- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A166090

3 KRX Growth Companies With High Insider Ownership And 62% Revenue Growth

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has risen 3.8%, driven by gains of 6.0% in the Information Technology sector, and it is up 5.8% over the last 12 months with earnings forecast to grow by 29% annually. In this favorable environment, growth companies with high insider ownership often stand out as promising investments due to their potential for substantial revenue growth and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| Bioneer (KOSDAQ:A064550) | 15.8% | 97.6% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 99.5% |

| Oscotec (KOSDAQ:A039200) | 26.3% | 122% |

| Vuno (KOSDAQ:A338220) | 19.5% | 110.9% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| Park Systems (KOSDAQ:A140860) | 33% | 35.7% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 83.6% |

Let's take a closer look at a couple of our picks from the screened companies.

Hana Materials (KOSDAQ:A166090)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hana Materials Inc., with a market cap of ₩651.84 billion, manufactures and sells silicon electrodes and rings in South Korea.

Operations: The company's revenue segments include the manufacture and sale of silicon electrodes and rings in South Korea.

Insider Ownership: 12.6%

Revenue Growth Forecast: 20.2% p.a.

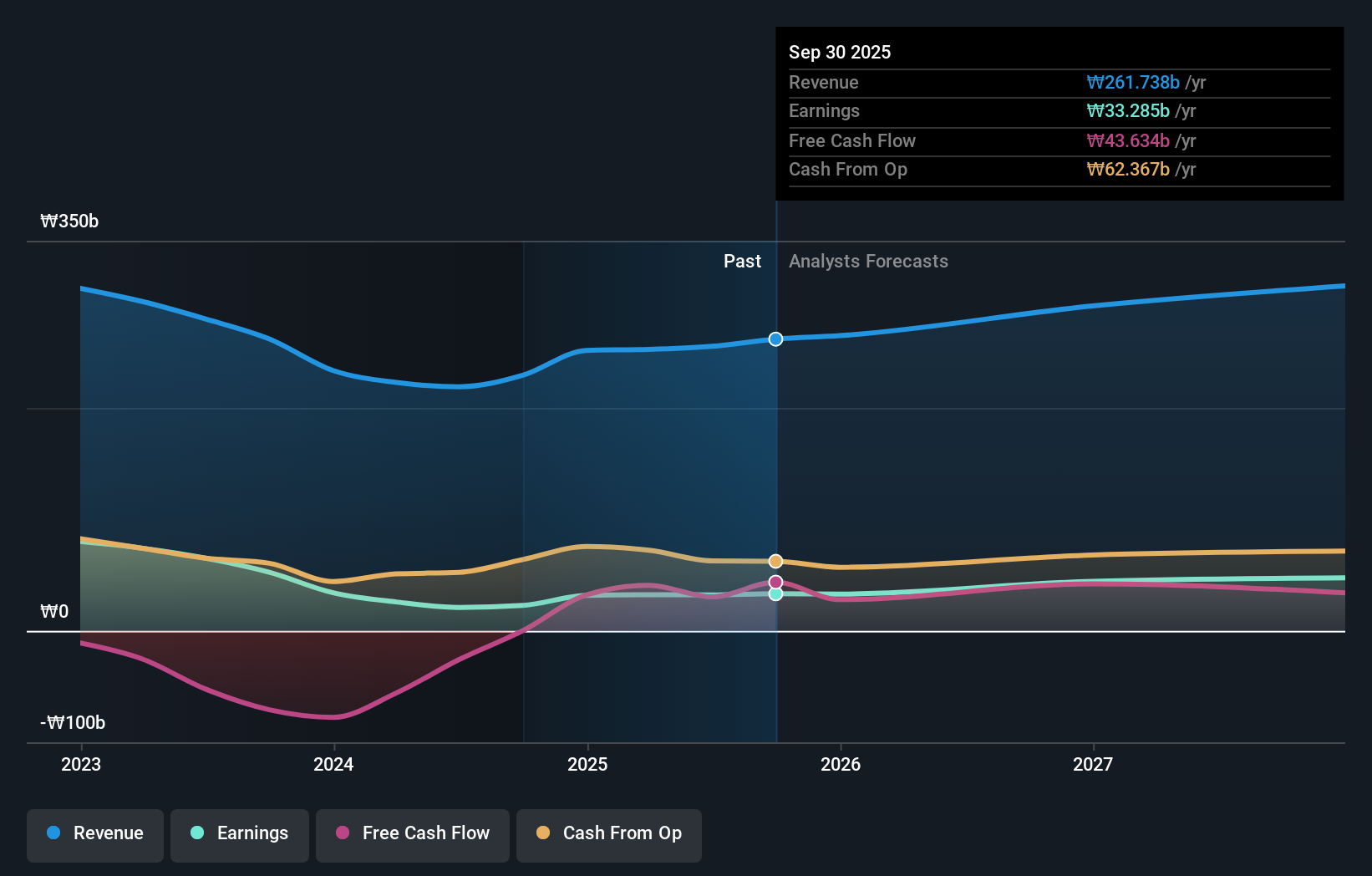

Hana Materials demonstrates strong growth potential with forecasted annual earnings growth of 50.1%, significantly outpacing the South Korean market average of 29.3%. Despite recent declines in profit margins, the company's revenue is expected to grow at 20.2% per year, faster than the market's 10.5%. Insider ownership remains high with no substantial insider selling or buying in recent months. The company has completed a share buyback plan, repurchasing shares worth KRW 3.09 billion ($2.32 million).

- Click here to discover the nuances of Hana Materials with our detailed analytical future growth report.

- According our valuation report, there's an indication that Hana Materials' share price might be on the cheaper side.

Shin Heung Energy & ElectronicsLtd (KOSDAQ:A243840)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shin Heung Energy & Electronics Co., Ltd. manufactures and sells parts and facilities for the secondary battery markets in South Korea and internationally, with a market cap of ₩359.82 billion.

Operations: Revenue from manufacturing and selling lithium-ion battery parts amounts to ₩552.15 billion.

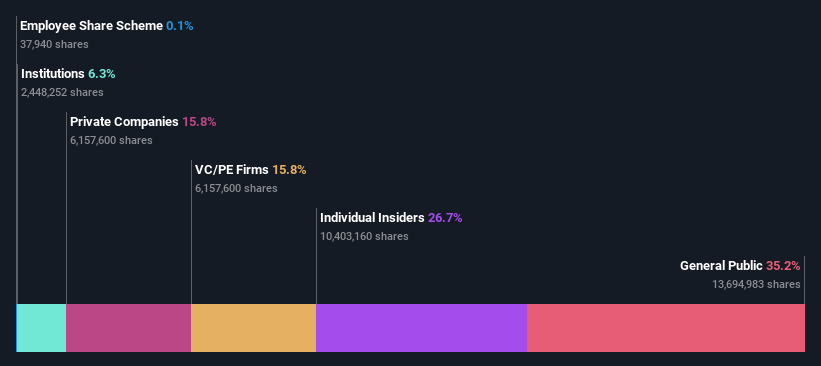

Insider Ownership: 26.7%

Revenue Growth Forecast: 22.1% p.a.

Shin Heung Energy & Electronics Ltd. exhibits promising growth potential with forecasted annual revenue growth of 22.1%, surpassing the South Korean market average of 10.5%. Despite a lower expected earnings growth rate of 23.8% compared to the market's 29.3%, the company offers good value with a price-to-earnings ratio of 11.6x, below industry averages. Recent buyback activity saw the repurchase of shares worth KRW 183.48 million ($0.14 million), reflecting management's confidence in future prospects despite low forecasted return on equity (10.5%).

- Dive into the specifics of Shin Heung Energy & ElectronicsLtd here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Shin Heung Energy & ElectronicsLtd's current price could be quite moderate.

Enchem (KOSDAQ:A348370)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Enchem Co., Ltd. manufactures and sells electrolytes and additives for secondary batteries and EDLC, with a market cap of ₩4.26 trillion.

