David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Narae Nanotech Corporation (KOSDAQ:137080) does carry debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is Narae Nanotech's Debt?

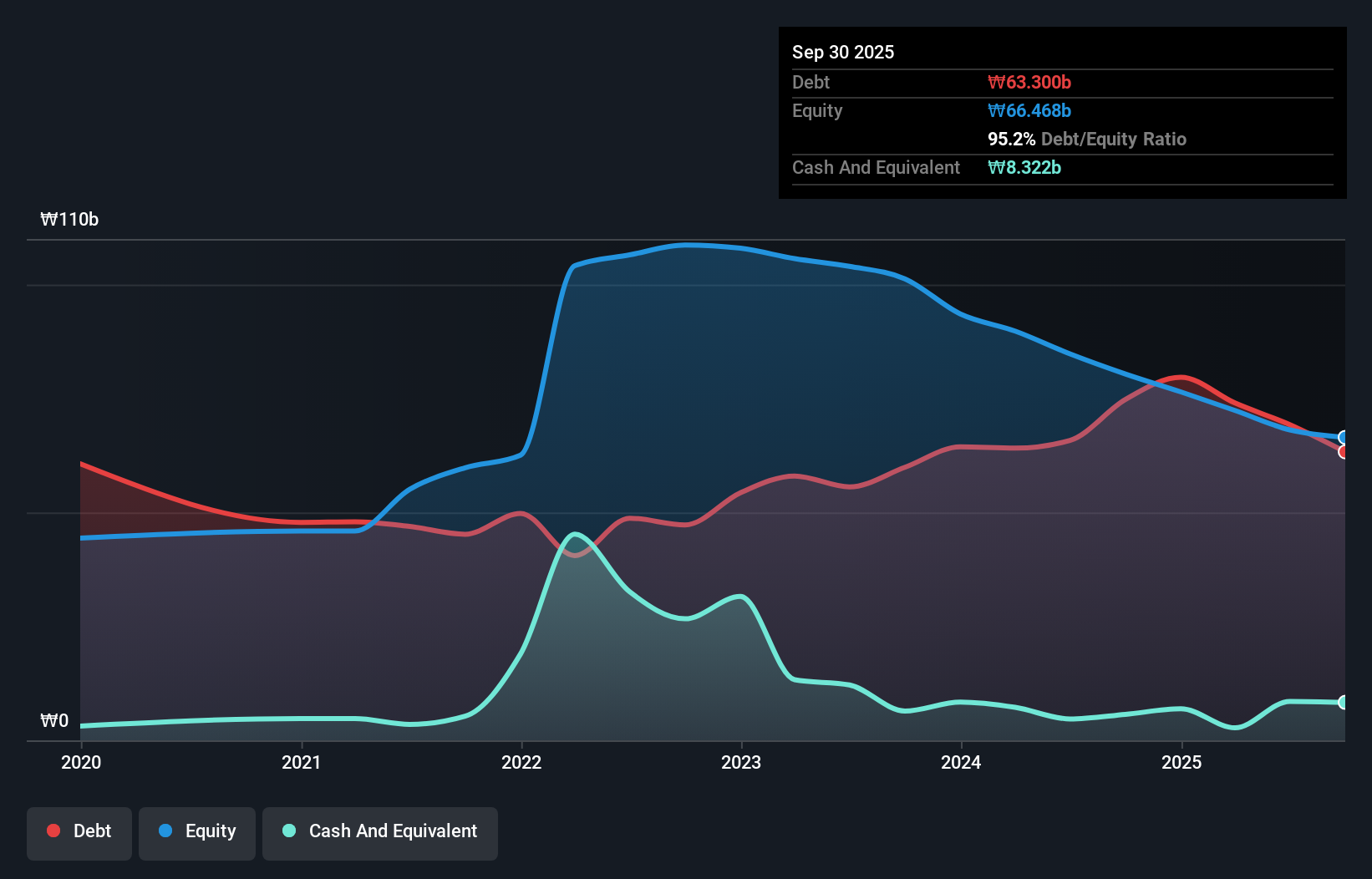

The image below, which you can click on for greater detail, shows that Narae Nanotech had debt of ₩63.3b at the end of September 2025, a reduction from ₩74.8b over a year. However, it does have ₩8.32b in cash offsetting this, leading to net debt of about ₩55.0b.

How Healthy Is Narae Nanotech's Balance Sheet?

The latest balance sheet data shows that Narae Nanotech had liabilities of ₩68.0b due within a year, and liabilities of ₩10.8b falling due after that. Offsetting this, it had ₩8.32b in cash and ₩4.00b in receivables that were due within 12 months. So it has liabilities totalling ₩66.5b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the ₩38.0b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Narae Nanotech would probably need a major re-capitalization if its creditors were to demand repayment. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Narae Nanotech will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

View our latest analysis for Narae Nanotech

In the last year Narae Nanotech wasn't profitable at an EBIT level, but managed to grow its revenue by 111%, to ₩60b. So its pretty obvious shareholders are hoping for more growth!

Caveat Emptor

While we can certainly appreciate Narae Nanotech's revenue growth, its earnings before interest and tax (EBIT) loss is not ideal. Indeed, it lost a very considerable ₩16b at the EBIT level. When we look at that alongside the significant liabilities, we're not particularly confident about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. It's fair to say the loss of ₩14b didn't encourage us either; we'd like to see a profit. And until that time we think this is a risky stock. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example Narae Nanotech has 2 warning signs (and 1 which is a bit concerning) we think you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Narae Nanotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A137080

Narae Nanotech

Manufactures and sells industrial equipment in South Korea and internationally.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026