- South Korea

- /

- Pharma

- /

- KOSDAQ:A216080

3 KRX Growth Stocks With Insider Ownership Up To 38%

Reviewed by Simply Wall St

The South Korean market has shown modest performance recently, remaining flat over the last week and rising 4.1% over the past year, with earnings expected to grow by 29% annually. In this context, identifying growth companies with significant insider ownership can be a strategic approach, as it often indicates confidence from those closest to the business in its future potential.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.8% | 49.1% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 99.5% |

| Bioneer (KOSDAQ:A064550) | 15.8% | 97.6% |

| Oscotec (KOSDAQ:A039200) | 26.1% | 122% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Vuno (KOSDAQ:A338220) | 19.4% | 110.9% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 96.7% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 83.6% |

Let's take a closer look at a couple of our picks from the screened companies.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩20.40 trillion.

Operations: The company generates revenue of ₩90.79 million from its biotechnology segment.

Insider Ownership: 26.6%

ALTEOGEN demonstrates significant growth potential with revenue expected to grow at 64.2% per year, outpacing the South Korean market average of 10.3%. Its return on equity is projected to be very high in three years, and it is anticipated to become profitable within the same timeframe. However, its share price has been highly volatile recently, and shareholders experienced dilution over the past year. Despite trading significantly below estimated fair value, insider trading activity remains unreported recently.

- Get an in-depth perspective on ALTEOGEN's performance by reading our analyst estimates report here.

- The analysis detailed in our ALTEOGEN valuation report hints at an inflated share price compared to its estimated value.

JETEMA (KOSDAQ:A216080)

Simply Wall St Growth Rating: ★★★★★★

Overview: JETEMA, Co., Ltd. is a bio venture company involved in the research and development of medicines and medical devices, with a market cap of ₩366.10 billion.

Operations: The company generates revenue primarily from its medical products segment, amounting to ₩63.88 billion.

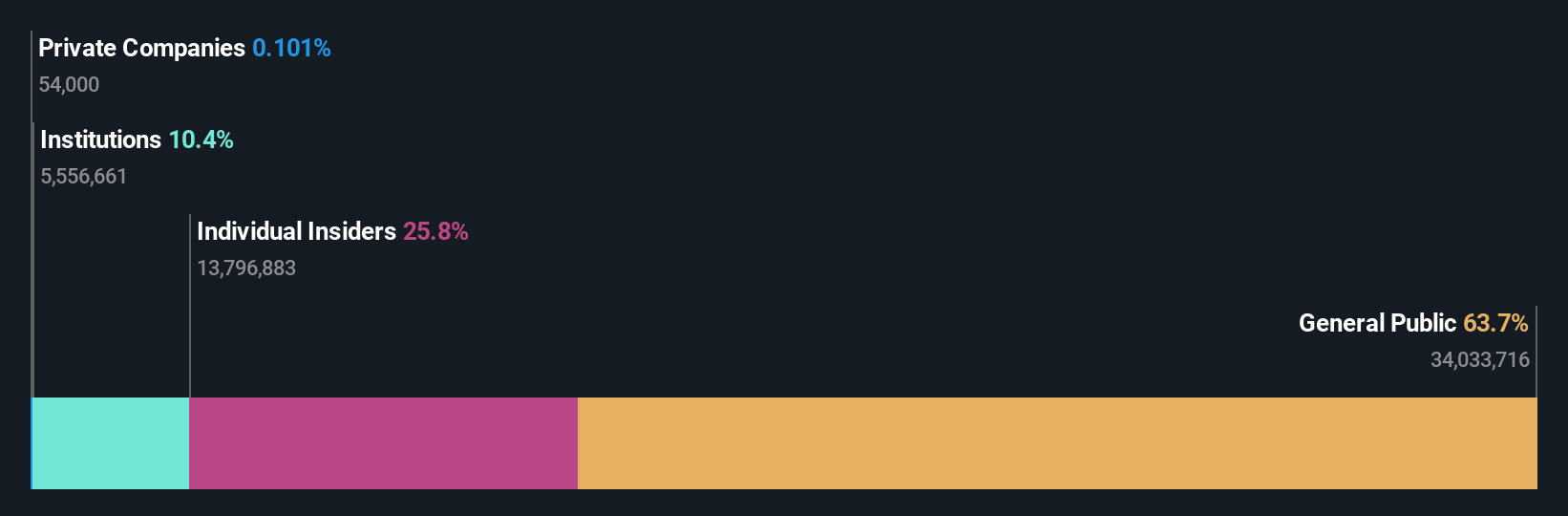

Insider Ownership: 29.2%

JETEMA's revenue growth is forecasted at 30.5% annually, surpassing the South Korean market average of 10.3%. It recently became profitable and is expected to see significant earnings growth of 35.3% per year, outpacing the broader market's 29.4%. Despite trading at a substantial discount to its estimated fair value, it faces challenges with insufficient financial data and interest payments not well covered by earnings. Insider trading activities have not been reported recently.

- Navigate through the intricacies of JETEMA with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of JETEMA shares in the market.

