- South Korea

- /

- Electrical

- /

- KOSDAQ:A247540

Ecopro BM. Co., Ltd. (KOSDAQ:247540) May Have Run Too Fast Too Soon With Recent 26% Price Plummet

To the annoyance of some shareholders, Ecopro BM. Co., Ltd. (KOSDAQ:247540) shares are down a considerable 26% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 48% share price drop.

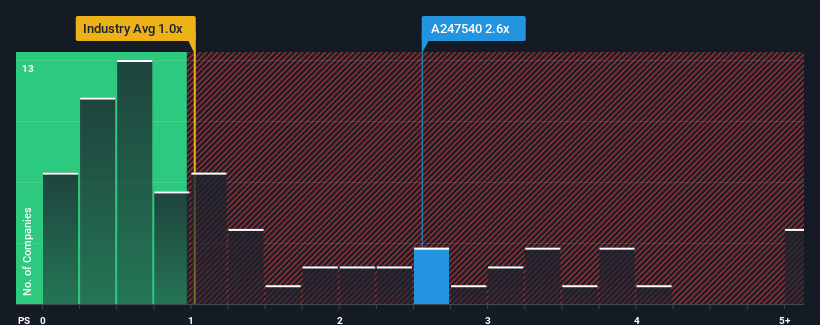

Even after such a large drop in price, when almost half of the companies in Korea's Electrical industry have price-to-sales ratios (or "P/S") below 1x, you may still consider Ecopro BM as a stock probably not worth researching with its 2.6x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Ecopro BM

What Does Ecopro BM's P/S Mean For Shareholders?

Ecopro BM has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think Ecopro BM's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Ecopro BM's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 36%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Looking ahead now, revenue is anticipated to climb by 19% each year during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 18% each year, which is not materially different.

With this in consideration, we find it intriguing that Ecopro BM's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Key Takeaway

Ecopro BM's P/S remain high even after its stock plunged. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Analysts are forecasting Ecopro BM's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. A positive change is needed in order to justify the current price-to-sales ratio.

You always need to take note of risks, for example - Ecopro BM has 2 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on Ecopro BM, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Ecopro BM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A247540

Ecopro BM

Ecopro BM Co. Ltd. develops and sells cathode materials used in batteries in Korea and internationally.

High growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives