- South Korea

- /

- Machinery

- /

- KOSDAQ:A290670

Update: Daebo MagneticLtd (KOSDAQ:290670) Stock Gained 49% In The Last Year

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Daebo Magnetic Co.,Ltd. (KOSDAQ:290670) share price is 49% higher than it was a year ago, much better than the market return of around 39% (not including dividends) in the same period. That's a solid performance by our standards! We'll need to follow Daebo MagneticLtd for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

View our latest analysis for Daebo MagneticLtd

Given that Daebo MagneticLtd only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Daebo MagneticLtd actually shrunk its revenue over the last year, with a reduction of 35%. The stock is up 49% in that time, a fine performance given the revenue drop. We can correlate the share price rise with revenue or profit growth, but it seems the market had previously expected weaker results, and sentiment around the stock is improving.

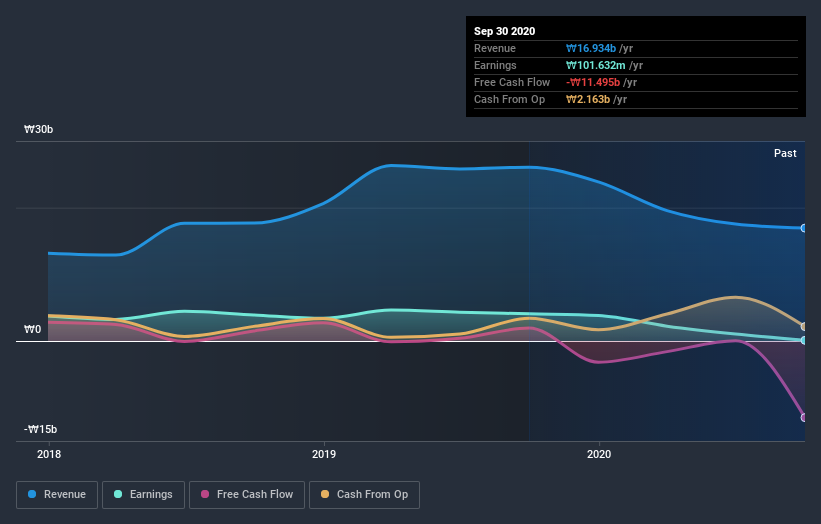

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Daebo MagneticLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Daebo MagneticLtd shareholders should be happy with the total gain of 49% over the last twelve months. And the share price momentum remains respectable, with a gain of 30% in the last three months. This suggests the company is continuing to win over new investors. It's always interesting to track share price performance over the longer term. But to understand Daebo MagneticLtd better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 6 warning signs with Daebo MagneticLtd (at least 3 which are a bit unpleasant) , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading Daebo MagneticLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A290670

Daebo MagneticLtd

Manufactures and sells electro magnetic filters that are used for secondary battery material process and cell process.

Mediocre balance sheet low.

Market Insights

Community Narratives