Doosan (KOSE:A000150)

Simply Wall St Growth Rating: ★★★★☆☆

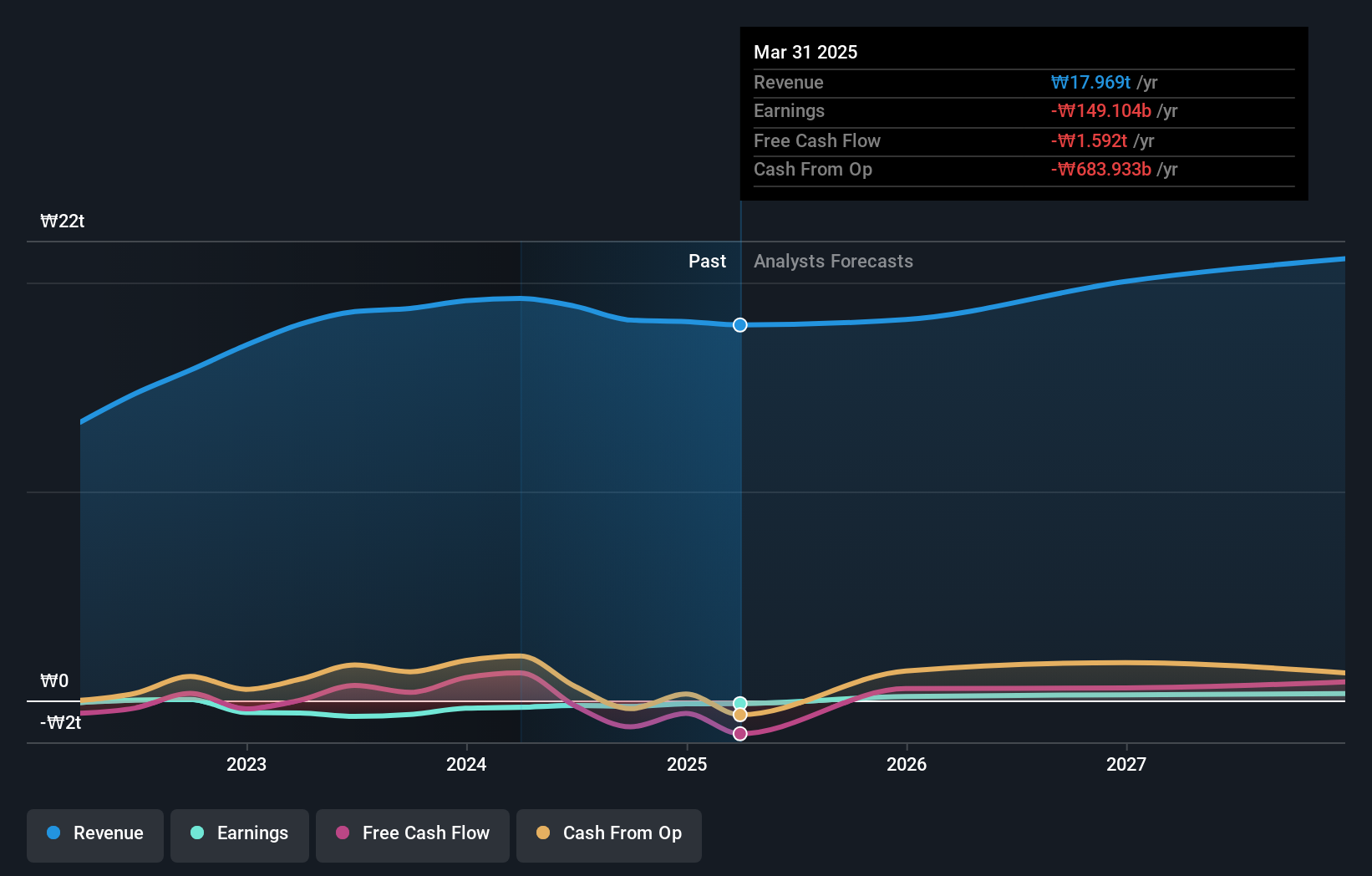

Overview: Doosan Corporation operates in heavy industry, machinery manufacturing, and apartment construction across South Korea, the United States, Asia, the Middle East, Europe, and internationally with a market cap of ₩3.25 trillion.

Operations: The company's revenue segments include Doosan Bobcat with ₩9.31 billion, Doosan Energy at ₩8.25 billion, Electronic BG contributing ₩855.42 million, Doosan Fuel Cell with ₩279.99 million, and Digital Innovation BU at ₩286.29 million.

Insider Ownership: 38.9%

Doosan is trading significantly below its estimated fair value, presenting potential for growth. It is expected to become profitable within three years, with earnings forecasted to grow at 65.51% annually, exceeding market averages. However, revenue growth of 3.7% per year lags behind the South Korean market's 10.3%. Recent inclusion in the S&P Global BMI Index highlights its growing recognition despite high share price volatility and lack of recent insider trading activity.

- Click to explore a detailed breakdown of our findings in Doosan's earnings growth report.

- Our comprehensive valuation report raises the possibility that Doosan is priced lower than what may be justified by its financials.

Key Takeaways

- Click through to start exploring the rest of the 83 Fast Growing KRX Companies With High Insider Ownership now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A216080

JETEMA

A bio venture company, engages in the research and development of medicines and medical devices.

Low and slightly overvalued.