- South Korea

- /

- Industrials

- /

- KOSE:A000150

Market Might Still Lack Some Conviction On Doosan Corporation (KRX:000150) Even After 30% Share Price Boost

Doosan Corporation (KRX:000150) shares have continued their recent momentum with a 30% gain in the last month alone. The annual gain comes to 172% following the latest surge, making investors sit up and take notice.

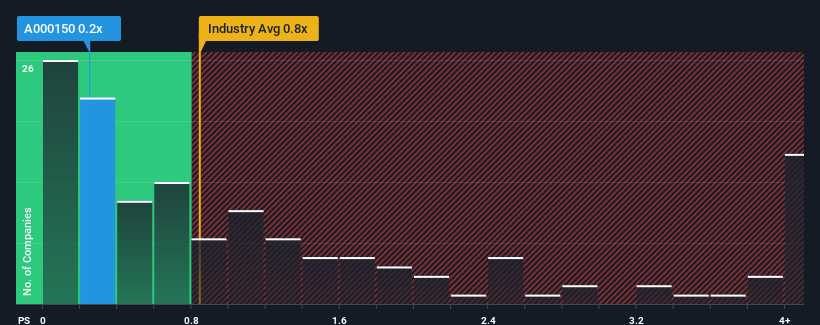

Although its price has surged higher, there still wouldn't be many who think Doosan's price-to-sales (or "P/S") ratio of 0.2x is worth a mention when it essentially matches the median P/S in Korea's Industrials industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Doosan

How Has Doosan Performed Recently?

Doosan hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Doosan's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Doosan's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.0%. Still, the latest three year period has seen an excellent 69% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 0.3% as estimated by the four analysts watching the company. With the rest of the industry predicted to shrink by 3.8%, it's still an optimal result.

With this information, it's perhaps curious but not a major surprise that Doosan is trading at a fairly similar P/S in comparison. With revenue going in reverse, it's not guaranteed that the P/S has found a floor yet. There's still potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Doosan's P/S

Doosan appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

In our view, Doosan appears to be undervalued with its current P/S ratio being lower than anticipated, considering that its revenue projections are not as dismal as the rest of the struggling industry. There's a chance that the market isn't looking too favourably on the potential risks which are preventing the P/S ratio from matching the more attractive outlook compared to its peers. Perhaps there is some hesitation about the company's ability to keep resisting the broader industry turmoil. So, the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Doosan with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A000150

Doosan

Engages in the power generation facilities, industrial facilities, construction machinery, engines, and construction businesses in Korea, the United States, Asia, the Middle East, Europe, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives