- South Korea

- /

- Industrials

- /

- KOSE:A000880

The Market Lifts Hanwha Corporation (KRX:000880) Shares 29% But It Can Do More

Hanwha Corporation (KRX:000880) shares have had a really impressive month, gaining 29% after a shaky period beforehand. The last month tops off a massive increase of 280% in the last year.

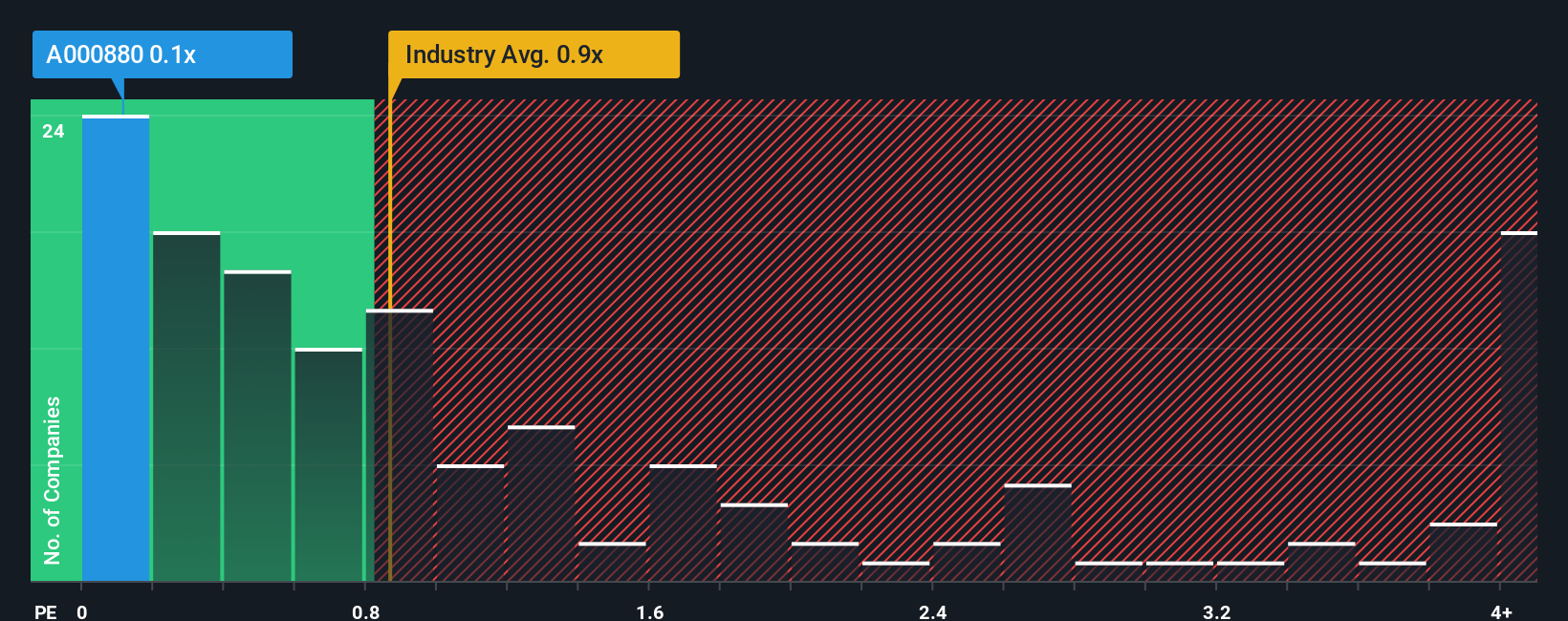

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Hanwha's P/S ratio of 0.1x, since the median price-to-sales (or "P/S") ratio for the Industrials industry in Korea is also close to 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Hanwha

What Does Hanwha's Recent Performance Look Like?

Hanwha could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Hanwha will help you uncover what's on the horizon.How Is Hanwha's Revenue Growth Trending?

In order to justify its P/S ratio, Hanwha would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 28% gain to the company's top line. As a result, it also grew revenue by 26% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 8.5% during the coming year according to the eight analysts following the company. That would be an excellent outcome when the industry is expected to decline by 16%.

With this information, we find it odd that Hanwha is trading at a fairly similar P/S to the industry. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

The Bottom Line On Hanwha's P/S

Hanwha's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Hanwha currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Hanwha that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hanwha might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A000880

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives