- South Korea

- /

- Machinery

- /

- KOSDAQ:A267320

Naintech CO.,LTD.'s (KOSDAQ:267320) Shares Climb 50% But Its Business Is Yet to Catch Up

Naintech CO.,LTD. (KOSDAQ:267320) shareholders have had their patience rewarded with a 50% share price jump in the last month. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 2.7% in the last twelve months.

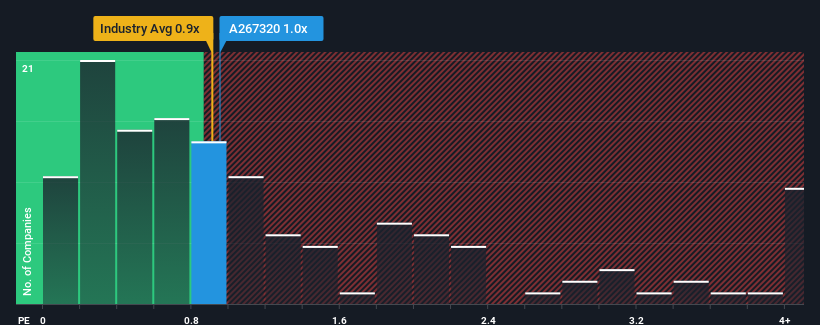

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about NaintechLTD's P/S ratio of 1x, since the median price-to-sales (or "P/S") ratio for the Machinery industry in Korea is also close to 0.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for NaintechLTD

How NaintechLTD Has Been Performing

NaintechLTD could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think NaintechLTD's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

NaintechLTD's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 20% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 118% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 34% as estimated by the sole analyst watching the company. With the industry predicted to deliver 52% growth, the company is positioned for a weaker revenue result.

With this information, we find it interesting that NaintechLTD is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Its shares have lifted substantially and now NaintechLTD's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at the analysts forecasts of NaintechLTD's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for NaintechLTD (2 make us uncomfortable) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if NaintechLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A267320

NaintechLTD

Naintech CO.,LTD engages in manufacturing semiconductor and LCD related equipment.

Slight and fair value.

Market Insights

Community Narratives