- South Korea

- /

- Electrical

- /

- KOSDAQ:A243840

Shin Heung Energy & ElectronicsLtd's (KOSDAQ:243840) Earnings Are Growing But Is There More To The Story?

Broadly speaking, profitable businesses are less risky than unprofitable ones. That said, the current statutory profit is not always a good guide to a company's underlying profitability. Today we'll focus on whether this year's statutory profits are a good guide to understanding Shin Heung Energy & ElectronicsLtd (KOSDAQ:243840).

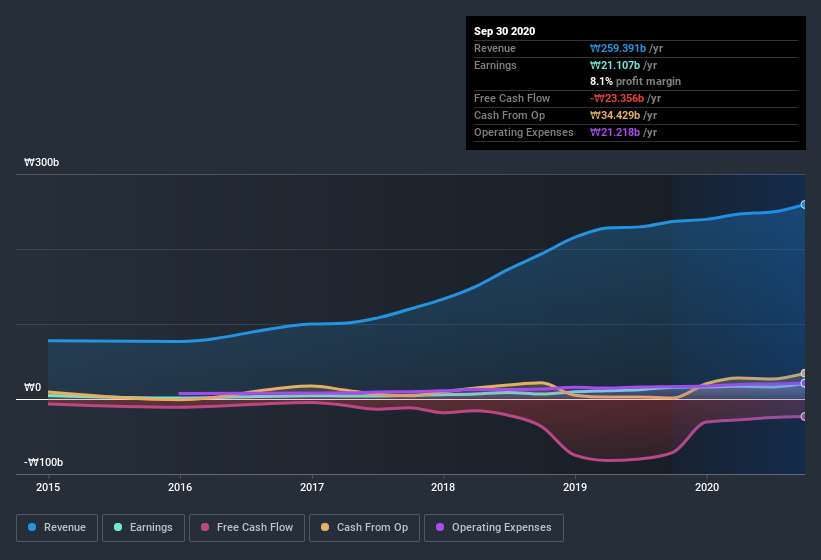

While Shin Heung Energy & ElectronicsLtd was able to generate revenue of ₩259.4b in the last twelve months, we think its profit result of ₩21.1b was more important. In the chart below, you can see that its profit and revenue have both grown over the last three years.

View our latest analysis for Shin Heung Energy & ElectronicsLtd

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. In this article we will consider how Shin Heung Energy & ElectronicsLtd's decision to issue new shares in the company has impacted returns to shareholders. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, Shin Heung Energy & ElectronicsLtd issued 6.0% more new shares over the last year. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Shin Heung Energy & ElectronicsLtd's historical EPS growth by clicking on this link.

A Look At The Impact Of Shin Heung Energy & ElectronicsLtd's Dilution on Its Earnings Per Share (EPS).

As you can see above, Shin Heung Energy & ElectronicsLtd has been growing its net income over the last few years, with an annualized gain of 334% over three years. In comparison, earnings per share only gained 249% over the same period. And at a glance the 36% gain in profit over the last year impresses. But in comparison, EPS only increased by 33% over the same period. So you can see that the dilution has had a bit of an impact on shareholders. Therefore, the dilution is having a noteworthy influence on shareholder returns. And so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, earnings per share growth should beget share price growth. So Shin Heung Energy & ElectronicsLtd shareholders will want to see that EPS figure continue to increase. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Our Take On Shin Heung Energy & ElectronicsLtd's Profit Performance

Each Shin Heung Energy & ElectronicsLtd share now gets a meaningfully smaller slice of its overall profit, due to dilution of existing shareholders. Because of this, we think that it may be that Shin Heung Energy & ElectronicsLtd's statutory profits are better than its underlying earnings power. But the good news is that its EPS growth over the last three years has been very impressive. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So while earnings quality is important, it's equally important to consider the risks facing Shin Heung Energy & ElectronicsLtd at this point in time. For example, we've discovered 2 warning signs that you should run your eye over to get a better picture of Shin Heung Energy & ElectronicsLtd.

This note has only looked at a single factor that sheds light on the nature of Shin Heung Energy & ElectronicsLtd's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading Shin Heung Energy & ElectronicsLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A243840

Shin Heung Energy & ElectronicsLtd

Engages in the manufacturing and sale of parts and facilities for the secondary battery markets in South Korea and internationally.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026