- South Korea

- /

- Electrical

- /

- KOSDAQ:A217820

Market Might Still Lack Some Conviction On Wonik Pne Co., Ltd. (KOSDAQ:217820) Even After 31% Share Price Boost

Wonik Pne Co., Ltd. (KOSDAQ:217820) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 41% over that time.

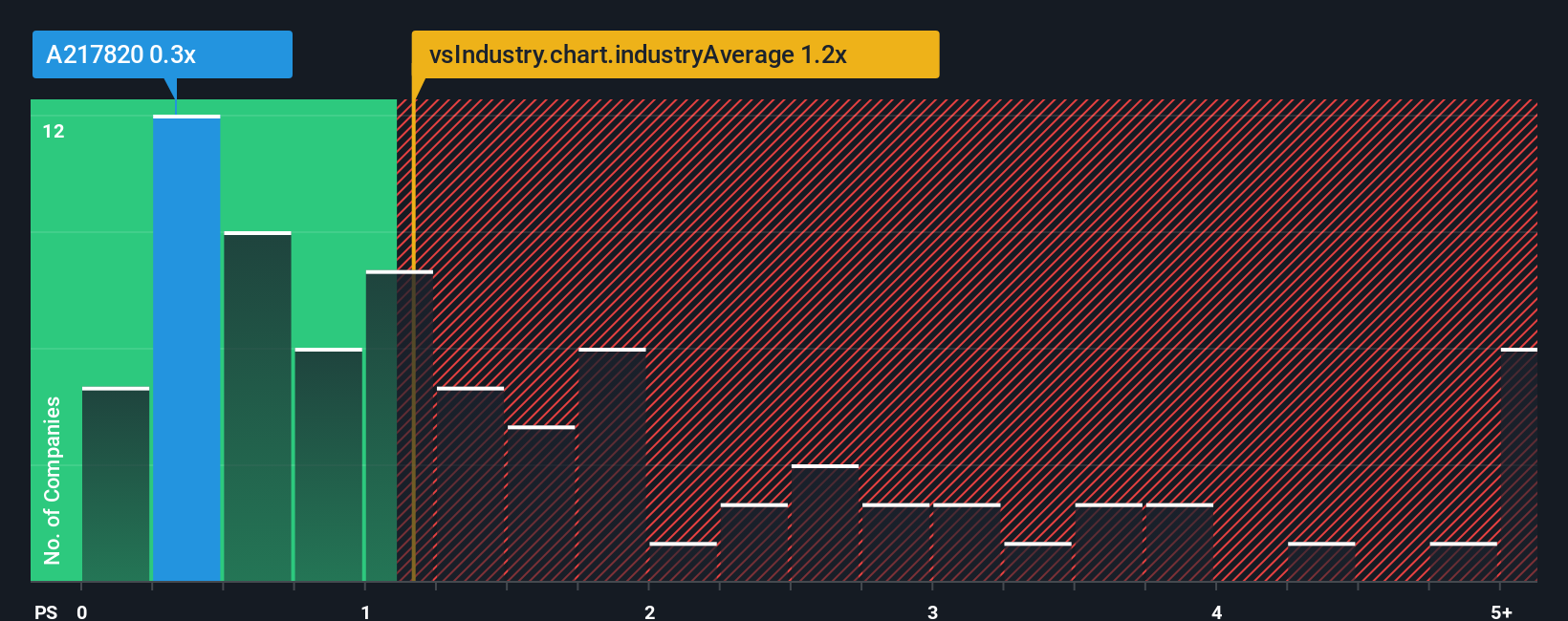

In spite of the firm bounce in price, given about half the companies operating in Korea's Electrical industry have price-to-sales ratios (or "P/S") above 1.2x, you may still consider Wonik Pne as an attractive investment with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Wonik Pne

What Does Wonik Pne's P/S Mean For Shareholders?

Revenue has risen at a steady rate over the last year for Wonik Pne, which is generally not a bad outcome. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Wonik Pne's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Wonik Pne?

Wonik Pne's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.9% last year. This was backed up an excellent period prior to see revenue up by 90% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 14% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this in mind, we find it intriguing that Wonik Pne's P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Wonik Pne's P/S?

Despite Wonik Pne's share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see Wonik Pne currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for Wonik Pne (2 are a bit unpleasant!) that you should be aware of.

If these risks are making you reconsider your opinion on Wonik Pne, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Wonik Pne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A217820

Wonik Pne

Manufactures and sells rechargeable battery process automation and laser-aided automation equipment in South Korea.

Low and slightly overvalued.

Market Insights

Community Narratives