- South Korea

- /

- Machinery

- /

- KOSDAQ:A277880

The Market Doesn't Like What It Sees From TSI Co., Ltd.'s (KOSDAQ:277880) Revenues Yet As Shares Tumble 25%

Unfortunately for some shareholders, the TSI Co., Ltd. (KOSDAQ:277880) share price has dived 25% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 51% share price decline.

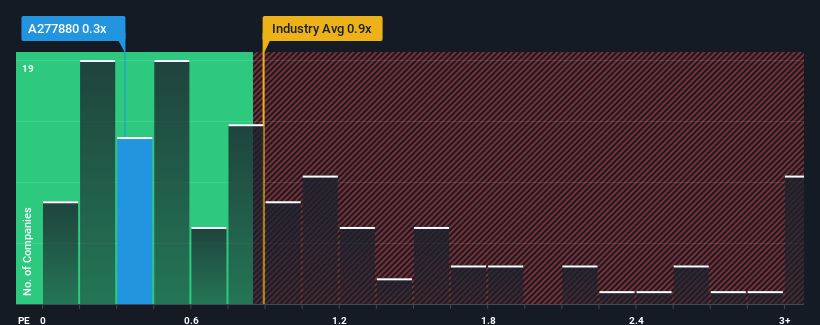

Following the heavy fall in price, considering around half the companies operating in Korea's Machinery industry have price-to-sales ratios (or "P/S") above 0.9x, you may consider TSI as an solid investment opportunity with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for TSI

How Has TSI Performed Recently?

Recent times have been advantageous for TSI as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on TSI.Is There Any Revenue Growth Forecasted For TSI?

TSI's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an exceptional 30% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue growth is heading into negative territory, declining 100% over the next year. With the industry predicted to deliver 40% growth, that's a disappointing outcome.

In light of this, it's understandable that TSI's P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

The southerly movements of TSI's shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's clear to see that TSI maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

It is also worth noting that we have found 4 warning signs for TSI (3 shouldn't be ignored!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if TSI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A277880

TSI

A mixing system company, engages in the manufacture and sale of rechargeable battery mixing systems in South Korea, China, Poland, Sweden, France, Vietnam, Malaysia, the United States, Hungary, and Indonesia.

Slight with acceptable track record.

Market Insights

Community Narratives