- South Korea

- /

- Machinery

- /

- KOSDAQ:A348340

Investors Interested In Neuromeka Co., Ltd.'s (KOSDAQ:348340) Revenues

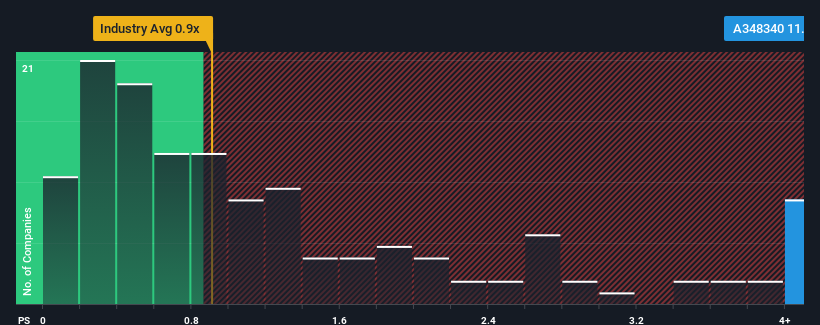

Neuromeka Co., Ltd.'s (KOSDAQ:348340) price-to-sales (or "P/S") ratio of 11.7x may look like a poor investment opportunity when you consider close to half the companies in the Machinery industry in Korea have P/S ratios below 0.9x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Neuromeka

How Neuromeka Has Been Performing

Neuromeka certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Neuromeka's future stacks up against the industry? In that case, our free report is a great place to start.How Is Neuromeka's Revenue Growth Trending?

Neuromeka's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 112% last year. The strong recent performance means it was also able to grow revenue by 224% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 109% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 21%, which is noticeably less attractive.

With this information, we can see why Neuromeka is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Neuromeka's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Neuromeka's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Neuromeka (1 is a bit unpleasant) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Neuromeka might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A348340

Mediocre balance sheet with limited growth.

Market Insights

Community Narratives