- South Korea

- /

- Machinery

- /

- KOSDAQ:A148930

Hytc's (KOSDAQ:148930) Shareholders Have More To Worry About Than Lackluster Earnings

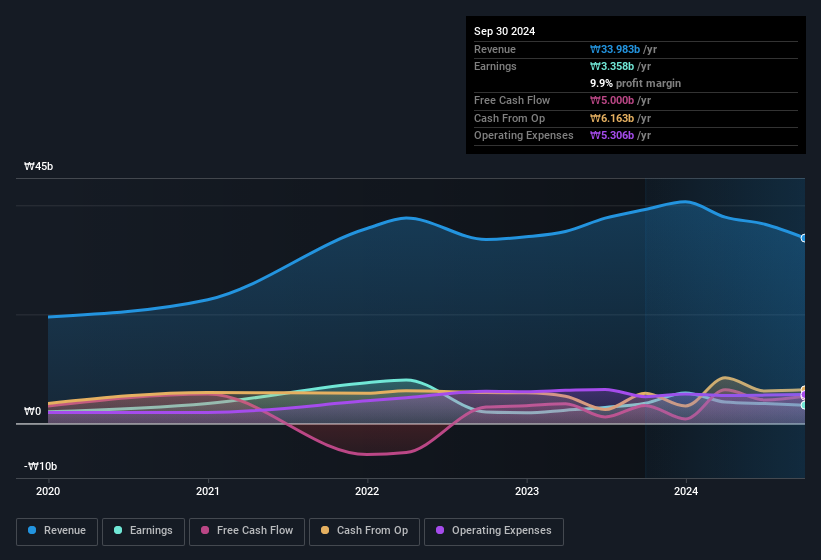

Hytc Co., Ltd's (KOSDAQ:148930) lackluster earnings announcement last week disappointed investors. We think that they may have more to worry about than just soft profit numbers.

Check out our latest analysis for Hytc

How Do Unusual Items Influence Profit?

For anyone who wants to understand Hytc's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit gained from ₩581m worth of unusual items. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And that's as you'd expect, given these boosts are described as 'unusual'. Hytc had a rather significant contribution from unusual items relative to its profit to September 2024. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Hytc.

An Unusual Tax Situation

Having already discussed the impact of the unusual items, we should also note that Hytc received a tax benefit of ₩295m. It's always a bit noteworthy when a company is paid by the tax man, rather than paying the tax man. Of course, prima facie it's great to receive a tax benefit. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal.

Our Take On Hytc's Profit Performance

In the last year Hytc received a tax benefit, which boosted its profit in a way that might not be much more sustainable than turning prime farmland into gas fields. And on top of that, it also saw an unusual item boost its profit, suggesting that next year might see a lower profit number, if these events are not repeated. Considering all this we'd argue Hytc's profits probably give an overly generous impression of its sustainable level of profitability. So while earnings quality is important, it's equally important to consider the risks facing Hytc at this point in time. For example, we've found that Hytc has 3 warning signs (1 doesn't sit too well with us!) that deserve your attention before going any further with your analysis.

Our examination of Hytc has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Hytc might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A148930

Hytc

Manufactures and sells high-precision parts in Korea and internationally.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives