- Romania

- /

- Electric Utilities

- /

- BVB:TEL

Discovering Undiscovered Gems in January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets are navigating a complex landscape marked by stronger-than-expected U.S. labor market data and ongoing inflation concerns, which have contributed to the underperformance of small-cap stocks compared to their larger counterparts. With the Russell 2000 Index dipping into correction territory, investors might find opportunities in lesser-known stocks that demonstrate resilience and potential for growth despite broader market volatility. Identifying such "undiscovered gems" often involves looking for companies with strong fundamentals and innovative strategies that can thrive even amid economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| NJS | NA | 5.31% | 7.12% | ★★★★★★ |

| GakkyushaLtd | 19.76% | 4.94% | 18.11% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Chuo WarehouseLtd | 12.36% | 0.35% | 9.16% | ★★★★★★ |

| MIRARTH HOLDINGSInc | 261.26% | 3.32% | 0.93% | ★★★★★☆ |

| Hayleys | 140.54% | 19.07% | 20.35% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

CNTEE Transelectrica (BVB:TEL)

Simply Wall St Value Rating: ★★★★★★

Overview: CNTEE Transelectrica SA operates as the transmission and system operator of the national power system, with a market capitalization of RON3.08 billion.

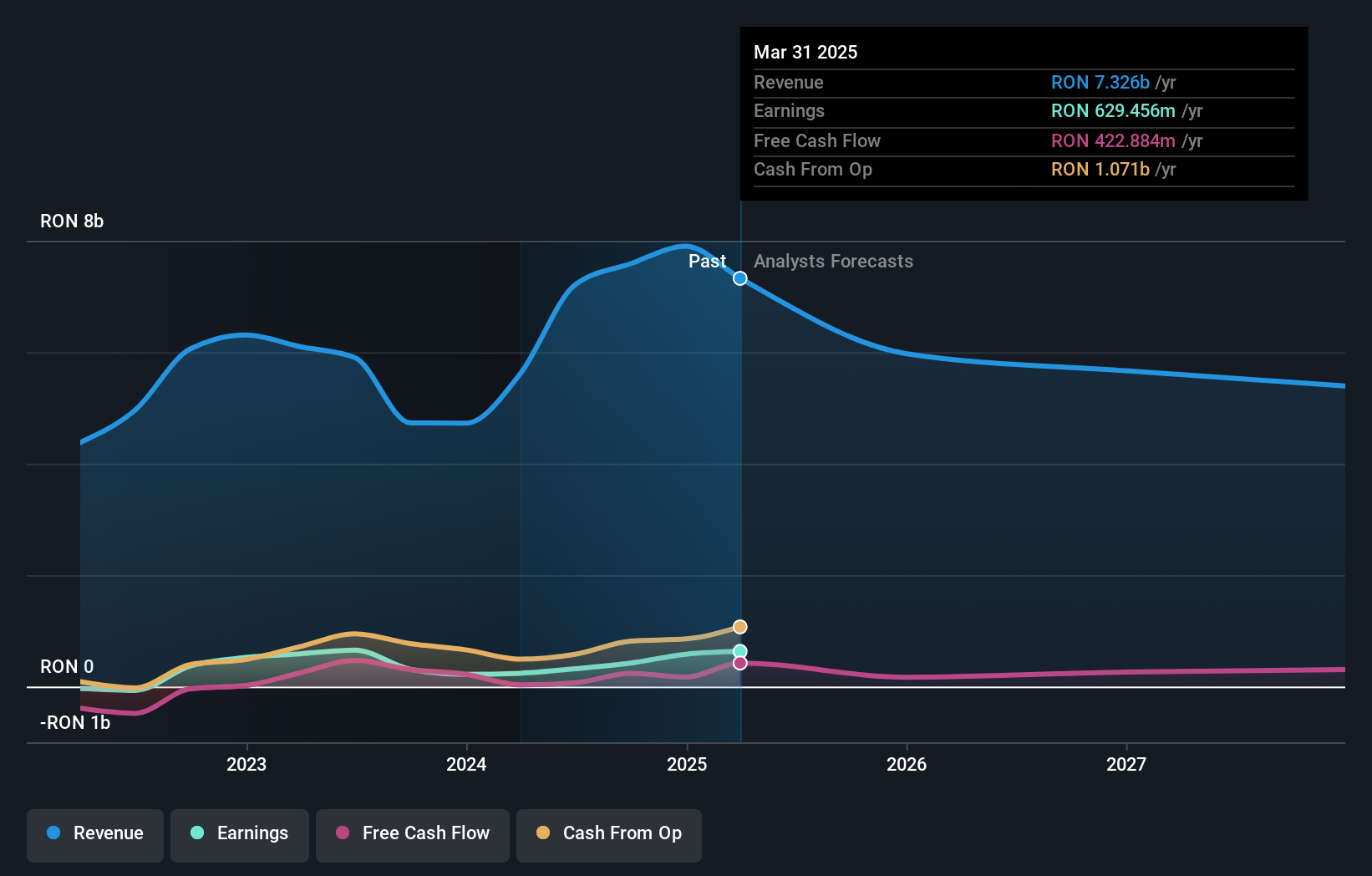

Operations: Transelectrica generates revenue primarily from its transmission and dispatch services, amounting to RON7.59 billion. The company's focus on these core operations is a significant contributor to its financial performance.

Transelectrica, a notable player in the electric utilities sector, has demonstrated robust financial health with earnings surging by 35.9% over the past year, outpacing the industry average of -10.9%. The company reported third-quarter sales of RON 1.45 billion and net income of RON 146.75 million, showcasing significant growth from last year's figures. Over five years, its debt-to-equity ratio notably decreased from 5.5 to 0.7, reflecting prudent financial management. With high-quality earnings and trading at a value below estimated fair market price by 4.7%, Transelectrica presents an intriguing opportunity for investors seeking stability and growth potential in emerging markets like Romania's energy sector.

- Get an in-depth perspective on CNTEE Transelectrica's performance by reading our health report here.

Hyundai Hyms (KOSDAQ:A460930)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hyundai Hyms Co., Ltd. is a South Korean company specializing in the manufacturing and sale of shipbuilding equipment, with a market cap of ₩600.25 billion.

Operations: The company's primary revenue stream is from its shipbuilding segment, generating ₩221.64 billion.

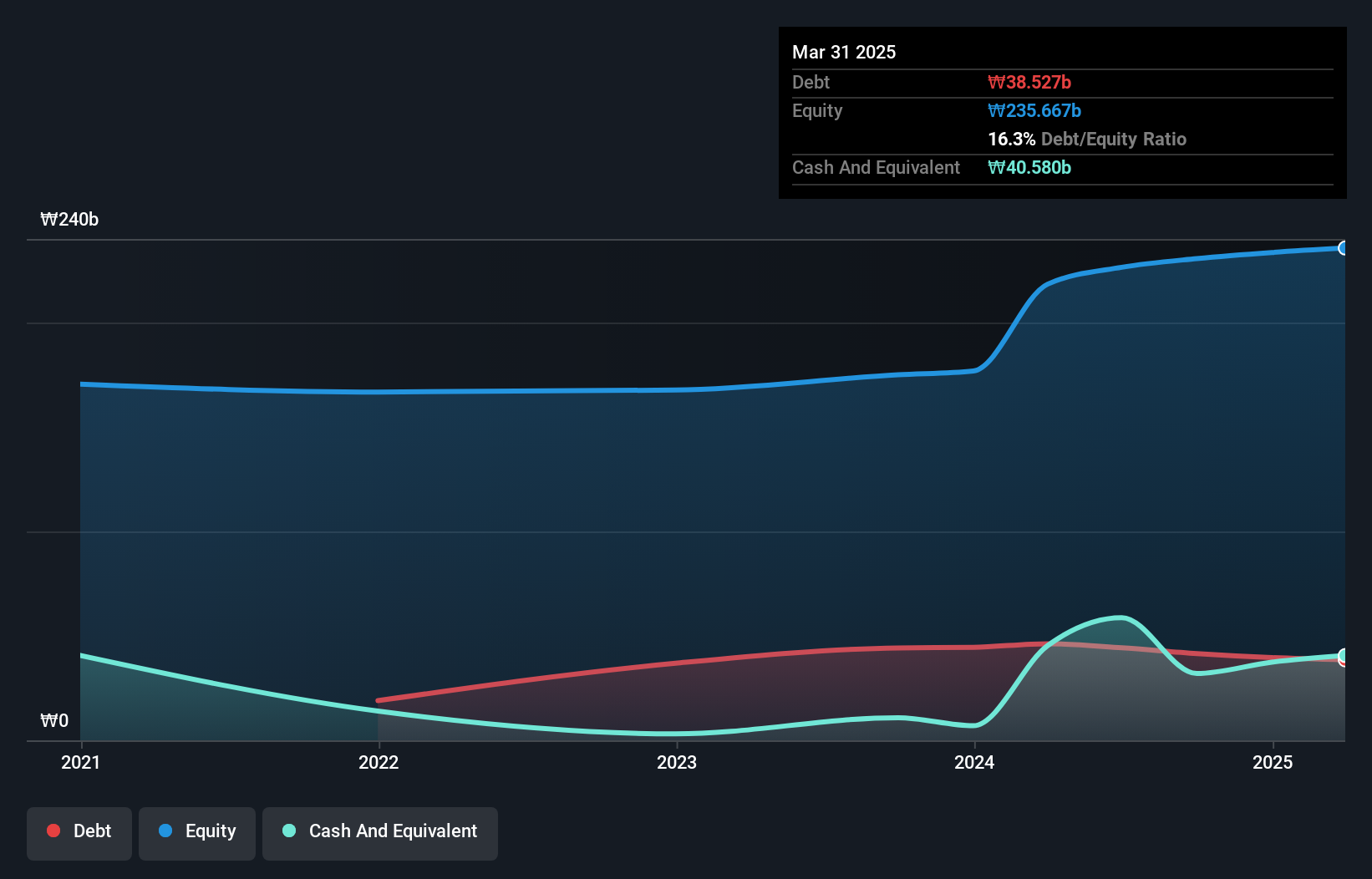

Hyundai Hyms, a promising player in the machinery sector, has shown impressive earnings growth of 89.9% over the past year, outpacing the industry's -0.3%. The company's net debt to equity ratio stands at a satisfactory 4.1%, indicating prudent financial management. Despite experiencing a highly volatile share price recently, Hyundai Hyms benefits from high-quality past earnings and has its interest payments well covered by EBIT with a 10.1x coverage ratio. While free cash flow remains negative, recent capital expenditures suggest strategic reinvestment to bolster future growth prospects in this dynamic industry landscape.

- Navigate through the intricacies of Hyundai Hyms with our comprehensive health report here.

Gain insights into Hyundai Hyms' past trends and performance with our Past report.

Micronics Japan (TSE:6871)

Simply Wall St Value Rating: ★★★★★★

Overview: Micronics Japan Co., Ltd. develops, manufactures, and sells testing and measurement equipment for semiconductors and LCD testing systems worldwide, with a market capitalization of ¥171.73 billion.