Operations: Enchem's revenue from electronic components and parts is ₩348.75 billion.

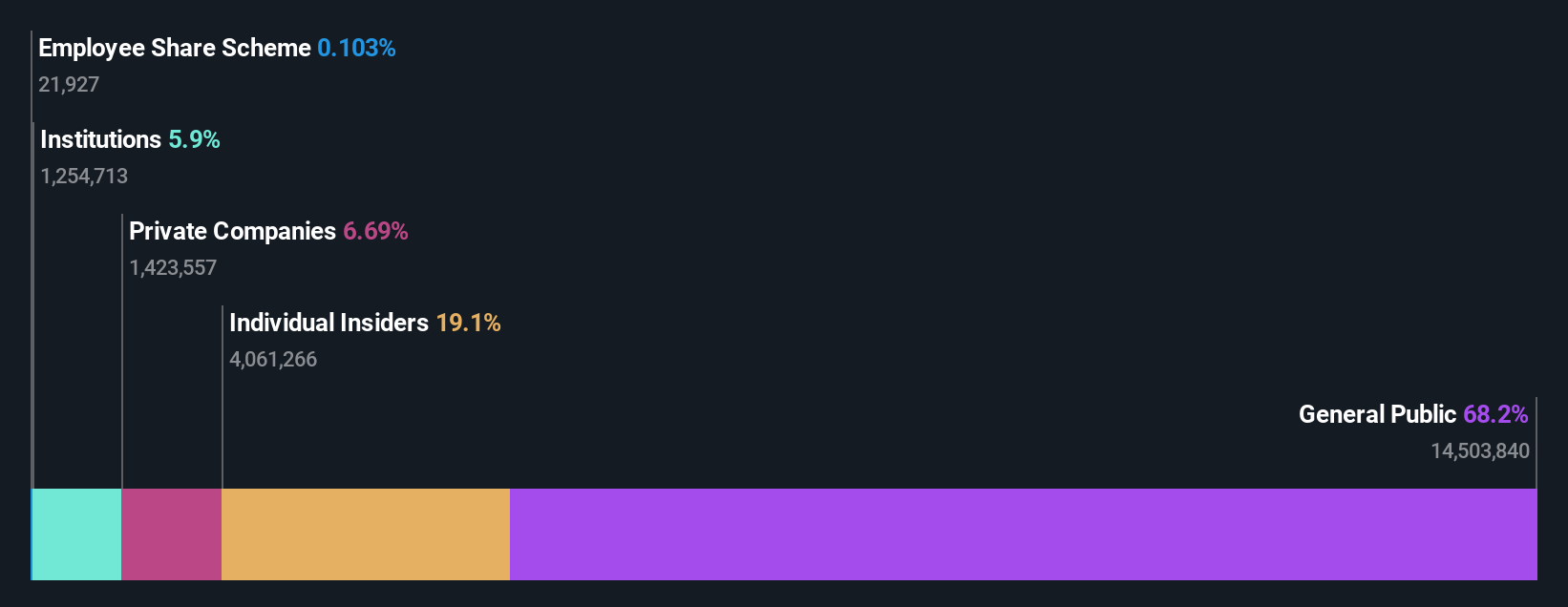

Insider Ownership: 19.4%

Revenue Growth Forecast: 63% p.a.

Enchem's revenue is forecast to grow 63% annually, significantly outpacing the South Korean market average of 10.5%. The company is expected to become profitable within three years, with earnings projected to increase by 155.2% per year. However, the share price has been highly volatile over the past three months and shareholders experienced dilution in the past year. Despite these challenges, Enchem remains a compelling growth prospect due to its strong revenue and earnings forecasts.

- Take a closer look at Enchem's potential here in our earnings growth report.

- Our valuation report unveils the possibility Enchem's shares may be trading at a premium.

Taking Advantage

- Discover the full array of 87 Fast Growing KRX Companies With High Insider Ownership right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hana Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A166090

Hana Materials

Manufactures and sells silicon electrodes and rings in South Korea.

Reasonable growth potential with adequate balance sheet.