- South Korea

- /

- Construction

- /

- KOSE:A001470

It's Down 28% But Sambu Engineering & Construction Co., Ltd (KRX:001470) Could Be Riskier Than It Looks

Sambu Engineering & Construction Co., Ltd (KRX:001470) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 71% loss during that time.

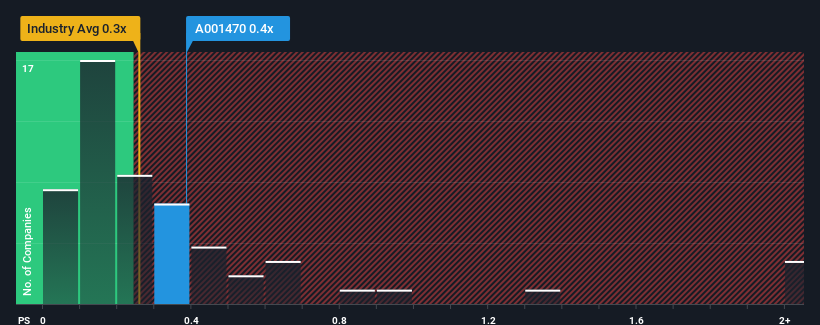

In spite of the heavy fall in price, there still wouldn't be many who think Sambu Engineering & Construction's price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S in Korea's Construction industry is similar at about 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Sambu Engineering & Construction

What Does Sambu Engineering & Construction's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Sambu Engineering & Construction over the last year, which is not ideal at all. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Sambu Engineering & Construction, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Sambu Engineering & Construction's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 33%. Regardless, revenue has managed to lift by a handy 9.6% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to decline by 3.0% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this information, we find it odd that Sambu Engineering & Construction is trading at a fairly similar P/S to the industry. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Final Word

Sambu Engineering & Construction's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As mentioned previously, Sambu Engineering & Construction currently trades on a P/S on par with the wider industry, but this is lower than expected considering its recent three-year revenue growth is beating forecasts for a struggling industry. When we see a history of positive growth in a struggling industry, but only an average P/S, we assume potential risks are what might be placing pressure on the P/S ratio. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Sambu Engineering & Construction, and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A001470

Sambu Engineering & Construction

Engages in the construction business in South Korea and internationally.

Good value slight.

Market Insights

Community Narratives