- South Korea

- /

- Machinery

- /

- KOSDAQ:A299030

Subdued Growth No Barrier To Hana Technology Co., Ltd. (KOSDAQ:299030) With Shares Advancing 36%

Those holding Hana Technology Co., Ltd. (KOSDAQ:299030) shares would be relieved that the share price has rebounded 36% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 64% share price decline over the last year.

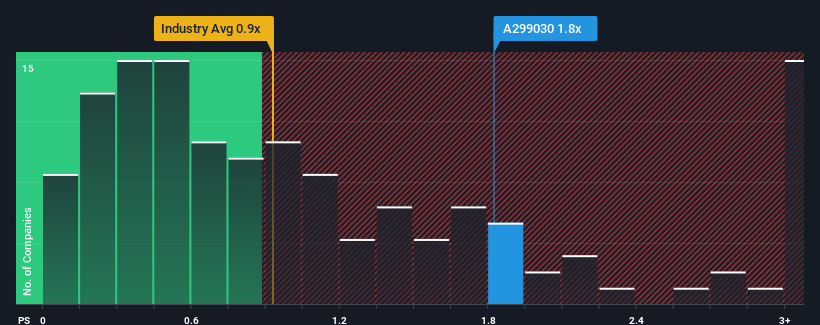

After such a large jump in price, you could be forgiven for thinking Hana Technology is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.8x, considering almost half the companies in Korea's Machinery industry have P/S ratios below 0.9x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Hana Technology

What Does Hana Technology's P/S Mean For Shareholders?

Hana Technology hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hana Technology.Is There Enough Revenue Growth Forecasted For Hana Technology?

The only time you'd be truly comfortable seeing a P/S as high as Hana Technology's is when the company's growth is on track to outshine the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 24%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 11% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 40% during the coming year according to the one analyst following the company. With the industry predicted to deliver 45% growth, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Hana Technology's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

Hana Technology's P/S is on the rise since its shares have risen strongly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Hana Technology, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Hana Technology that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Hana Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A299030

Hana Technology

Engages in the development of precision automation solutions in the industrial field in South Korea.

High growth potential with imperfect balance sheet.

Market Insights

Community Narratives