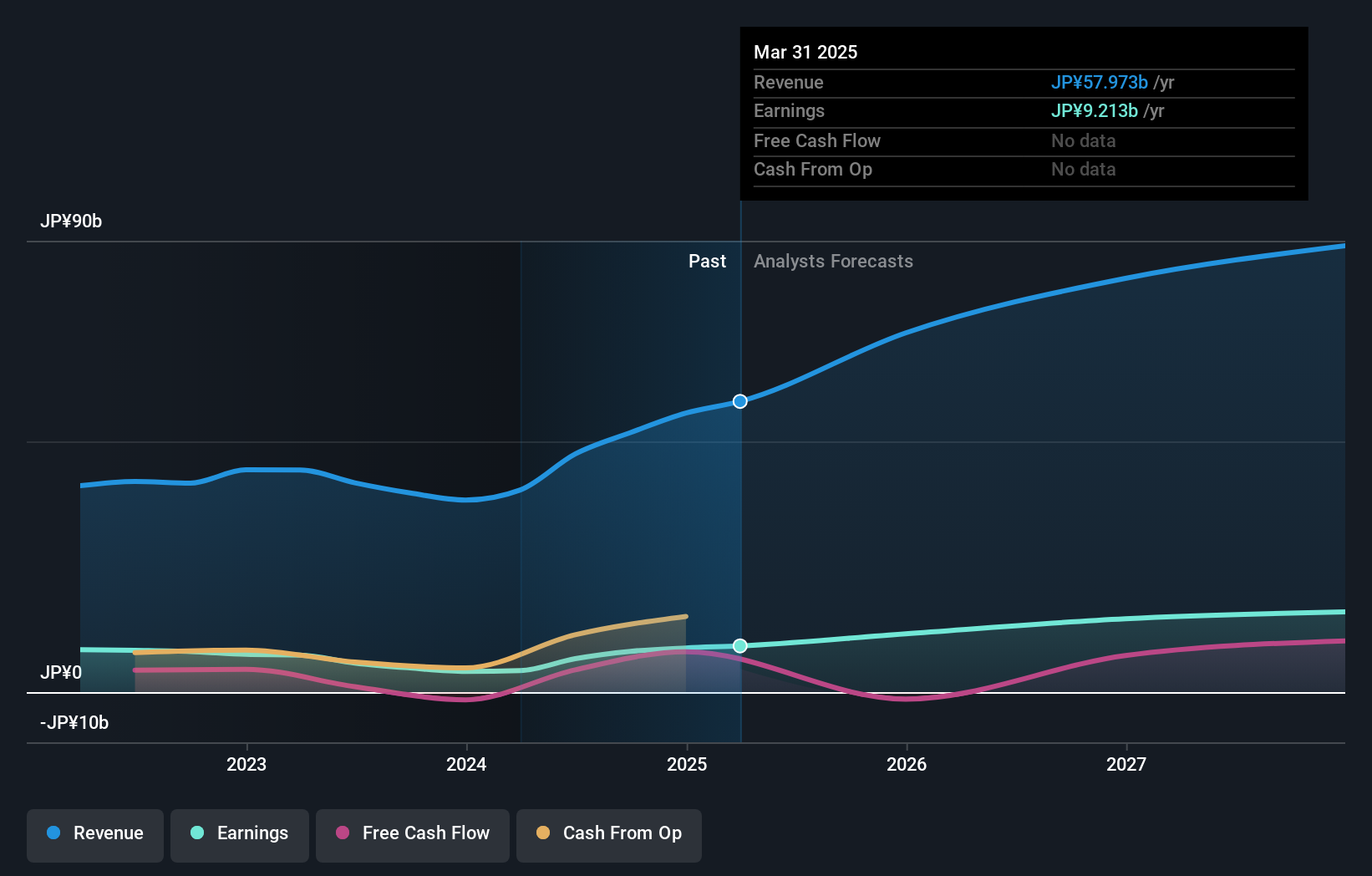

Operations: Micronics Japan generates revenue primarily from its Probe Card Business, which accounts for ¥49.56 billion, and the TE Business contributing ¥2.19 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Micronics Japan, a nimble player in the semiconductor space, has shown impressive earnings growth of 68.9% over the past year, outpacing the industry average of 7.4%. With its debt to equity ratio improving from 7.1% to 2.5% over five years and trading at a significant discount of 60.2% below fair value estimates, it presents an intriguing opportunity for investors seeking undervalued stocks with strong financial health. The company recently announced a cash dividend of ¥65 per share and participated in a global investors conference, signaling active engagement with stakeholders and potential future growth prospects.

- Delve into the full analysis health report here for a deeper understanding of Micronics Japan.

Evaluate Micronics Japan's historical performance by accessing our past performance report.

Summing It All Up

- Access the full spectrum of 4536 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:TEL

CNTEE Transelectrica

CNTEE Transelectrica SA acts as a transmission and system operator of the national power system.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives