- South Korea

- /

- Machinery

- /

- KOSE:A002900

Is Tong Yang Moolsan Co., Ltd. (KRX:002900) Popular Amongst Insiders?

The big shareholder groups in Tong Yang Moolsan Co., Ltd. (KRX:002900) have power over the company. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones. Warren Buffett said that he likes "a business with enduring competitive advantages that is run by able and owner-oriented people." So it's nice to see some insider ownership, because it may suggest that management is owner-oriented.

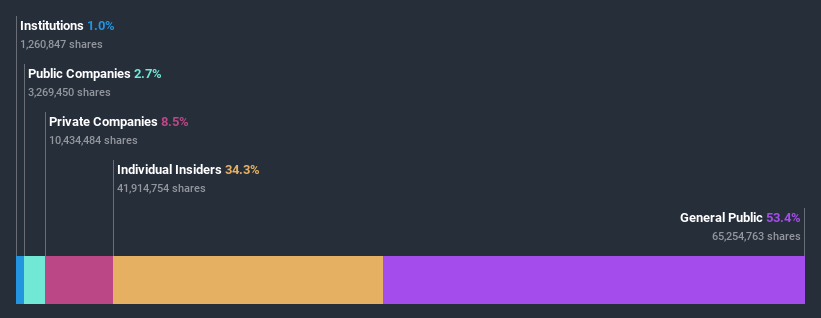

Tong Yang Moolsan is a smaller company with a market capitalization of ₩200b, so it may still be flying under the radar of many institutional investors. Our analysis of the ownership of the company, below, shows that institutional investors have not yet purchased much of the company. Let's take a closer look to see what the different types of shareholders can tell us about Tong Yang Moolsan.

View our latest analysis for Tong Yang Moolsan

What Does The Institutional Ownership Tell Us About Tong Yang Moolsan?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

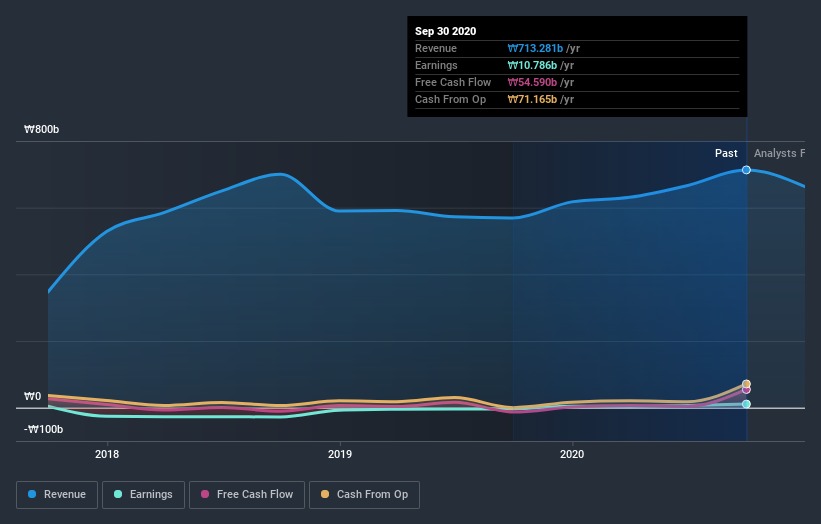

Since institutions own only a small portion of Tong Yang Moolsan, many may not have spent much time considering the stock. But it's clear that some have; and they liked it enough to buy in. If the business gets stronger from here, we could see a situation where more institutions are keen to buy. We sometimes see a rising share price when a few big institutions want to buy a certain stock at the same time. The history of earnings and revenue, which you can see below, could be helpful in considering if more institutional investors will want the stock. Of course, there are plenty of other factors to consider, too.

We note that hedge funds don't have a meaningful investment in Tong Yang Moolsan. With a 21% stake, CEO Hi-Yong Kim is the largest shareholder. Sik Kim is the second largest shareholder owning 8.3% of common stock, and Mk Asset holds about 7.1% of the company stock.

On studying our ownership data, we found that 12 of the top shareholders collectively own less than 50% of the share register, implying that no single individual has a majority interest.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. There is some analyst coverage of the stock, but it could still become more well known, with time.

Insider Ownership Of Tong Yang Moolsan

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our most recent data indicates that insiders own a reasonable proportion of Tong Yang Moolsan Co., Ltd.. It has a market capitalization of just ₩200b, and insiders have ₩69b worth of shares in their own names. I would say this shows alignment with shareholders, but it is worth noting that the company is still quite small; some insiders may have founded the business. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public, who are mostly retail investors, collectively hold 53% of Tong Yang Moolsan shares. This size of ownership gives retail investors collective power. They can and probably do influence decisions on executive compensation, dividend policies and proposed business acquisitions.

Private Company Ownership

It seems that Private Companies own 8.5%, of the Tong Yang Moolsan stock. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Tong Yang Moolsan better, we need to consider many other factors. For example, we've discovered 4 warning signs for Tong Yang Moolsan (1 shouldn't be ignored!) that you should be aware of before investing here.

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you’re looking to trade Tong Yang Moolsan, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TYM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A002900

TYM

Manufactures and sells agriculture machineries, cigarette filters, and other related products in South Korea and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives