- China

- /

- Electrical

- /

- SZSE:002028

Global Growth Stocks Insiders Are Eager To Own

Reviewed by Simply Wall St

As global markets grapple with AI-related concerns and fluctuating economic indicators, investor sentiment has been cautious, particularly in tech-heavy sectors like the Nasdaq Composite. Despite these challenges, growth companies with high insider ownership often stand out as potential opportunities due to their alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Pharma Mar (BME:PHM) | 12% | 41.5% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 34.1% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Elliptic Laboratories (OB:ELABS) | 22.5% | 109.1% |

| CD Projekt (WSE:CDR) | 29.7% | 50.6% |

Here's a peek at a few of the choices from the screener.

Rainbow RoboticsLtd (KOSDAQ:A277810)

Simply Wall St Growth Rating: ★★★★★★

Overview: Rainbow Robotics Co.,Ltd. is a professional technological mechatronics company specializing in robotic system engineering technology, with a market cap of ₩7.44 billion.

Operations: The company's revenue primarily comes from its Industrial Automation & Controls segment, amounting to ₩23.53 billion.

Insider Ownership: 23.6%

Revenue Growth Forecast: 118.6% p.a.

Rainbow Robotics Ltd. is poised for significant growth, with revenue expected to increase by 118.6% annually, outpacing the Korean market's 10.4%. Earnings are forecast to grow at a remarkable 132.9% per year, surpassing the market average of 28.4%. The company became profitable this year and boasts high-quality earnings despite its volatile share price recently. Insider trading activity has been minimal over the past three months, indicating stability in insider sentiment amidst rapid growth projections.

- Navigate through the intricacies of Rainbow RoboticsLtd with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Rainbow RoboticsLtd is trading beyond its estimated value.

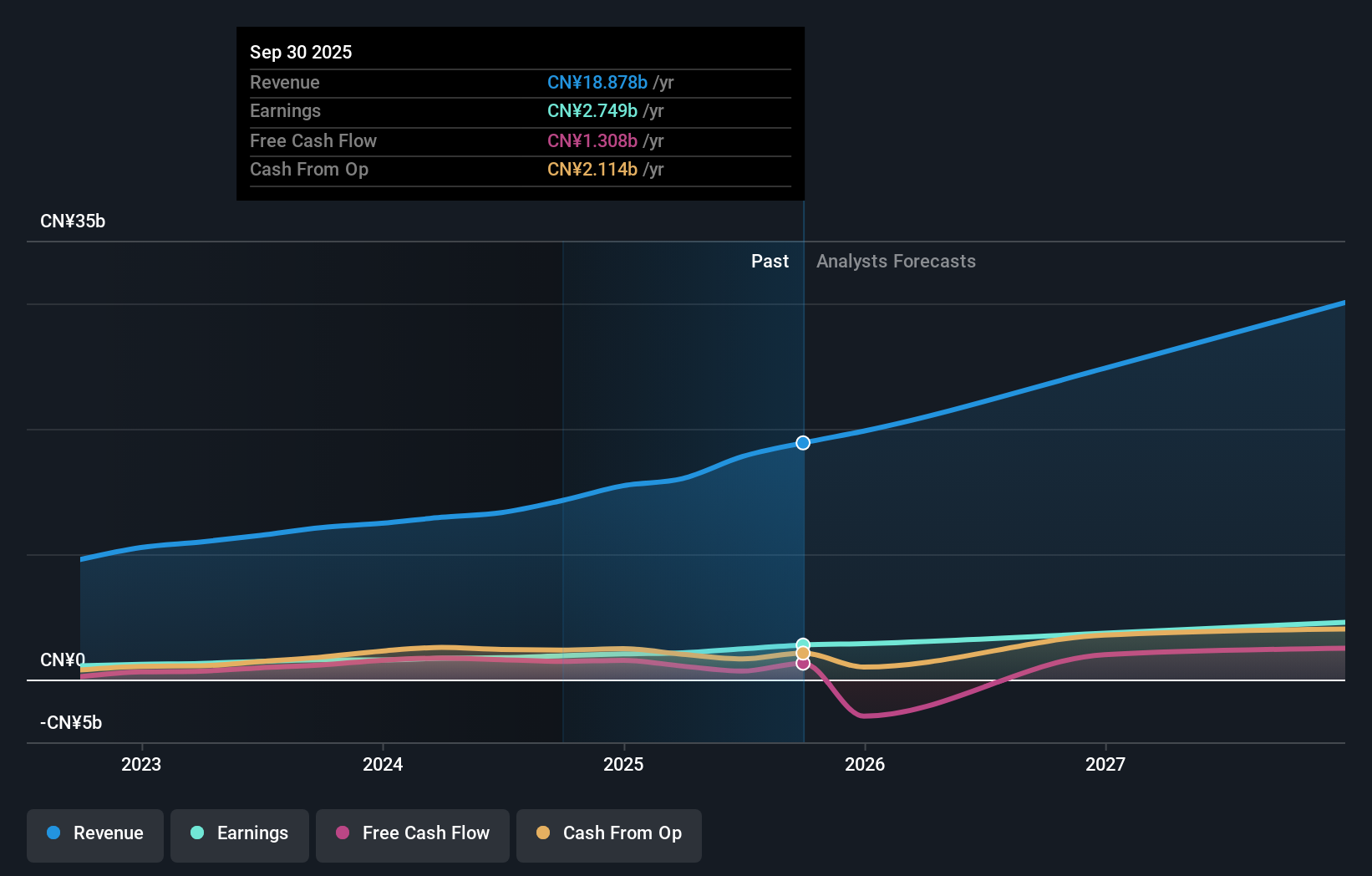

Sieyuan Electric (SZSE:002028)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sieyuan Electric Co., Ltd. is involved in the research, development, production, sale, and service of power transmission and distribution equipment both in China and internationally, with a market cap of CN¥109.61 billion.

Operations: The company generates revenue of CN¥18.88 billion from its Distribution and Controls Equipment/Furniture segment.

Insider Ownership: 35.1%

Revenue Growth Forecast: 22.5% p.a.

Sieyuan Electric demonstrates strong growth potential, with earnings forecasted to grow significantly at 25.1% annually, although slightly below the CN market average. Revenue is expected to increase by 22.5% per year, outpacing the market's 14.5%. Recent earnings reports show substantial revenue and net income growth over the past year, despite recent share price volatility and its removal from the S&P Global BMI Index in September 2025.

- Click here to discover the nuances of Sieyuan Electric with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Sieyuan Electric's share price might be too optimistic.

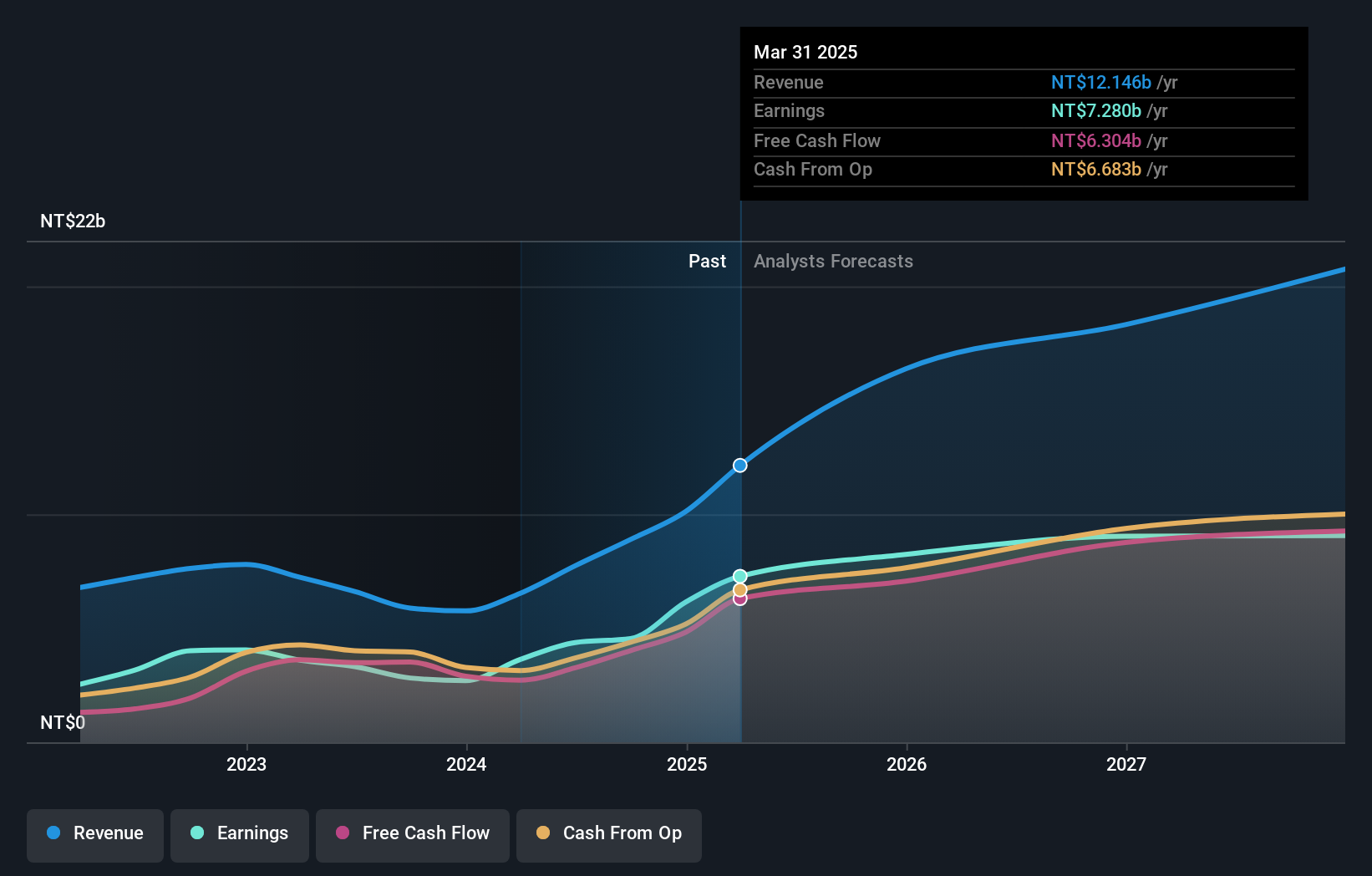

King Slide Works (TWSE:2059)

Simply Wall St Growth Rating: ★★★★★★

Overview: King Slide Works Co., Ltd. designs, manufactures, and sells rail kits for computer and network communications equipment, furniture wooden kitchen accessories, slides, and molds in Taiwan and internationally with a market cap of NT$343.55 billion.

Operations: The company's revenue segments include NT$2.09 billion from King Slide Works Co., Ltd. and NT$14.07 billion from King Slide Technology Co., Ltd.

Insider Ownership: 14.3%

Revenue Growth Forecast: 25% p.a.

King Slide Works is positioned for robust growth, with earnings projected to rise significantly at 26% annually, surpassing the TW market average. Revenue is expected to grow by 25% per year, outpacing the market's 13.7%. The company reported substantial increases in sales and net income for Q3 and nine months ending September 2025. Despite recent share price volatility, its Return on Equity is forecasted to remain high at 39.3% in three years.

- Click to explore a detailed breakdown of our findings in King Slide Works' earnings growth report.

- Our valuation report here indicates King Slide Works may be overvalued.

Where To Now?

- Take a closer look at our Fast Growing Global Companies With High Insider Ownership list of 855 companies by clicking here.

- Ready For A Different Approach? Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002028

Sieyuan Electric

Engages in research and development, production, sale, and service of power transmission and distribution equipment in China and internationally.

High growth potential with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.