- South Korea

- /

- Electrical

- /

- KOSDAQ:A217820

Wonik Pne Co., Ltd. (KOSDAQ:217820) Might Not Be As Mispriced As It Looks

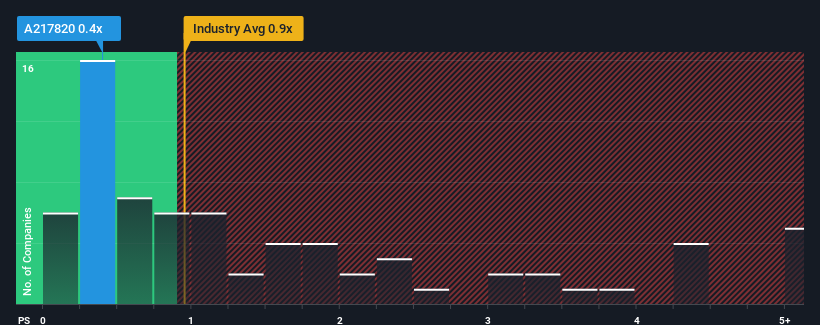

You may think that with a price-to-sales (or "P/S") ratio of 0.4x Wonik Pne Co., Ltd. (KOSDAQ:217820) is a stock worth checking out, seeing as almost half of all the Electrical companies in Korea have P/S ratios greater than 0.9x and even P/S higher than 3x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Wonik Pne

What Does Wonik Pne's Recent Performance Look Like?

Wonik Pne has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Wonik Pne will help you shine a light on its historical performance.How Is Wonik Pne's Revenue Growth Trending?

In order to justify its P/S ratio, Wonik Pne would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 29% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 2.1% shows it's a great look while it lasts.

In light of this, it's quite peculiar that Wonik Pne's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Bottom Line On Wonik Pne's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Upon analysing the past data, we see it is unexpected that Wonik Pne is currently trading at a lower P/S than the rest of the industry given that its revenue growth in the past three-year years is exceeding expectations in a challenging industry. One assumption would be that there are some underlying risks to revenue that are keeping the P/S from rising to match the its strong performance. The most obvious risk is that its revenue trajectory may not keep outperforming under these tough industry conditions. While the chance of the share price dropping sharply is fairly remote, investors do seem to be anticipating future revenue instability.

Plus, you should also learn about these 3 warning signs we've spotted with Wonik Pne (including 2 which make us uncomfortable).

If you're unsure about the strength of Wonik Pne's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Wonik Pne, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wonik Pne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A217820

Wonik Pne

Manufactures and sells rechargeable battery process automation and laser-aided automation equipment in South Korea.

Slight and slightly overvalued.

Market Insights

Community Narratives