the current share price of ₩5160. If you buy this business for its dividend, you should have an idea of whether Haein's dividend is reliable and sustainable. We need to see whether the dividend is covered by earnings and if it's growing.

See our latest analysis for Haein

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Haein is paying out just 24% of its profit after tax, which is comfortably low and leaves plenty of breathing room in the case of adverse events. A useful secondary check can be to evaluate whether Haein generated enough free cash flow to afford its dividend. Luckily it paid out just 4.1% of its free cash flow last year.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see how much of its profit Haein paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. For this reason, we're glad to see Haein's earnings per share have risen 14% per annum over the last five years. Earnings per share are growing rapidly and the company is keeping more than half of its earnings within the business; an attractive combination which could suggest the company is focused on reinvesting to grow earnings further. Fast-growing businesses that are reinvesting heavily are enticing from a dividend perspective, especially since they can often increase the payout ratio later.

Unfortunately Haein has only been paying a dividend for a year or so, so there's not much of a history to draw insight from.

To Sum It Up

Should investors buy Haein for the upcoming dividend? Haein has been growing earnings at a rapid rate, and has a conservatively low payout ratio, implying that it is reinvesting heavily in its business; a sterling combination. There's a lot to like about Haein, and we would prioritise taking a closer look at it.

While it's tempting to invest in Haein for the dividends alone, you should always be mindful of the risks involved. To that end, you should learn about the 3 warning signs we've spotted with Haein (including 1 which is significant).

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Haein, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Haein might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A003010

Haein

Supplies equipment for construction, energy, and power industries in South Korea and internationally.

Low not a dividend payer.

Market Insights

Community Narratives